The 5 Biggest Issues Facing Investors Today

“If you spend 13 minutes per year on economics, you’ve wasted 10 minutes.”

-Peter Lynch

“I don’t pay too much attention to macroeconomic trends.”

-Charlie Munger

“If we’re right about the business, macroeconomic factors won’t matter. And if we’re wrong about the business, macroeconomic factors won’t save us.”

-Warren Buffett

This isn’t fair.

This isn’t fair because I’m not including quotes from successful macroeconomic investors like George Soros.

But my guess is that the number of investors who’ve succeeded – in the sense of having verifiable track records to show for it – with a pure macro approach is far, far smaller than those who’ve succeeded while ignoring macro.

Partly, that’s because “pure macro” funds tend to be large and tend to employ a lot of leverage – constraints that, well, constrain the number of participants. George Soros may have cornered the British pound in 1992, making a billion dollars in the process, but that’s not the sort of trade the Average Joe can pull off with his iPhone.

There is an argument that with ETFs for everything and the increased retail-ization of formerly institutional-only trading instruments, those constraints are lessening. But I think the below points about macroeconomic investing are still mostly true:

- Relatively few investors trade purely based on macro factors (ironically, many, if not most, investors use them to some degree)

- Macro investors’ styles differ, and many of them still trade in ways that might not be practical for individual investors to replicate

- Macro investors often have made their reputations based on a small number of big bets (sometimes just one), making separating luck from skill difficult.

I’m not bashing macro. I’m just establishing that it’s the sort of thing that’s hard to form a strong case either for or against.

Macro is a broad category. I’m not even sure all the concepts I list below are fully “macro,” but they are big-picture-ish things that affect investors. (And they’re definitely not “micro.”)

- Narrow Markets (i.e., a Magnificent Seven-driven market): A narrow market is a market in which a small number of stocks do all or most of the lifting. (“Narrow market” is sometimes used in place of “thin market” to describe a market with low trading volume, but that’s a separate usage.) In the long run, markets are extremely narrow: I love referencing Arizona State University Hank Bessembinder’s finding that from 1926 to (roughly) the present day, just 4% of US stocks have been responsible for all the S&P 500’s gains. As Harvey Shapiro from Barron’s points out (registration or subscription may be required), before also citing Bessembinder, the Magnificent Seven have accounted for nearly 60% of the S&P 500’s return for the first half of the year. Add this to the fact that in 2023, only 24% of the stocks in the S&P 500 outperformed the index, which is either an all-time low or close to it. Harvey says it’s hard to be an active fund manager because of this, which is true if you’re an active fund manager picking stocks other than the Mag 7. From another perspective, we could philosophically nitpick Harvey’s assertion that it’s not a stockpicker’s market – arguably, this is the ultimate stockpicker’s market, and the rewards have been huge, but only for stockpickers who picked a handful of stocks from the S&P 500 that give exposure to a handful of factors (big tech, momentum, and AI). Harvey’s right, though, in the sense that if you’re a traditional stockpicker using traditional factors, this hasn’t been your market. Whether or not it’s the stockpicker’s job to know when to disregard, say, 90% of his or her craft and just pile into what’s hot because it’s a “what’s hot”-driven market is a matter of debate, but how much to regard “traditional” factors and how patient to be with them is a decision investors need to make these days.

- Slowing China: I have a mini-collection of article titles predicting when China would overtake the US to be the largest economy (by GDP, in US dollars) in the world: 2017. 2019. 2022. I’m sure there are more, and they’ve all been wrong so far. On a purchasing power parity (PPP) basis, which some people say is the better measure, though every measure is flawed, China overtook the US in 2014, but not on an absolute basis. On a PPP basis, China is 19% of the world’s GDP, and supplies 16.5% of US imports (as of 2022, per the BLS). More importantly, China is still the biggest single contributor, by far, to global economic growth: Through 2029 (registration may be required), China is expected to contribute 21% of the world’s new economic activity, versus just 12% from the US and 20% from the entire G-7. But China’s economy – long known for growing faster than 5% per year – posted growth of just 0.7% for the second quarter of 2024 (registration may be required) which puts it on track for 2.8% annualized growth – at least for the moment, though it’ll likely end higher. China recently announced a significant monetary stimulus plan, but with many countries increasing or contemplating increasing tariffs on Chinese goods, high youth unemployment, a depressed stock market, a plunging birth rate, and potential municipal debt problem – not to mention the absence of transparent economic data – a worsening Chinese economy would ding the global economy generally, and certain stocks very much (4.3% of S&P 500 revenues come from China, but that number is very unevenly distributed).

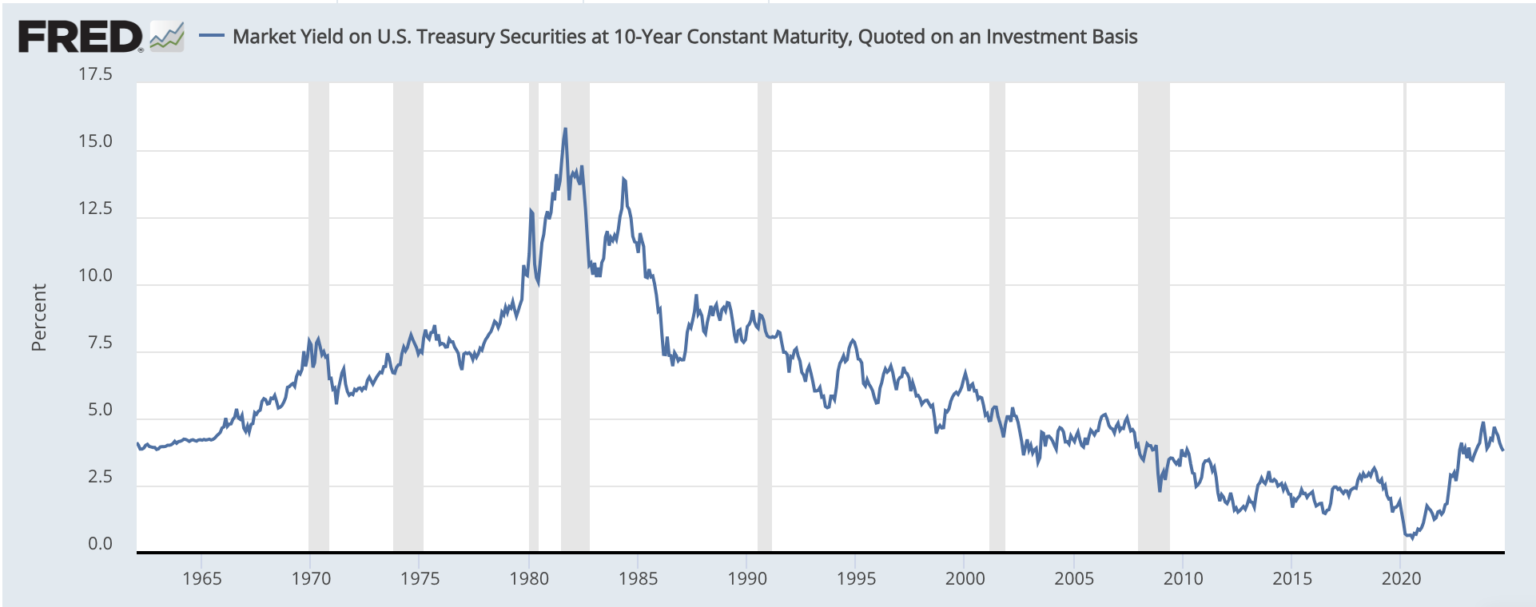

- Future interest rates won’t be like the past 15 years of interest rates: News stories and commentators tend to focus on the blow-by-blow of interest rates and Fed decisions (by the way, the Fed doesn’t set market interest rates; NYU professor Aswath Damodaran has a good, if slightly cantankerous, piece on this). But the bigger issue is that the upcoming generation of investors only knows – last few years notwithstanding – low rates. Interest rates are essentially either a headwind or tailwind for stocks. Well, sort of – as we’ve discussed before at BBAE, whether and by how much interest rates move stocks is debatable, at least in the near term. And rates have broadly declined for 40 years, the last few years notwithstanding, as you can see below. It’s no surprise that we’ve had a bull market in stocks during that time. The Federal Reserve may be so good at managing the economy that rates can stay relatively low-ish, even if not COVID-era low. But what if the Fed isn’t that good – and even if rates stay low and flat, isn’t the decline in interest rates likely the bigger catalyst for stocks to rise than constantly flat (if low) rates?

- AI and the possibility of tech adding exponential value: This might be me just making stuff up, but a potential offset to the interest rate gloom is the question of how much increased productivity technology will bring. As sociologists have pointed out, much of what’s economically valuable in modern society has happened in the past few hundred years, when GDP started growing in the low double digits per year. The cadence started slowly, but has been picking up: Fire. The wheel. Trade. Money. Metal. Gunpowder. Antibiotics. Flush toilets. Electricity. Radio. TV. Beverly Hills 90210. The internet. AI. I may be joking about one of those, but humankind’s achievements have been accelerating – like a stock chart, not always in a linear way, but overall – and it’s possible that with better technology and better collaboration, the rate of acceleration will continue to increase. Annual GDP growth has been just above zero for most of human history. It probably ramped up to 2% several hundred years ago, and is 2.5% to 3% (again, on average) now. Will it go to 3.5% or even 4% as not just AI moves along but developing countries experience a flush of hypergrowth as they modernize?

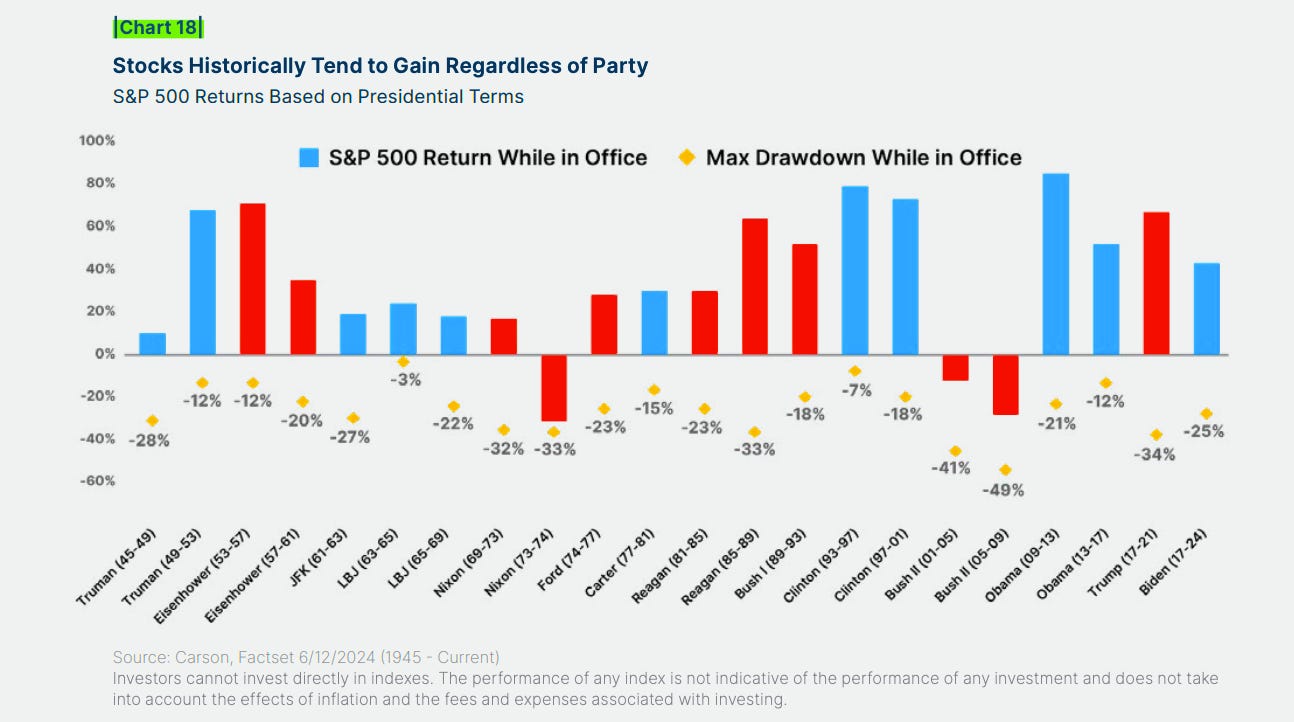

- Non-issue: US election. One red herring is the US presidential election. It’s fun (for some people) to think about and speculate on this, and it’s surely something news outlets adore discussing (and we’ve done it, too). But even our own piece is an example of the difficulty in predicting elections: Trump was a shoo-in according to the data at the time I wrote that article. Biden had not yet dropped out. As I type, he trails Kamala Harris slightly in polls. Come election time, the situation could be different again. The point is that not only are politics harder to predict than they seem, but the effect of US presidential politics on the US stock market has been less notable than expected – at least if we focus on which political party is in the White House. Here’s a graphic I shared a few weeks ago that’s apropos here:

What is the most important macroeconomic issue of all for investors?

It won’t be one of the above.

Rather, it will be the one that nobody’s talking about – something that nobody could have predicted.

“Something different happens all the time. And that’s one reason economic predictions just don’t enter into our decisions.”

-Warren Buffett

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.