The Sam Altman SPAC: A Primer

Many people know Sam Altman for his role at OpenAI, particularly following ChatGPT’s remarkable success. He has also been in the spotlight due to recent drama surrounding his ouster and subsequent return to the company. However, fewer are aware that, in addition to being the CEO of OpenAI, Sam Altman is also the co-founder and CEO of a SPAC, partnering with the renowned SPAC sponsor Michael Klein of Churchill Capital. Anyone involved in the SPAC market during 2021 is likely familiar with $CCIV, the ticker symbol for Churchill Capital’s SPAC which successfully took Lucid Motors public at a valuation of $24 billion.

In July 2021, Sam and Michael formed AltC Acquisition Corp, trading under the ticker symbol $ALCC, which raised $500 million at its IPO. Two years later, the SPAC finally announced its target company: Oklo, a company on a mission to provide clean, reliable, affordable energy on a global scale through the design and deployment of next-generation fast reactor technology.

In this piece, I will review Oklo’s business model and examine its SPAC merger deal with AltC Acquisition Corp.

What is Oklo?

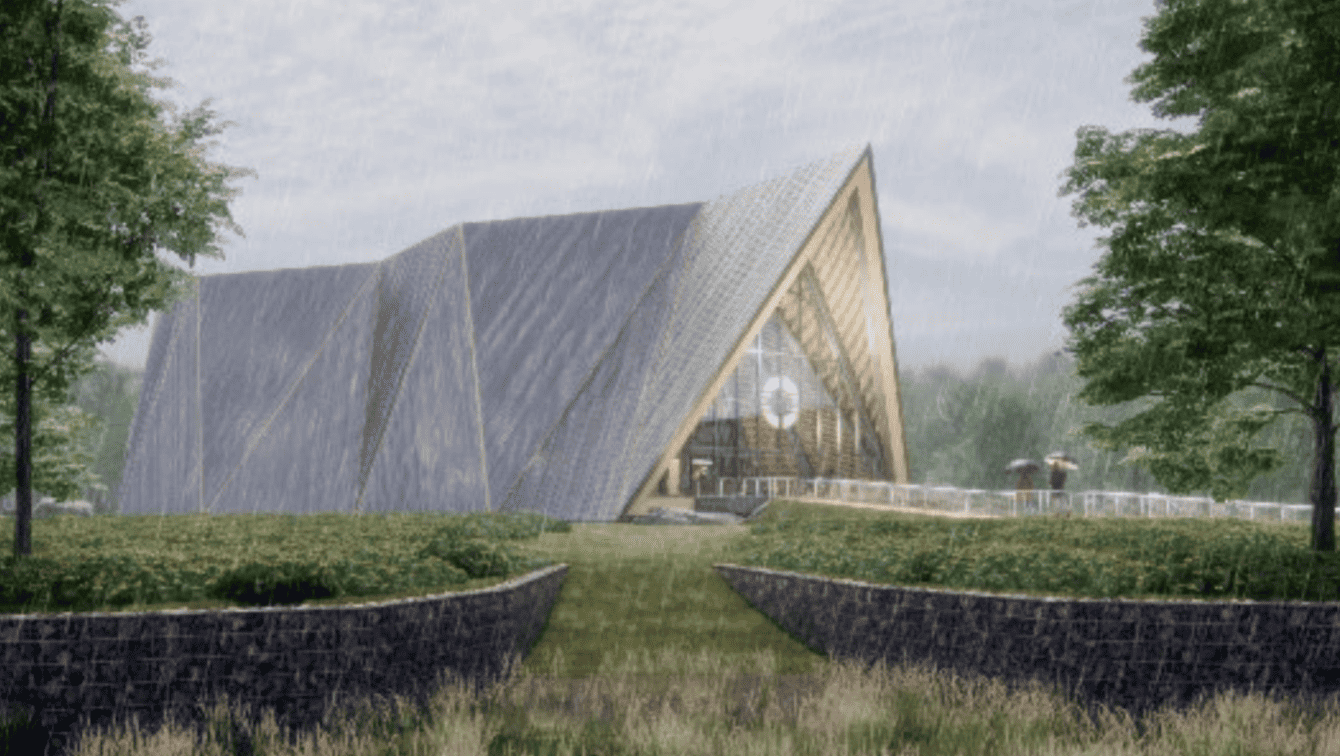

Founded in 2013, Oklo employs 48 full-time workers across 15 different states in the United States. Oklo went through Y Combinator in 2014 and Sam Altman has been Chairman since 2015. The company plans to commercialize advanced fission reactors that generate clean, affordable, and safe energy. Its flagship product Aurora, powered by its liquid metal fast reactor technology is designed to produce up to 15 megawatts of electricity using both recycled nuclear fuel and fresh fuel.

In their differentiated build, own, and operate business model, the company plans to sell power in the forms of electricity and heat directly to customers as opposed to licensing designs or selling powerhouses.

Driven by the increasing global demand for reliable, clean energy, the International Energy Agency projects an estimated $2 trillion investment in new clean power generation worldwide by 2030. Recognizing this growing demand, Oklo is positioned to pursue two markets: providing reliable, commercial-scale energy to customers and offering used nuclear fuel recycling services to the U.S. market.

Oklo is a pre-revenue company, the company expects to deploy its first powerhouse in Idaho in either 2026 or 2027.

Oklo’s Aurora powerhouse (Digital rendering)

Aurora Powerhouse Illustrative Unit Economics

The first reactors to be deployed will have a 15 MWe capacity. Oklo states that this design is also scalable to a 50 MWe capacity reactor.

These are the key assumptions for the expected first-of-a-kind (“FOAK”) unit economics of the Aurora 15 MWe plant design include:

- Expected Life of Plant: The plant will have a 40-year design life.

- Plant Capital Expenditures: The initial construction cost of the plant will be approximately $34 million, excluding initial fuel load costs.

- Fuel Capital Expenditures: The plant will require an estimated initial fuel load of 5,000 kg, costing approximately $35 million. It will need a refueling load of approximately 2,500 kg every 10 years over the 40-year design life, with each refueling load costing about $17.5 million. The total cost over the 40-year life will be approximately $53 million. These assumptions are based on all fuel being newly fabricated HALEU purchased from a third-party supplier at $7,000 per kg and do not account for any fuel Oklo may recycle and fabricate for its own internal supply.

- Revenue from Annual Power Sales: Annually, the plant will generate and sell approximately 121,000 megawatt hours (MWh) at an average real price of $105 per MWh, for total annual recurring revenue of approximately $13 million. This is based on a 15 MWe generating capacity at a 92% capacity factor.

- Operating Costs: The plant will incur annual fixed expenses of $3.8 million and variable expenses of $6.00 per MWh.

| 15 MWe design | 50 MWe design | |

| Plant cost | $34 Million | $86 Million |

| Initial fuel cost | $35 Million | $56 Million |

| Annual recurring revenue | $13 Million | $36 Million |

| Annual expenses | $5 Million | $9 Million |

| Annual cash flow | $8 Million | $27 Million |

| Payback | 8 Years | 5 Years |

Unit economics do not include investment tax credits, project finance, or fuel recycling upside

Competition

In the power generation industry, Oklo’s competitors include various technologies and approaches, such as:

- Traditional Baseload

- Fossil Fuels with Carbon Capture

- Renewables with or without Energy Storage

- Other Advanced Nuclear Reactors

It is worth noting that two of Oklo’s competitors were also listed via SPAC transactions: NET Power, which merged with Rice Acquisition Corp. II at a valuation of $1.5 billion, and NuScale, which went public after completing its merger with Spring Valley Acquisition Corp. at a valuation of $1.9 billion.

SPAC Transaction Structure

The transaction values Oklo at a pre-money equity value of $850 million, the transaction includes a minimum cash condition of $250 million. AltC currently has approximately $303 million in trust, (41.7% of its trust was redeemed at the shareholders’ meeting to extend the time AltC has to complete the business combination business combination).

All net transaction proceeds from the AltC trust account will be invested in Oklo’s growth. These funds are expected to support Oklo’s go-to-market strategy for emission-free energy production, targeted to commence in 2026 or 2027, and to finance the construction of a commercial-scale fuel recycling facility, expected to begin by the early 2030s. AltC’s sponsor has committed to subjecting 100% of its retained shares to performance vesting, meaning the shares will not vest unless the share price performs. Oklo’s founders shares will be subject to a staggered lockup over 3 years following closing of the business combination.

The transaction is expected to close in early 2024. Upon closing, AltC will change its name to Oklo Inc., and its common stock will begin trading on the NYSE under the symbol “OKLO.”

Post-Closing Ownership (Assuming No Redemptions)

| Shares | % | |

| Oklo shareholders | 78,223,495 | 64.5% |

| SPAC Sponsor | 13,9540,000 | 11.5% |

| ALTC Acquisition Corp. – Public shareholders | 29,150,521 | 24.0% |

| Total | 121,324,016 | 100% |

Conclusion

Oklo stands out with its distinctive business model, and the team led by Michael Klein and Sam Altman truly captures attention. However, insights from the 2021 SPAC boom reveal that a proficient team alone isn’t a guaranteed recipe for a successful SPAC transaction or profitability for shareholders. Many high-profile SPAC sponsors have seen their backed deals perform very poorly after the completion of the business combination.

Additionally, the current market conditions are unfavorable for companies projecting negative cash flow in the coming years. Retaining $250 million in a trust account, which is necessary to fund Oklo’s growth, will also be a challenging task, as the vast majority of SPAC deals closing in 2023 result in minimal funds remaining in trust. Redemption rates below 90% are extremely rare in the current landscape.

The deal is enabled by Sam Altman’s deep insight into Oklo and his acknowledgment of its technological capabilities, developed over nearly ten years of involvement. It will be fascinating to observe the performance of the Altman-backed company in the energy sector, especially following the transformative impact his vision at OpenAI has had on artificial intelligence.

All expected financial data are provided by the Oklo management team in their S-4 Filing and are for illustrative purposes only. Actual results may differ materially.