Welcome to the third installment of our blog series where we delve deeper into advanced options techniques. Our focus is on risk management tools and how you can effectively leverage BBAE’s MyMarket options product to enhance your trading success. As your proficiency in options trading escalates, understanding and applying risk management strategies becomes crucial in the complex landscape of advanced options trading.

Decoding Risk Management in Options Trading

Risk management is a systematic process of identifying, evaluating, and managing risks in options trading. It employs a variety of tools and techniques to mitigate potential losses while maximizing potential gains. In advanced options trading, risk management is a shield for your investment capital, ensuring long-term success.

Key components of risk management in options trading include:

- Position Sizing: This involves calculating the appropriate number of contracts to trade based on your account size and risk tolerance. Adequate position sizing helps avoid overexposure to a single trade, limiting potential losses.

- Stop-Loss Orders: A stop-loss order is an order you place with your broker to close a position once a specific price level is reached. This strategy helps you exit a losing trade, curtailing losses before they escalate.

- Diversification: Diversification involves spreading your investment capital across various strategies, asset classes, and market sectors. Diversification can reduce your portfolio’s overall risk as the performance of individual investments is typically less correlated.

- Hedging: Hedging is the practice of taking a position in an asset or derivative expected to move counter to your primary trade. It helps neutralize potential losses on your primary trade, offering a buffer against unfavorable market movements.

Leveraging Advanced Options Techniques with BBAE’s MyMarket

With a firm grasp of risk management’s significance, let’s explore some advanced options trading techniques that you can implement with BBAE’s MyMarket options product:

- Diagonal Spreads: Diagonal spread is a strategy involving buying and selling options with different expiration dates and strike prices, with either calls or puts. Diagonal spreads can generate income, hedge an existing position, or profit from volatility changes.

Example: Assume you anticipate a stock will gradually rise over the next few months. With MyMarket, you can quickly establish this strategy by selecting to sell a near-term call option with a lower strike price and buy a longer-term call option with a higher strike price. The premium from the sold near-term option can offset the cost of the longer-term option. If the stock price increases as expected, the longer-term option gains value. - Ratio Spreads: This strategy involves buying one options contract and selling multiple contracts of the same type (calls or puts), but with different strike prices. Ratio spreads can profit from a directional move in the underlying asset while also controlling the risk associated with the sold options.

Example: Suppose you expect a moderate rise in a stock over the next month. With MyMarket, you can easily establish a bull vertical spread by choosing to buy a call option with a strike price near the current stock price and sell another call option with a higher strike price, both expiring on the same day. The MyMarket app swiftly calculates a reasonable purchase price through the theoretical option price, assisting users in estimating their maximum potential profit and break-even point. - Backspreads: Backspread is a strategy involving selling one options contract and buying multiple contracts of the same type (calls or puts), but with different strike prices. Backspreads can profit from a significant directional move in the underlying asset while limiting the potential loss associated with the bought options.

Example: If you predict a significant price increase in a stock over the next month, you can leverage MyMarket to simultaneously sell a call option with a lower strike price and buy two call options with a higher strike price. If the stock price increases significantly, the bought call options gain value, with the loss on the sold option being contained due to its lower strike price.

Utilizing BBAE’s MyMarket for Advanced Options Techniques

BBAE’s MyMarket offers an array of tools and features that can help you effectively implement advanced options techniques and manage risk. Here are some ways that MyMarket can enchance your options trading experience:

- Options Chain Visualization: MyMarket displays an options chain, which shows available options contracts for a specific underlying asset. This visualization aids in quickly identifying the strike prices and expiration dates for the contracts you want to trade.

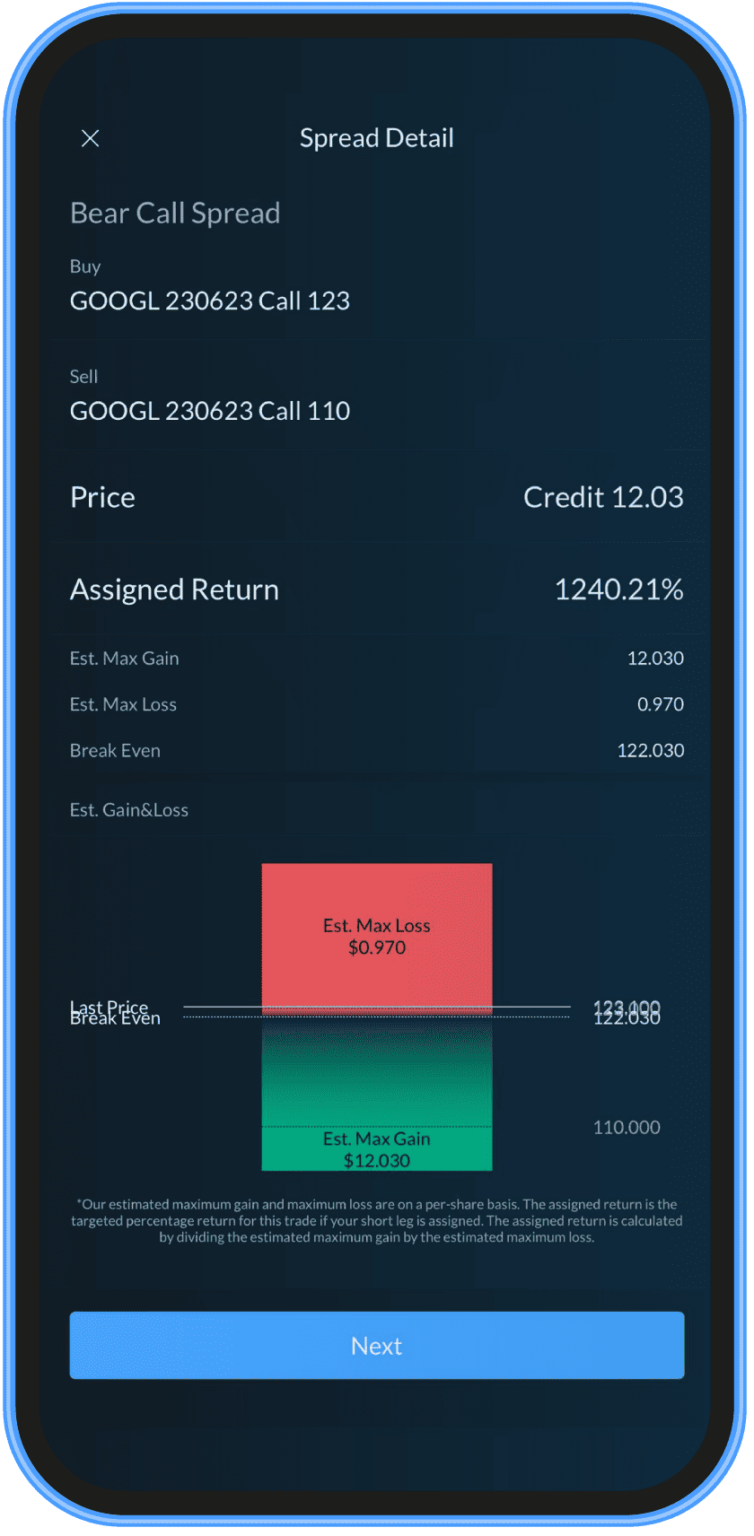

- Options Strategy Builder: MyMarket’s strategy builder lets you create, analyze, and execute complex options strategies like diagonal spreads, ratio spreads, and backspreads. The strategy builder visualizes potential profit and loss scenarios, helping you assess your chosen strategy’s risk-reward profile before placing the trade.

- Theoretical Pricing Tool: MyMarket’s theoretical pricing tool, a hallmark of BBAE’s options platform, calculates real-time and historical arbitrage-free theoretical option prices. These prices give an accurate and fair representation of an option’s value under given market conditions. By being ‘arbitrage-free’, it removes the possibility for others to gain from price disparities at your expense, thereby ensuring that the price you pay for an option accurately reflects its theoretical value in the current market.

- Portfolio Management: Utilize MyMarket’s portfolio management tools to monitor your options positions, track performance, and manage risk. This includes setting stop-loss orders, establishing position size limits, and diversifying your portfolio across various asset classes and strategies.

- Education and Support: BBAE provides a range of educational resources and customer support to help you advance as an options trader. This includes webinars, video tutorials, articles, and personalized support from experienced options traders.

Conclusion

Advanced options techniques offer a range of ways to profit from various market conditions while effectively managing risk. Understanding and implementing these strategies with the aid of MyMarket can enhance your trading success and protect your investment capital.

BBAE’s MyMarket offers a plethora of tools and resources to help you navigate advanced options trading and implement efficient risk management strategies. By harnessing these tools and continually educating yourself about options trading, you can lay a strong foundation for lasting success in the markets.

p.s. If you do not yet have a BBAE account, you can get an up to $400 first deposit bonus here.