Everyone seems to be talking about the Arm IPO.

I get why: If the IPO raises just $5 billion – half of what owner SoftBank was originally hoping for – Arm’s IPO will easily be the biggest US 2023 IPO to date, and likely the biggest of the year.

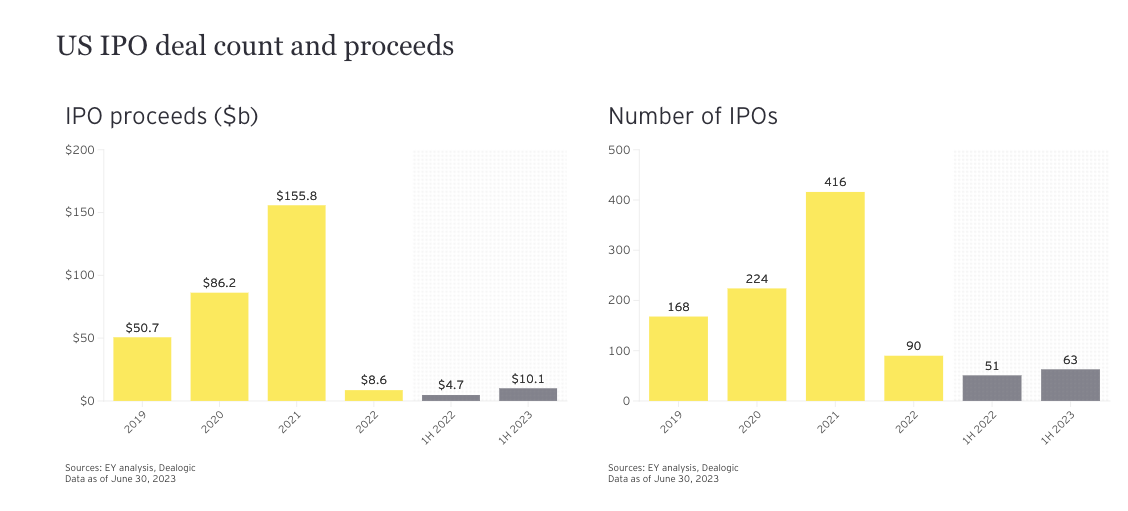

And as charts from Ernst & Young show, we’re in an IPO drought, so the 28 investment banks that SoftBank has hired to help sell Arm to investors were surely happy to have some work.

But there’s something weird about it, as I told Will Bain on BBC’s Wake Up to Money last night,

For backstory, SoftBank bought Arm for $32 billion in 2016, taking it private. Arm designs semiconductor chip architecture (without making or selling the chips) and related software. Arm-designed chips tend to be small and economical on power, making them perfect for cell phones; in fact, 99% of cell phones use them. And 31 billion of them were created last year.

Arm has reportedly languished a bit under SoftBank’s ownership; recent results have been soft, and the company really wants to expand from phone and appliance chips to data centers, especially AI.

AI is hot: It helped propel Nvidia – an actual chipmaker that tried to buy Arm in 2020, and which is still investing in its IPO – to a $1.2 trillion market cap.

So – and I can’t get inside Masayoshi Son’s head here, so I’m just guessing – SoftBank (fresh off of losing $32 billion in its Vision Fund, and not long off the WeWork debacle and the Oyo debacle, and now with a reputation for recklessly throwing money at anything that seems hot) saw a cool IPO market and a hot industry (AI, and to a lesser extent, chips, although Arm is better described as a “near-AI” company than a real one) and hoped the hotness would prevail.

It doesn’t seem to be going that way.

Now, nothing’s finalized. The IPO is expected next week and the bankers are out there presenting roadshows to institutional investors and soliciting commitments to invest; we may see more interest, and IPO-ing companies and their bankers sometimes downplay interest in media to spring-load an upside surprise on the actual IPO day. Now, IPOs tend to underperform, and it’s been well-documented in academia, so this spring loading is of questionable value to the company, but if you’re a banker taking a percentage of proceeds, an ephemeral feeding frenzy helps you.

Anyway, whoever owns the “IPO-ing” company can decide how much to carve out and float on the public markets; it’s seldom a majority, and looks to be about 10% in Arm’s case. But 10% of what?

SoftBank had hoped investors would value Arm at $70 billion at the IPO; now, it’s closer to $50 billion.

Bummer, but what’s peculiar is that on August 18th, SoftBank paid a reported $16 billion to repurchase the 25% of Arm it sold to the SoftBank Vision Fund in 2017. The August 18th purchase was at a $64 billion valuation.

So, yes, it’s optically weird for a company to be selling and then buying from its own VC fund. And one might suspect – as Doomberg has eloquently suggested – that SoftBank was hoping to plant a flag in the sand by creating a recent trade-clearing valuation that IPO investors would anchor off of.

Hoping. If that was the plan, those IPO investors don’t seem to be going along – SoftBank said the $64 billion valuation was arrived at via a pre-set formula, without disclosing more. But it’s a far cry from the $52 billion we’re seeing most recently.

But just as how you and I wouldn’t pay $64 for something that we turn around and sell for $50 or $52 a few weeks later, why would SoftBank pay $16 billion at a $64 billion valuation for shares it’s selling for 20% a few weeks later?

James

p.s. Hopefully you won’t be buying and then selling something for 20% a few weeks later… hopefully you’ll buy good businesses and hold them for massive long-term gains. And hopefully you’ll do that with a BBAE account. Click here to see what a BBAE account has to offer you.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions.