News Recap: US GDP Growth Wasn’t so Bad, TikTok’s Fallout, Meta Earnings

US economy grew slower than expected

In my youthful radio days, I used to have a saying: “You show me a confident economist, and I’ll show you an idiot.”

A little mean, if mostly true. Predicting economics is hard. After 3.4% real (i.e., inflation-adjusted) growth in the first quarter of last year, Bloomberg survey estimates were for 2.5% growth for the first quarter of this year.

It was supposed to be a good report:

Source: Bloomberg

Except it wasn’t. Real GDP growth was just 1.6%

But don’t blame the predictors for failing to predict the unpredictable. Instead, blame math:

GDP = Consumer Spending + Government Spending + Business investment + (Exports – Imports)

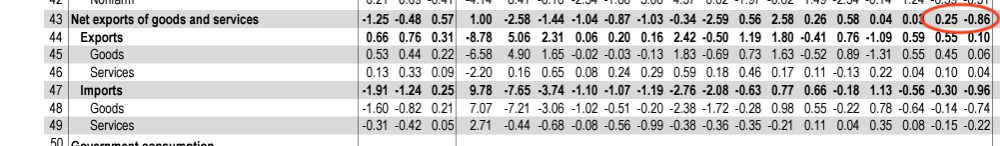

In this case, imports were a surprising culprit. Most people in the media – at least those in the mainstream outlets writing the gloomy “US GDP Growth Drops!” headlines – are getting this wrong.

A GDP release contains a lot of data points, but look at net exports (the “Exports – Imports” above). It swung from 0.25% growth in the last quarter of 2023 to an 0.86% decline in the first quarter of 2024. That’s a 111-basis point move, which may sound like small beans but was enough to ding the numbers.

Screenshot: US Bureau of Economic Analysis

Takeaway? Although goods and government spending and exports were down, service spending rose, and because the math of increasing imports reduces GDP, the US economy isn’t really doing as badly as a drop from 3.4% to 1.6% real growth would suggest.

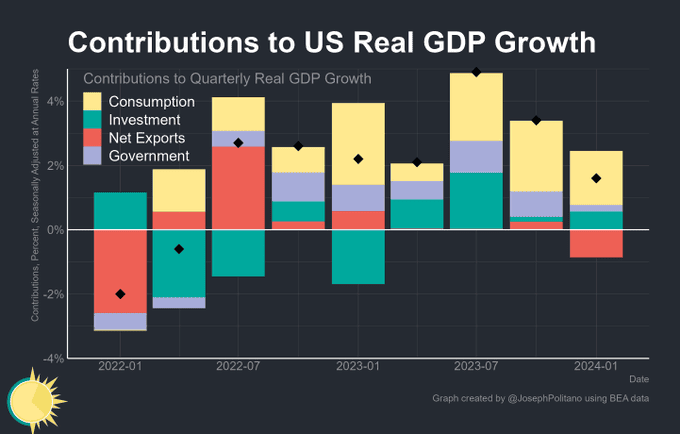

If you look at the chart below, shared by Sam Ro of Tker.co (I know Sam and am a subscriber, but we have no relationship with him), you’ll see that the red “net exports” block is roughly the same size as the drop from last quarter’s GDP growth to this one’s.

Source: @JosephPolitano X account; also cited by Sam Ro of Tker.co

It’s not the predictors. It’s math.

US to force divestment of TikTok. Who wins?

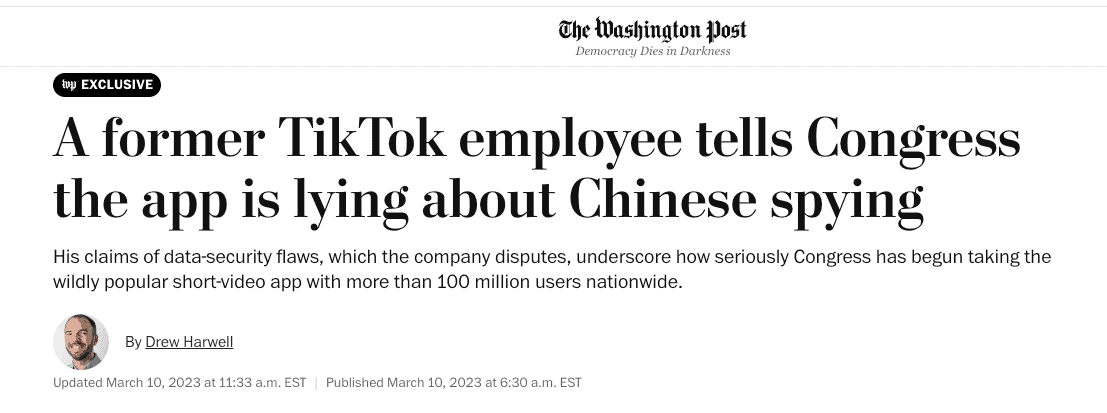

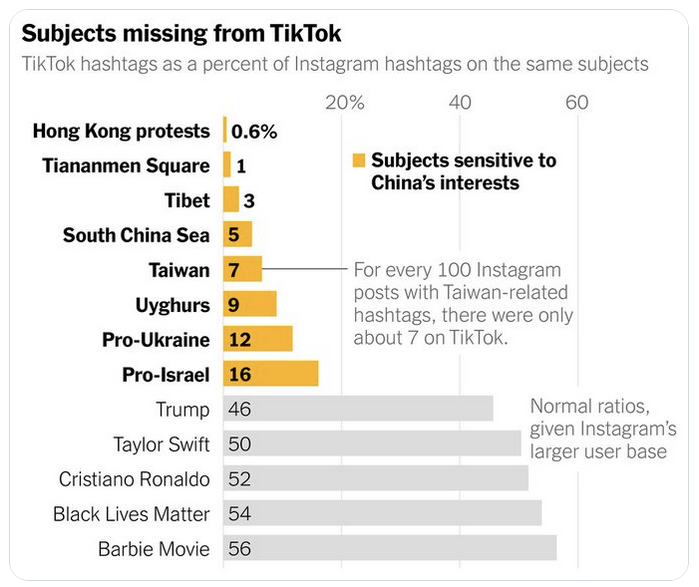

There seems to be no shortage of reasons for the US to force TikTok to find a new owner: the precedent of US law itself, evidence of prior censorship in the US, multiple accusations of dishonesty to US regulators, and now disturbing data analytics highlighted in outlets like The Wall Street Journal and The New York Times.

Source: Washington Post

A particularly incriminating graphic in the New York Times shows the relative preponderance of certain hashtags between TikTok and Instagram, and found that, for example, for every 100 Instagram posts with Taiwan hashtags, TikTok had just 7.

Source: New York Times

In other words, it’s not surprising that TikTok user President Joe Biden signed a bill into law on Wednesday that gives TikTok 12 months to find a new owner… or else.

TikTok will use the US’ legal system to challenge the ban, and it may go to the Supreme Court, Aside from that, the ball is in the hands of ByteDance and the CCP – whether or not they’ll even agree to a TikTok sale (the app might go for $100 billion intact, per Wedbush Securities), or whether they might agree to a sale for everything but the algorithm, in which TikTok might go for 30%-40% of its “intact” price. (ByteDance reiterated that they won’t sell shortly after the law passed.)

A study claims that TikTok contributed $24.2 billion to the US GDP in 2023. One reason to be suspicious? The study was commissioned by TikTok. Another is that US GDP in 2023 was $27.4 trillion; it seems hard to imagine an app like TikTok contributing nearly 1/1000th of the US’ economy. (The BBC also references TikTok’s claim of $15 billion in direct benefit to US small businesses, although their link appeared to be broken as I was writing this.)

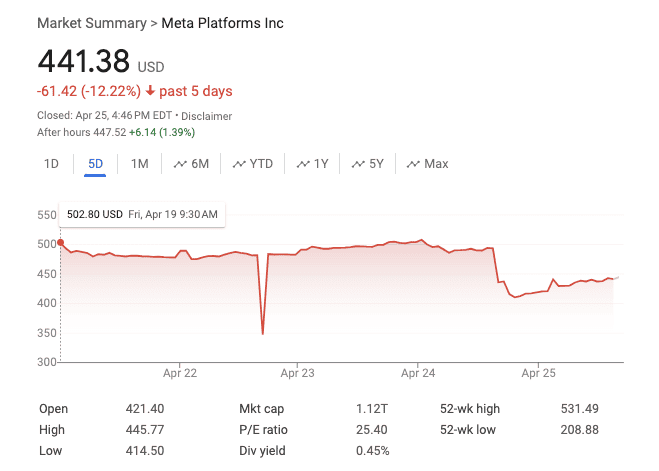

If a sale doesn’t happen, the biggest economic winner would be Meta. EMarketer claims that Meta might capture roughly ¼ of TikTok’s US ad revenue, which could deliver $2 billion in additional profit to Meta. Meta made $39 billion in profit last year, so that’s a 5.1% gain.

Just 5.1%? Doesn’t that seem disappointing? To be fair, other analysts have predicted a higher take (WSJ link; subscription may or may not be required) for Meta, and some benefit to Google, but given the theories going around suggesting that a cabal of US tech companies was in cahoots with the US government to oust TikTok for their own gain, if the biggest beneficiary stands to potentially gain just 5% in profit, that doesn’t seem like enough justification.

And if investors expected any material benefit to Meta from this law, it wasn’t showing in this week’s stock price.

Screenshot: Google Finance

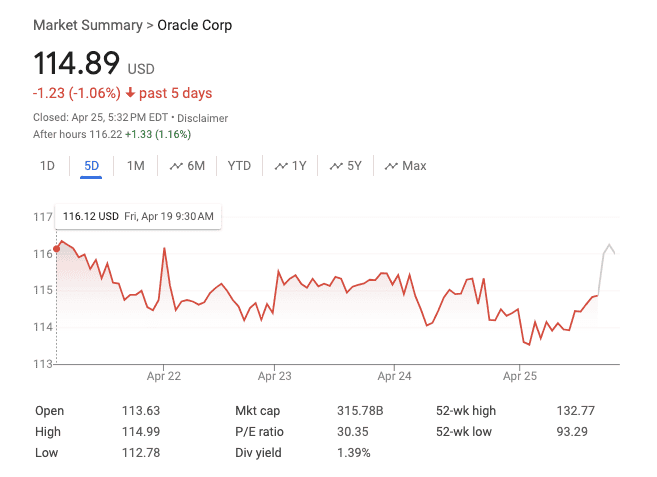

Meanwhile, Oracle, which some analysts have suggested could lose 1% of its revenue were TikTok’s server business to disappear, was down by about 1%.

Screenshot: Google Finance

Meta’s mystery results

Speaking of Meta, the truth is that unless there’s an obvious single data point and an obvious immediate price reaction, it’s hard to know the exact reasons for a stock’s movement up or down.

And while TikTok’s potential demise doesn’t seem to be a positive needle mover for Meta this week, Meta’s market value loss – $400 billion at its worst, before the stock recovered a bit – appears to stem from mysterious forces.

Bloomberg notes that up until this earnings release, Meta’s AI spending was a hero – the reason for its strong stock performance.

The BBC sees it opposite, framing Meta’s AI spending as a villain.

Screenshot: BBC.com

Without brain scans of at least the major market participants, we’ll never know.

But they could both be right if the market itself has just passed an AI inflection point – in other words, the point where AI’s connotation starts to retrench a bit in the mindshare spectrum spanning from “asset” to “liability.”

The AI adjective is still mostly an asset. But like all good things, the word can have too much of it.

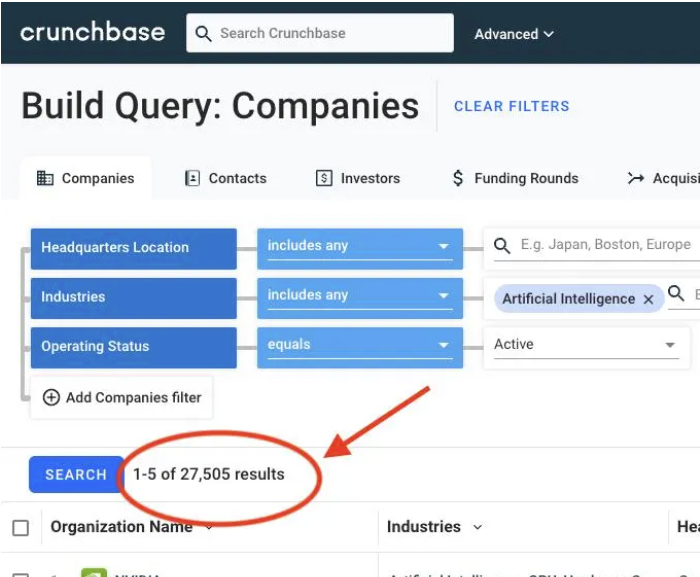

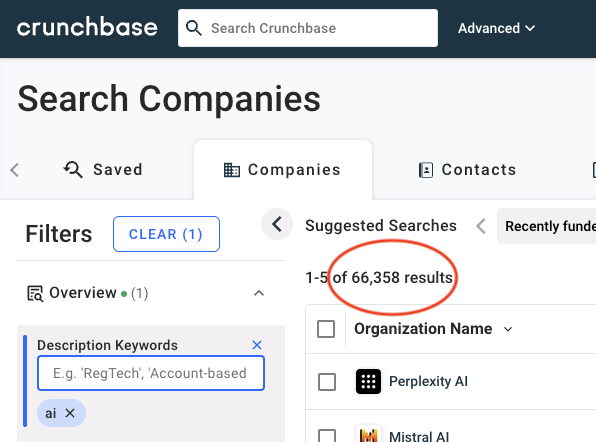

I ran Crunchbase screen last spring for AI companies. There were 27,505.

Crunchbase AI screen, spring 2023. (Source: Crunchbase)

This year? More than twice that.

Crunchbase AI screen, spring 2024. (Source: Crunchbase)

The market has seen Mark Zuckerberg’s costly metaverse failure, and knows he sometimes builds things that work, and sometimes doesn’t. He did say on Meta’s earnings call (Investopedia link) that 30% of Facebook content and 50% of Instagram’s is delivered via AI recommendation engines. But how deep a leverage of AI is that?

I can’t tell you, and I can’t tell you whether Meta’s stock – which I own – is struggling this week because of a lousy revenue forecast, or because investors have suddenly decided that AI investment in the hands of Mark Zuckerberg have become a little less “asset” and a little more “liability” but I can say that in something as hot as AI, most spending won’t end well.

Financially illiterate Europeans? (And James’ cause)

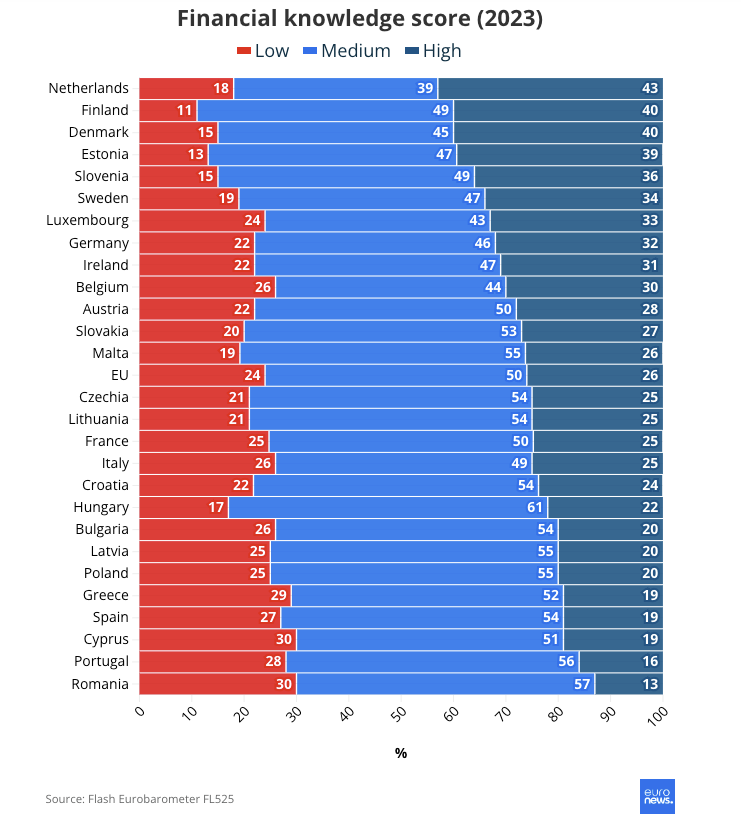

Usually it’s the Americans who look like dummies on surveys. Turns out, though, that 35% of Europeans are unaware of how inflation works.

Having been an “expert” interviewed by TV and written media on multiple continents, I can tell you that in terms of financial media sophistication, the bar is definitely highest in the US. There are plenty of exceptions, but this makes sense because America’s financial markets are the most robust. The US has way too many short-term traders, but still, stock investing in the US is most likely to be equated with owning a portion of a company, whereas in much of the world, it’s seen as a step up from gambling.

Screenshot: Euronews.com

Still, the US has far to go. It’s my belief that the investing knowledge (and behavior, which can be a separate thing) of a populace is a long-term determinant in the wealth of a society, so I’m a firm believer in financial literacy efforts. More should be taught in school, across the world. My friend Caleb Silver, who runs Investopedia, has done a great job not just with their website, but in supporting numerous charity efforts related to financial literacy across the country (and never telling anyone about it, so I’m outing him here).

Through our work at BBAE, we want to do our part to increase investors’ understanding. That’s one reason I focus as much or more on the why, instead of just the what, in this blog. The more you know, the better you’ll tend to do as an investor. At least I believe so.

And “you” really means you. I have a soft spot for financial education, so please feel free to drop me a line if you’d like to see any particular investing topics – thorny investing topics included – explained in this blog.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares of Meta. BBAE has no position in any investment mentioned.