WeRide ($WRD) IPO: Everything You Need to Know

WeRide ($WRD), a Chinese autonomous driving technology company, has recently filed for an initial public offering (IPO) in the United States. WeRide intends to list on the Nasdaq under the ticker symbol “WRD” this week. In this article I will provide an in-depth analysis of WeRide’s IPO, including its business model, product portfolio, financial performance, and competitive landscape.

What is WeRide

Founded in 2017, WeRide specializes in developing and commercializing autonomous driving solutions that span from Level 2 to Level 4 automation. Below is an overview of WeRide’s main products and their current operational status:

Main Products

- Robotaxi: WeRide’s flagship product, offering fully autonomous ride-hailing services. WeRide claims to be the first company globally to provide paid Level 4 robotaxi services to the public. These robotaxis operate in five cities. Since launching in November 2019, WeRide’s robotaxis have completed 1,700 days of commercial operations on open roads in China and the Middle East without a single accident.

- Robobus: An autonomous minibus designed for micro-transit applications, deployed in nearly 30 cities worldwide, including luxury resorts and popular tourist attractions. The company reports that more than 300 Robobus vehicles have been produced and are currently in operation.

- Robovan: An autonomous vehicle focused on urban logistics and delivery services, currently in the commercial pilot phase. According to the company, it is the first of its kind to obtain a test driving permit for operation on open roads.

- Robosweeper: An autonomous vehicle for environmental sanitation, part of WeRide’s diversified autonomous vehicle portfolio. Robosweepers are operating in nine cities for trial and commercial purposes.

- Advanced Driving Solution (ADAS): This system can be integrated into various vehicle types to enable autonomous capabilities. WeRide partners with Bosch to develop its ADAS solutions.

Valuation and Fundraising Target

WeRide is targeting a valuation of up to $5 billion. The company expects to receive net proceeds of approximately $96.0 million from its initial public offering (or approximately $111.3 million if the underwriters fully exercise their over-allotment option). This estimate assumes an IPO price of $17.00 per ADS, which is the midpoint of the projected range, after deducting underwriting discounts, commissions, and estimated offering expenses. Additionally, WeRide anticipates net proceeds of $320.3 million from concurrent private placements.

The largest investors in the concurrent private placements include:

- Alliance Ventures ($97 million)

- JSC International Investment Fund SPC ($69.5 million)

- Get Ride Inc. ($50 million)

- Beijing Minghong ($46 million)

In 2022, WeRide raised $400 million in a Series D private funding round at a $4 billion valuation, according to Crunchbase.

Use of proceeds

The company expects to use the proceeds from this offering to drive its growth and development across several key areas. The funds will be allocated as follows:

- 35%: Research and development of autonomous driving technologies, products, and services.

- 30%: Commercialization and operation of autonomous driving fleets, including marketing activities to expand into new markets.

- 25%: Capital expenditures, including the purchase of testing vehicles, development facilities, and covering administrative expenses.

- 10%: General corporate purposes and working capital.

Financial Data

Revenue

Source: SEC Filing

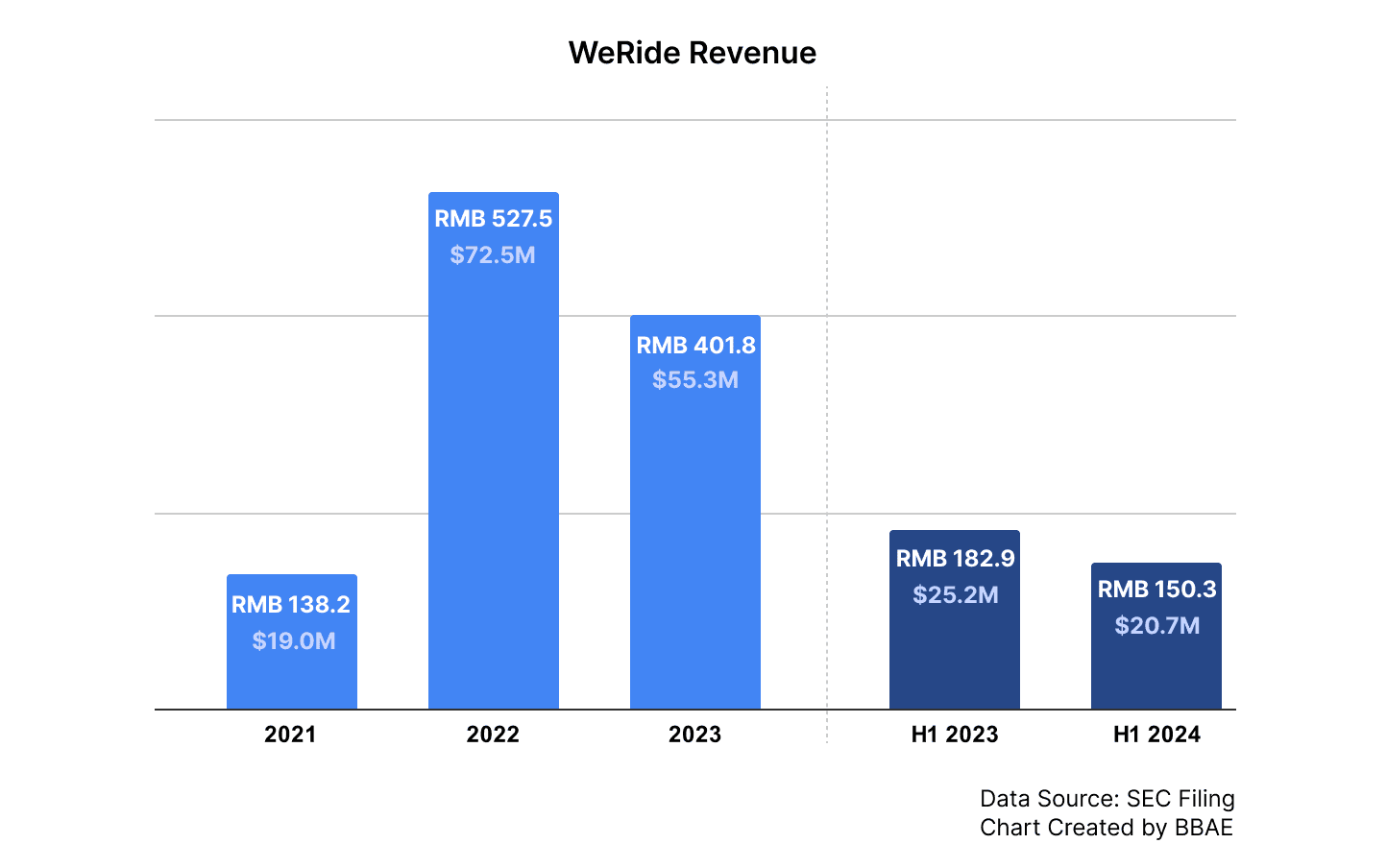

WeRide experienced substantial revenue growth between 2021 and 2022, with a remarkable 281.7% increase. This growth was primarily driven by a surge in service revenue, particularly from the customized research and development services provided to Bosch. However, in 2023, revenue declined by 23.8% compared to the previous year. The downturn continued into the first half of 2024, with a further decline of 17.8% compared to the same period in 2023.

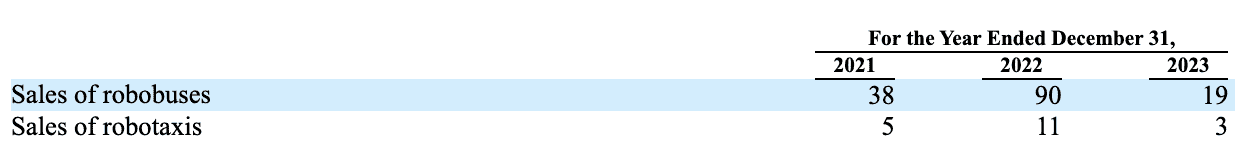

The revenue decrease in 2023 can largely be attributed to a significant drop in sales of Robobuses and Robotaxis, with only 19 Robobuses and 3 Robotaxis sold in 2023, compared to 90 and 11, respectively, in 2022.

The revenue fluctuations reflect the early stage of commercialization in the autonomous driving industry and do not necessarily indicate long-term growth potential.

Gross Profit and Margin

- Gross profit: Increased from $7.1 million (2021) to $32 million (2022), then decreased to $25.2 million (2023)

- H1 2024: $7.5 million (35% decrease from H1 2023)

- Gross margins: Improved from 37.4% (2021) to 45.5% (2023), but declined to 36.5% in H1 2024

Margin fluctuations are closely tied to the variability in service revenue, which generally carries higher margins than product sales.

Liquidity

As of June 30, 2024, WeRide had RMB 2,349.5 million (US$323.3 million) in cash and cash equivalents. The company believes that this liquidity is sufficient to meet its current and anticipated working capital requirements and capital expenditures for at least the next 12 months.

WeRide Competitor Analysis

WeRide faces competition from both well-established tech giants and specialized autonomous driving startups. Each competitor brings unique strengths to the market. It’s important to note that this list of competitors is not exhaustive:

Waymo

- Competing segment: Robotaxi services and autonomous trucking

- Backed by: Alphabet (parent company)

- Valuation: Estimated $30 billion (as of 2021)

- Main market: United States

Waymo, formerly the Google self-driving car project, is a leader in autonomous driving technology and robotaxi services, presenting significant competition to WeRide.

Cruise

- Competing segment: Robotaxi services and autonomous delivery

- Backed by: General Motors, Honda

- Valuation: $30 billion (as of 2021), Reuters reported that the valuation was slashed by more than half in 2024.

- Main market: United States

Cruise is developing both robotaxi services and autonomous delivery vehicles, directly competing with WeRide’s robotaxi and robovan offerings.

Pony.ai

- Competing segment: Robotaxi services and autonomous trucking

- Backed by: Toyota

- Valuation: $8.5 billion (as of 2021)

- Main markets: China and United States

Pony.ai is one of WeRide’s closest competitors, operating in both China and the US. It focuses on robotaxi services and has also ventured into autonomous trucking.

AutoX

- Competing segment: Robotaxi services

- Backed by: Alibaba, Dongfeng Motor, and SAIC Motor

- Valuation: Not publicly disclosed

- Main market: China

AutoX is primarily focused on robotaxi services in China, directly competing with WeRide in its home market.

Baidu Apollo

- Competing segment: Robotaxi services and autonomous driving technology

- Backed by: Baidu (parent company)

- Valuation: Not separately disclosed (part of Baidu)

- Main market: China

Baidu’s Apollo project competes with WeRide in robotaxi services and in providing autonomous driving technology to other automakers.

Momenta

- Competing segment: Autonomous driving software

- Backed by: SAIC Motor, Toyota, Bosch, Daimler, Nio Capital

- Valuation: Over $1 billion (as of 2021)

- Main market: China

Momenta focuses on developing autonomous driving software, competing with WeRide in providing technology to automakers.

DeepRoute.ai

- Competing segment: Robotaxi services and autonomous driving solutions

- Backed by: Alibaba

- Valuation: Estimated at $1.2 billion when it raised $350 million in private funding in 2021.

- Main markets: China and United States

DeepRoute.ai is developing both robotaxi services and autonomous driving solutions for automakers, putting it in direct competition with WeRide across multiple segments.

Aurora Innovation (NYSE: AUR)

- Competing segment: Autonomous trucking and robotaxi services

- Backed by: Uber, Toyota

- Valuation: $6.4 billion (Publicly Traded)

- Main market: United States

The autonomous driving market remains highly competitive and dynamic, with rapid technological advancements and evolving regulatory landscapes shaping the industry’s future.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. BBAE has no position in any investment mentioned.