Welcome back to our blog series on BBAE’s approach to options trading. In this installment, we delve into the array of options trading strategies offered through BBAE MyMarket. Catering to all experience levels and diverse investment goals, BBAE is ready to guide you from beginner tactics through to advanced techniques. Let’s embark on this journey of exploration together, and uncover how these strategies can fortify your investment playbook.

Laying the Foundation: Beginner Strategies

Every master was once a beginner, and in options trading, a strong foundation is crucial. Here, we introduce a few elementary strategies that are straightforward to grasp and implement:

- Protective Put: Think of this as an insurance policy for your stock. By buying a put option for a stock you own, you acquire the right to sell the stock at the strike price if its market price falls, effectively limiting your losses.

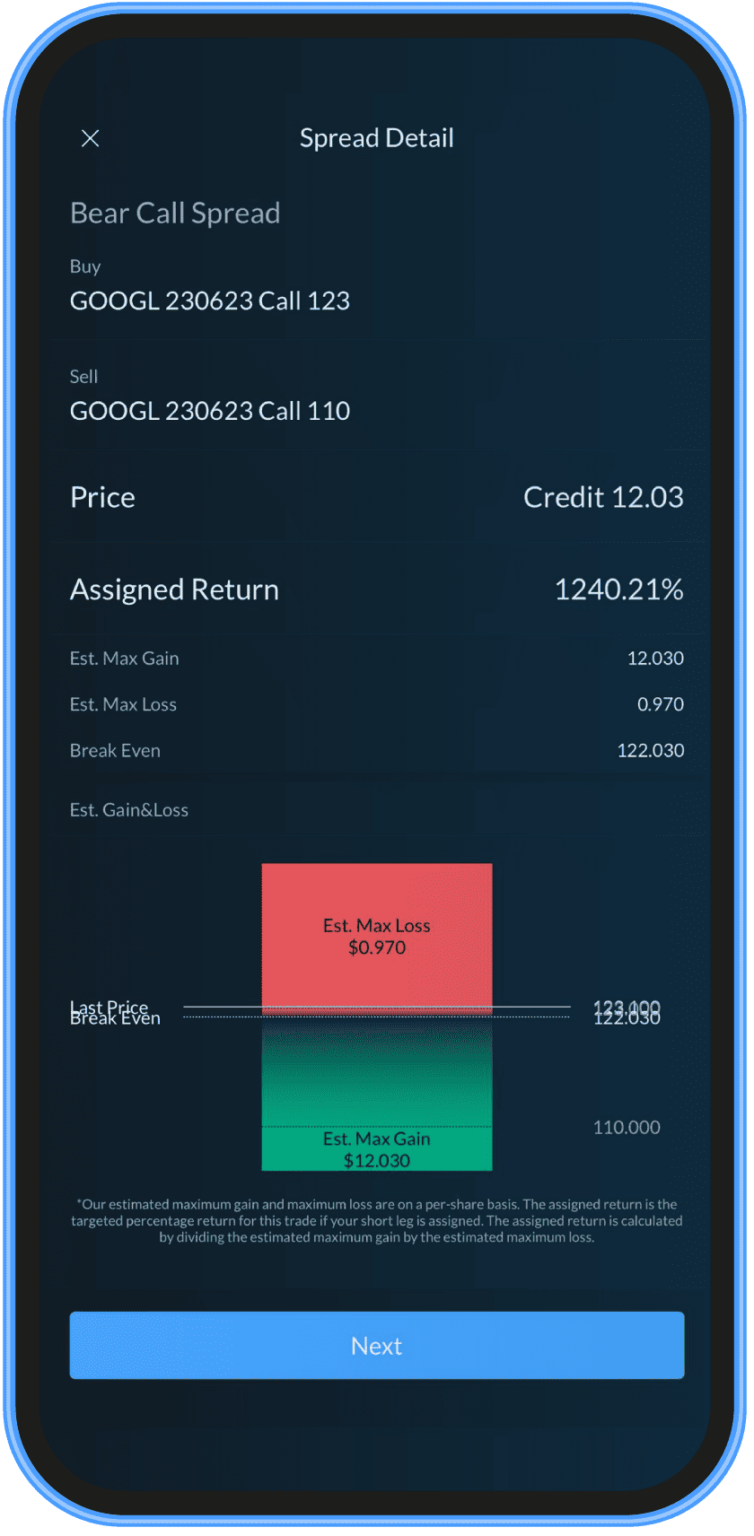

- Bull Call Spread & Bear Put Spread: These strategies are your offensive line in bullish or bearish markets, respectively. With limited risk, they can be profitable if the stock price moves significantly in the anticipated direction.

- Covered Call: This strategy is akin to a homeowner renting out their property. By owning the underlying stock and selling a call option on it, you generate income from the premium, similar to rent. However, if the stock price skyrockets, your gain is capped.

Leveling Up: Intermediate Strategies

Once you’re comfortable with basic strategies, you might be ready for the next level: intermediate strategies. These tactics involve a bit more complexity but unlock additional profit and risk management opportunities:

- Iron Condor: Imagine a bird soaring high, unbothered by market turbulence below. This strategy profits when the stock price remains within a specific range, allowing you to collect the premium from the sold options.

- Calendar Spread: This strategy profits from the time decay of options. It’s like running a car rental service where you rent out cars for short-term use and lease them for the long term.

- Butterfly Spread: Like a butterfly resting on a flower, this strategy thrives when the stock price remains near the strike price of the sold options.

The Pros’ Game: Advanced Strategies

For seasoned traders looking for sophisticated techniques, advanced options trading strategies offer a deeper engagement with the market. These strategies often involve multiple options contracts and provide more substantial opportunities to manage risk and generate income.

- Iron Butterfly: A variant of the Iron Condor, this strategy involves selling at-the-money call and put options, which can profit when the stock price remains close to the strike price.

- Long Straddle & Long Strangle: These strategies work best when you expect a significant price movement but are uncertain about the direction. They’re like placing a bet on both teams in a match, ensuring you win regardless of who scores.

Accessing Different Levels of Complexity: Suitability and Requirements

At BBAE, we ensure that traders engage with strategies suitable for their experience, knowledge, and risk tolerance. To access more complex strategies, traders may need to meet certain requirements. These may include a demonstrated understanding of options trading, prior experience, or a minimum account balance.

Conclusion: Your Journey, Our Commitment

From your first steps in options trading to mastering advanced strategies, BBAE supports you throughout your investment journey. With our robust platform, we provide the necessary tools and resources to help you navigate various strategies with confidence.

Remember, every expert trader was once a beginner. The journey may seem daunting, but with time, practice, and the right resources, you too can master the art of options trading.

In our next blog post, we’ll dive deeper into advanced options techniques and risk management tools, equipping you with a holistic understanding of this investment area. Stay tuned, as we continue to empower you on your journey towards becoming a successful options trader.

p.s. If you don’t have a BBAE account, you can get an up to $400 first deposit bonus here.