When 1% of stocks = 80% of Gains, Do You Invest like Charlie Munger or Charlie Bilello?

“Diversification is a protection against ignorance. It makes very little sense for anyone who knows what they’re doing.”

-Warren Buffett

“Diversification is for the no-nothing investor.”

-Charlie Munger

I’d like to present two diametrically opposing views on a topic that affects your investing success more than almost anything else.

The first revolves around the idea of narrow markets.

That term seems to undersell what I’ve come to see as a pretty huge phenomen: a small number of stocks (and a small number of trading days) are disproportionately responsible for the lion’s share of the stock market’s gains.

The takeaway for most investors, according to Vanguard founder Jack Bogle: “Just buy the haystack” (as opposed to looking for the needle). Sure, Bogle was in the business of selling haystacks, but he doesn’t strike me as the kind of guy who’d be biased.

Charlie Bilello of Creative Planning is one of the early financial writers to grasp the importance of graphs in the modern social media-driven information ecosystem. He recently published some great visuals underscoring the notion of narrow markets (and the related notion of buying and holding working out in the long run).

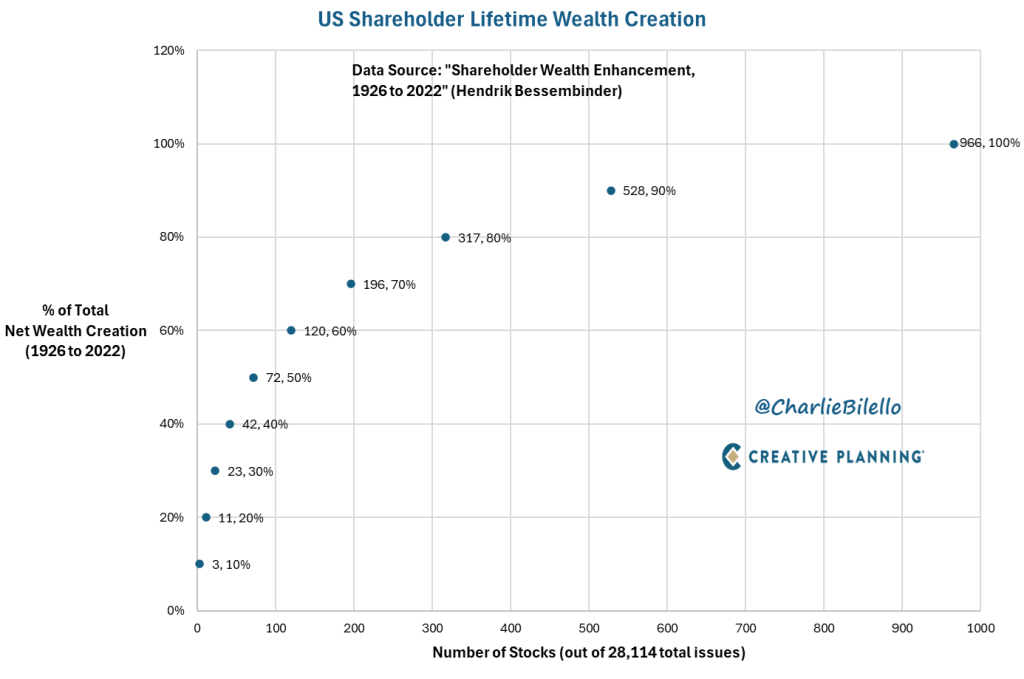

In the chart below, Charlie presents research from Arizona State University professor Hank Bessembinder, who found that from 1926 to 2022, just a small portion of S&P 500 stocks contributed all the index’ gains (the rest collectively matched US Treasuries).

Through that near-century of returns, Hank looked at 28,114 stocks in total.

Charlie’s font is tiny, but 966 stocks (3.4% of 28,114) accounted for 100% of the total US market gains. And 317 (1.1%, which I’ll round to 1%) stocks accounted for 80% of gains.

Let me put that in bullet points to hammer it home:

- 3.4% of stocks accounted for 100% of market gains

- 1% of stocks accounted for 80% of market gains

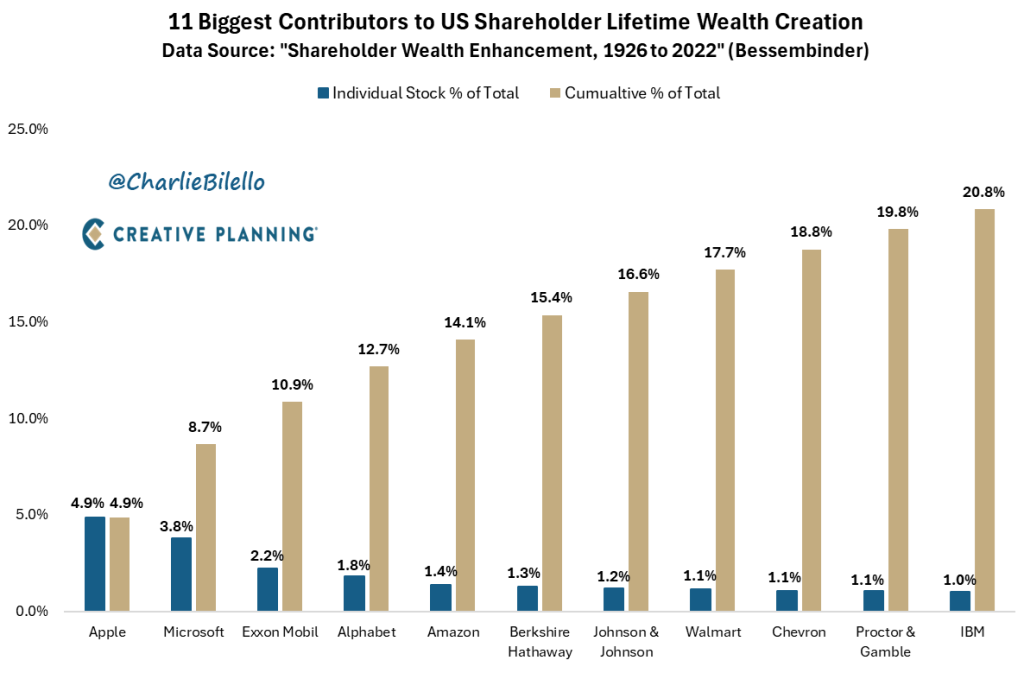

Which stocks? Per below, Apple (Nasdaq: $AAPL) has single handedly contributed 5% (technically 4.9% at of this 2022 graphic, but I’d guess it’s more than 5% by now) of US stock market wealth over the past near-century. Microsoft added 3.8%. ExxonMobil, 2.2%.

One takeaway: If you’re going to step away from index investing and pick individual stocks, you’d better be good. Very good.

Even Warren Buffett, arguably the world’s greatest investor (Jim Simons would also be a defensible #1), has said that the majority of Berkshire Hathaway’s returns came from a small number of its investments, and that he’d be better off had he never sold a single share of stock. The first point doesn’t mean that Buffett’s any less of a stock picker than one might think, but the second illustrates that the “cost,” in terms of forsaken performance, of accidentally selling a winner is really high – even when you’re the best investor around.

A dud of a stock can only go to zero – and roughly 40% of public companies have, per Morgan Housel. But a winner can go up infinitely, or more practically, by hundreds or thousands of percentage points.

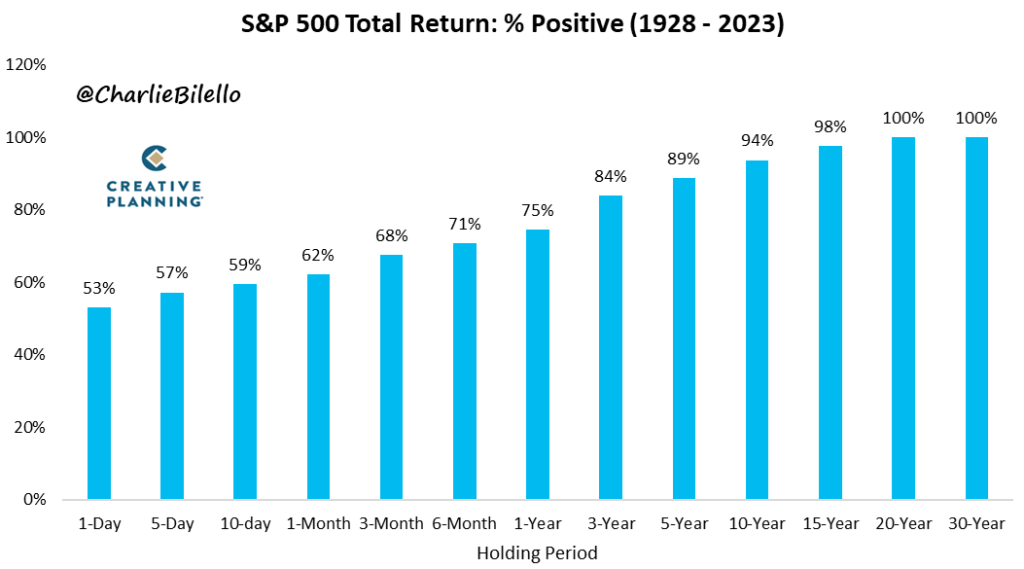

And buying the haystack has worked, at least if you’re happy with “average” market returns, which are, in fact, far above the average returns most investors get. (Ned Davis found that during a 20-year period in which the S&P 500 rose by more than 10% annually, the average mutual fund investor earned just 4% annually, and the average active mutual fund investor did even worse.)

In other words, there’s a strong case that most investors are hopelessly incompetent at investing, and thus should just buy and hold an index fund.

The Charlie Munger / Warren Buffett perspective

But back to Buffett.

Warren Buffett, Charlie’s partner, said (speaking to individual investors) to invest as if you have a punch card with just 20 potential holes – in other words, choose your stocks extremely carefully.

This is considered extreme advice by finance academics, who’ve seen not only the narrow markets data but also other research suggesting that many dozens of stocks may be necessary for “proper” diversification across the myriad factors researchers now consider to be moving equity markets. (Some good diversification quotes here.)

“Much of what is taught in modern corporate finance courses is twaddle.”

-Charlie Munger

“If you know how to analyze businesses, and value businesses, it’s crazy to own 50 stocks or 40 stocks or even 30 stocks.”

-Warren Buffett

Ironically, Berkshire Hathaway owns more than 50 companies. But to be fair, Berkshire got so big that it had to spread its wealth out over more companies for practical reasons, so in a way, Buffett’s advice made him so successful that he grew out of the ability to follow his own advice.

If there’s a candidate for “best problem to have in the whole world” that may be it.

But true to form, Charlie Munger’s smaller Wesco held just four stocks.

Charlie Munger was a billionaire, and one of the most famous investors who ever lived. Charlie Bilello is not, although he’s darn good with charts and seems like a nice guy from the videos I’ve seen.

Which Charlie is Right?

My best answer is that for 99% of people, Charlie Billello is right. (Or John Bogle, who said to buy the haystack.)

Even for the 99% of people who aspire to be Charlie Munger, Charlie Bilello is probably still right. Casinos actually like card counters, because so few of them can do it correctly. Same logic here: Most would-be Mungers or Buffetts aren’t.

And for the few investors who aspire to be the next Charlie Munger – and who have the awareness to understand the odds? I doubt they even need this article; they know where they stand already.

In other words, if you don’t, it’s probably better to buy the haystack.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.