Welcome to the first installment of our five-part blog series, “BBAE’s Guide to Dividend Investing.” This series aims to guide you through the intricacies of dividend investing, a strategy that has proven to be a cornerstone of many successful investment portfolios. Whether you’re a novice investor or a seasoned pro, this series will provide you with valuable insights and tools to enhance your investing journey.

Dividend investing is a strategy that focuses on purchasing shares in companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. This approach offers a dual-income potential: the potential for capital appreciation (the increase in the stock’s price over time) and the regular income from dividends. This combination of growth and income can be a powerful tool for wealth creation and financial stability.

The benefits of dividend investing are manifold. In the short term, the regular income from dividends can provide a steady cash flow, which can be particularly appealing for those seeking a passive income stream. In the long term, the power of compounding dividends can significantly boost the growth of your investment portfolio, especially when those dividends are reinvested. Moreover, companies that consistently pay dividends are often well-established with stable earnings, making them less risky compared to companies that do not pay dividends.

BBAE MyMarket: Your Companion for Dividend Investing

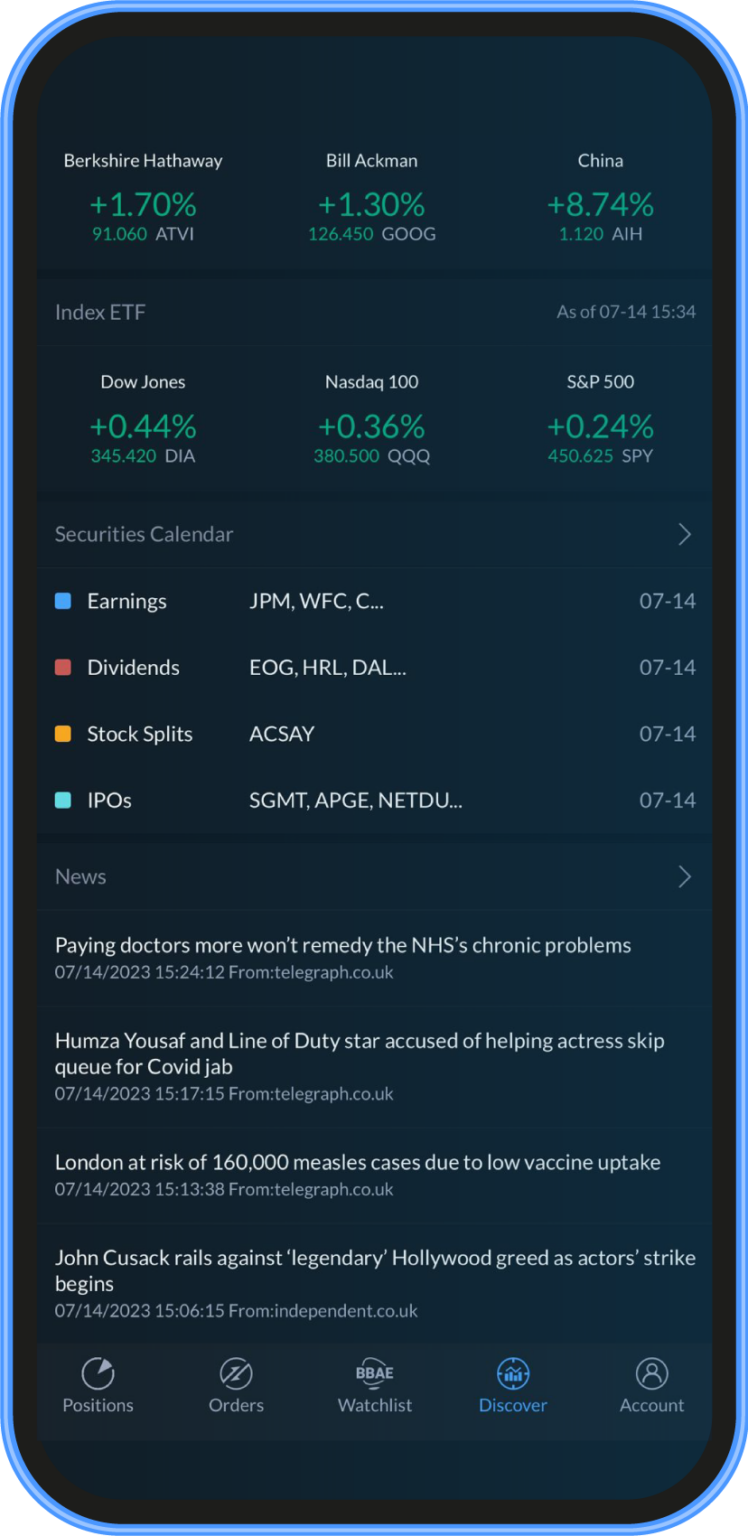

To successfully navigate the world of dividend investing, you need the right tools. That’s where BBAE MyMarket comes in. Designed with the modern investor in mind, BBAE MyMarket offers a suite of features to help you track, analyze, and manage your dividend investments.

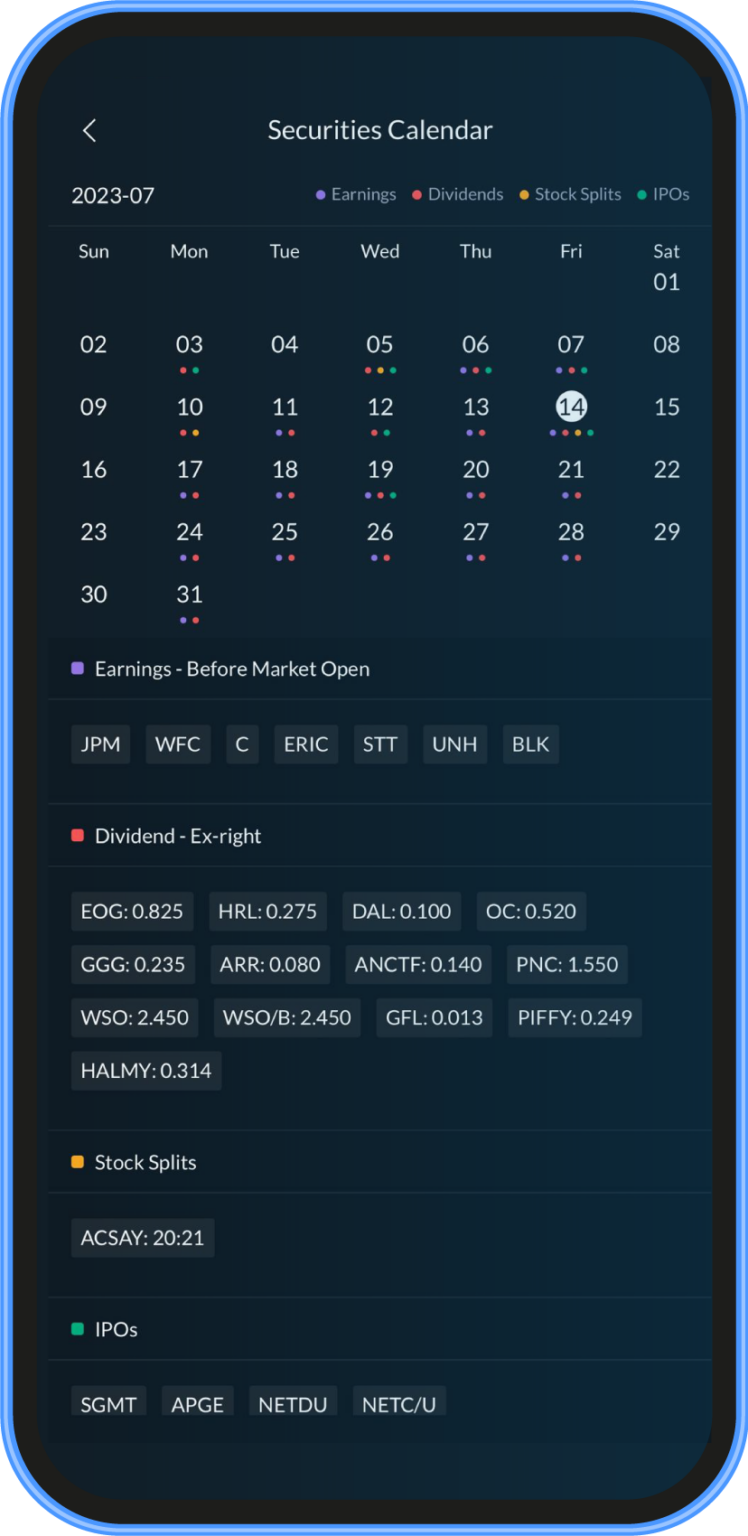

One of the standout features of BBAE MyMarket is the Dividend Calendar. This tool provides you with easy-to-find information on when dividends are paid and by which companies. With the Dividend Calendar, you can plan your investments around dividend payment schedules, ensuring you never miss a dividend payout. The calendar is intuitive and easy to use, making it a valuable tool for both novice and experienced investors.

But BBAE MyMarket offers more than just a dividend calendar. It also provides a wealth of information about each company, including financial metrics, dividend history, and news updates. This information can help you make informed decisions about which stocks to add to your portfolio.

Understanding Dividends

Before we delve deeper into the strategies and nuances of dividend investing, it’s important to understand what dividends are. In simple terms, dividends are a portion of a company’s earnings that are distributed to shareholders. They are a way for companies to share their profits with those who have invested in them.

Dividends are typically paid on a regular basis, usually quarterly, semi-annually, or annually. The exact timing can vary from company to company. When a company declares a dividend, it will also announce a record date and an ex-dividend date. The record date is the date by which you must be on the company’s books as a shareholder to receive the dividend. The ex-dividend date is the date on which the stock starts trading without the value of its next dividend payment. If you buy a stock on its ex-dividend date or after, you will not receive the next dividend payment.

The concept of ex-dividend, or ex-right, is crucial in dividend investing. It helps investors plan when to buy or sell their stocks to qualify for dividend payments. Understanding these dates and their implications can help you maximize your dividend income.

The Power of Dividend Reinvestment

One of the key advantages of dividend investing is the opportunity for dividend reinvestment. This is where the dividends you receive are used to purchase more shares in the company, thereby increasing your holdings without additional capital investment. Over time, this can lead to exponential growth in your investment portfolio, a phenomenon known as compounding.

Compounding is often referred to as the ‘eighth wonder of the world’ due to its powerful impact on wealth creation. By reinvesting your dividends, you’re not just earning income on your initial investment, but also on the dividends that have been reinvested. Over the long term, this can significantly enhance the growth of your portfolio and your overall returns.

Dividend Investing and Market Volatility

Another benefit of dividend investing is its potential to provide stability during market volatility. Companies that have a history of paying consistent dividends are often well-established with stable earnings and strong financial health. These companies are typically less susceptible to market fluctuations compared to growth-oriented companies that do not pay dividends.

During market downturns, the income from dividends can provide a cushion against falling stock prices. Moreover, if you’re reinvesting your dividends, market downturns can present opportunities to accumulate more shares at lower prices. This can position you for greater gains when the market recovers.

Conclusion

In this first installment of our four-part blog series, we’ve introduced you to the world of dividend investing and the BBAE app, your companion for navigating this investment strategy. We’ve covered the basics of dividends, the power of dividend reinvestment, and how dividend investing can provide stability during market volatility.

In our next blog post, we will delve deeper into the mechanics of dividend investing. We’ll explore the key components of this strategy, including the dividend payout ratio, dividend yield, and dividend growth rate. We’ll also discuss the appeal of dividend investing and how it differs from other investment strategies.

We hope you’ve enjoyed the first installment of “BBAE’s Guide to Dividend Investing” and are eager to learn more. Our mission is to empower you with the knowledge and tools necessary to make the most of your investments.

If you’re ready to step into the world of dividend investing, we invite you to download the BBAE app. With our intuitive Dividend Calendar, comprehensive company insights, and user-friendly interface, BBAE MyMarket is the perfect companion for your dividend investing journey.

Download the BBAE MyMarket App now and start making smarter, more informed investing decisions.

Subscribe to BBAE’s Blog and stay ahead in the world of investing!