The BBAE MarketGrader Core Portfolio: Index Investing, Amplified

Ah, index investing. It’s like the trusty minivan of the financial world. Steady, reliable, and doesn’t burn a hole in your wallet. It’s a big hit among the investing crowd, including the Oracle of Omaha, Warren Buffett himself. But wouldn’t it be nice to trade that minivan for a sportier model that still offers plenty of room for passengers, doesn’t guzzle gas, and packs a punchier performance? Imagine if all it took was a simple click of a button, and voila, you’re in the driver’s seat of that vehicle. Well, buckle up, because that’s precisely what the BBAE MarketGrader Core Portfolio offers.

Index Funds, But With a Strategic Makeover

Picture an index fund. It’s like a buffet offering a variety of stocks of different companies. Now, imagine if that buffet was curated by a Michelin-star chef, injecting a level of sophistication and strategy to elevate it beyond your average spread. Well, that’s the BBAE MarketGrader Core Portfolio. It’s as if an index fund hit the gym, hired a personal stylist, and got a high-powered job.😎

This portfolio isn’t about gambling your savings on a high-stakes bet. Far from it. It’s about a pursuit of superior performance over the long haul without cranking up the risk dial. It’s less about rolling the dice and more about playing a well-thought-out game of chess.

The Secret Ingredient

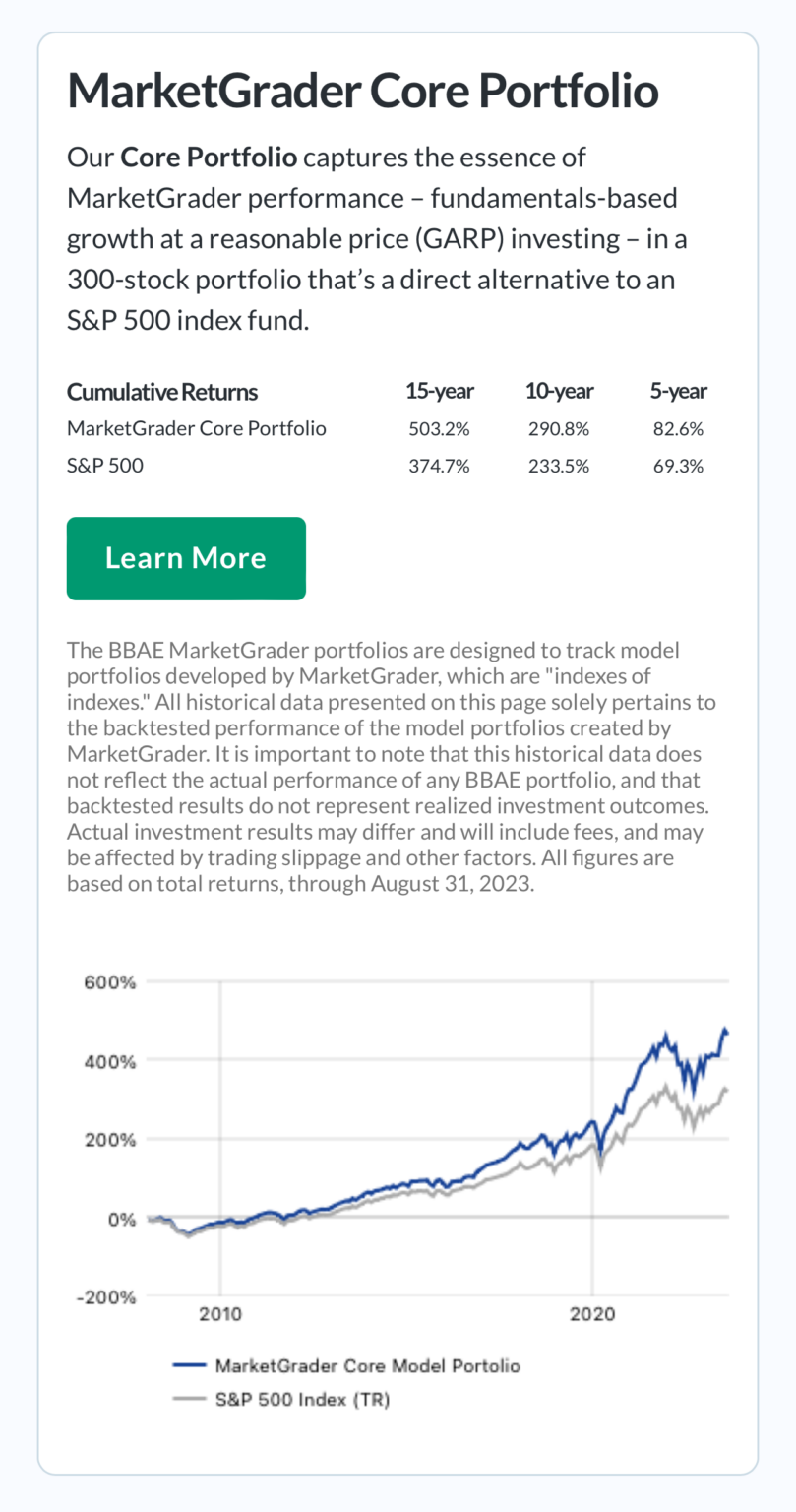

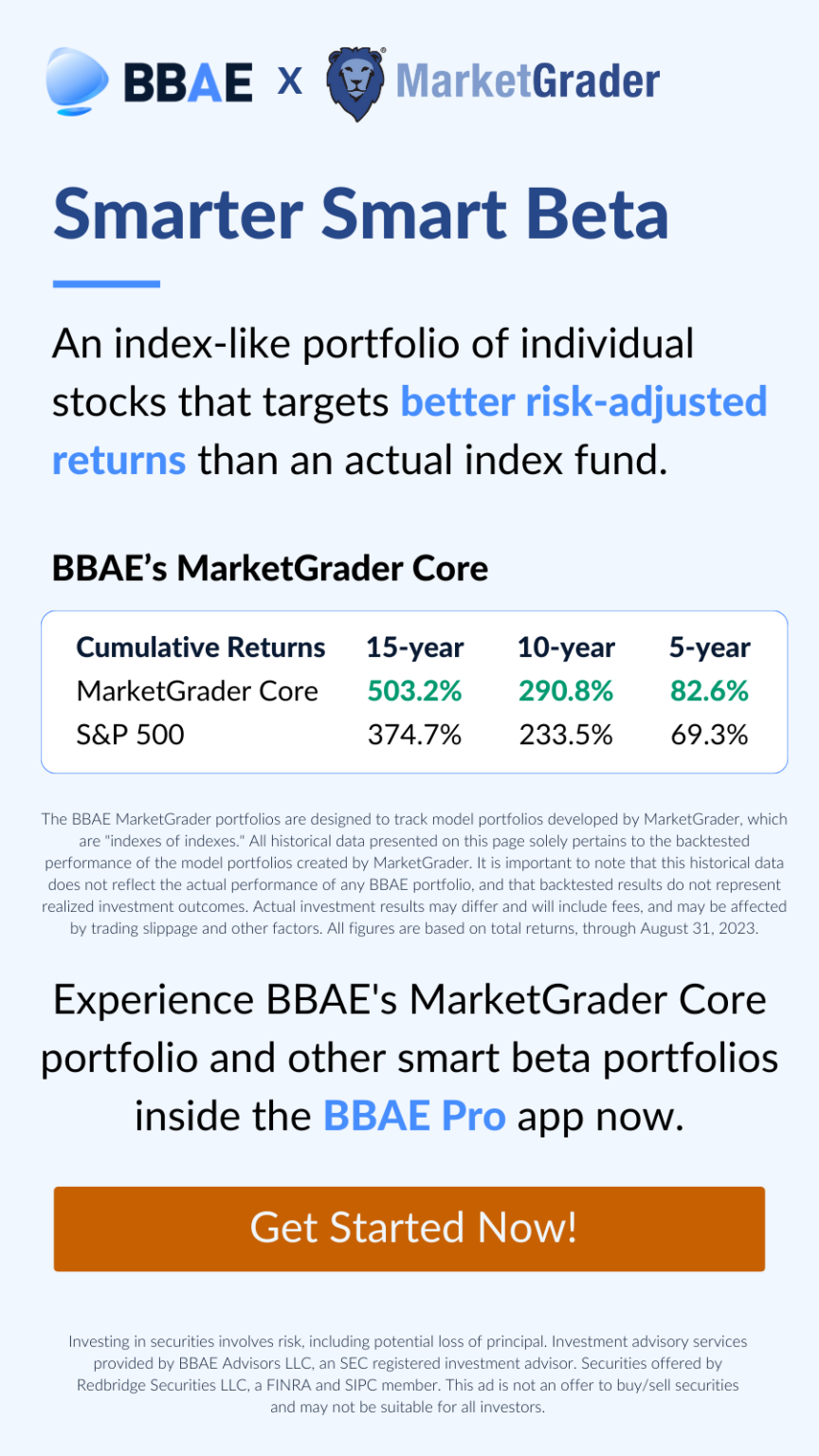

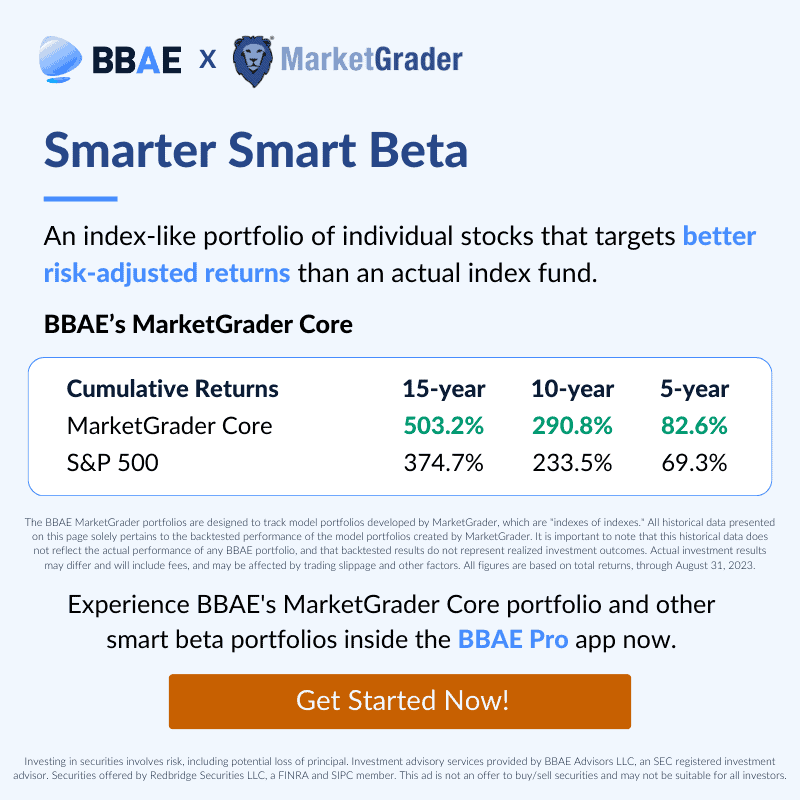

So, what’s the rabbit in the hat of this portfolio? The credit goes to our partners at MarketGrader. They create smart beta indices, employing the power of quantitative analysis to cherry-pick companies with solid fundamentals and bright futures. Their smart beta indices aren’t some flashy new kids on the block; they come with a 15-year track record of outperforming the market. It’s a testament to the precision of their strategy.

Transparency and Affordability

Despite the strategic maneuvering behind the scenes, the BBAE MarketGrader Core Portfolio won’t demand a king’s ransom. The fee structure? A straightforward flat rate of 0.50% per annum of the assets you’ve invested, covering all the trading costs and tune-ups needed to keep your portfolio optimized. This fee is not only significantly lower than many mutual funds or even a vast number of ETFs, but it also covers all trading fees. That’s right, no sneaky ETF costs or trading charges; everything is wrapped up in that 50bps fee.

And a standout feature of all BBAE portfolios, including this one, is that you’re not just watching from the sidelines—you directly own the stocks in your portfolio. It’s a marriage of two worlds: the potential for the outperformance of active management, combined with the clear-as-day transparency of direct ownership.

Now, you might be scratching your head, thinking, “How can I possibly invest in a portfolio with over 300 stocks without tying up a large sum of money? Don’t I need at least $100,000?” The answer is a resounding no. The minimum investment required is just $2,000. This is made possible by the innovative use of fractional shares. This approach lets us spread your investment across all 300 stocks, even with a smaller initial investment. It’s a game-changing move that dramatically lowers the entry threshold to a mere $2,000—significantly less compared to the lofty $100,000 or more often required by many managed accounts.

The BBAE MarketGrader Core Portfolio: Why It Matters

So, why should your investment radar be picking up the BBAE MarketGrader Core Portfolio? Simple. It takes the wide exposure, cost-efficiency, and consistency of index funds and turns the dial up on the potential for returns. It’s not about passively bobbing along with the market’s current; it’s about steering your own course. It’s about harnessing the power of BBAE and MarketGrader to make every dollar of your investments work harder.

Investing shouldn’t be a passive activity—it should be a strategic endeavor to find the best opportunities for your money. The BBAE MarketGrader Core Portfolio presents a finely tuned vehicle for that pursuit. So, why wait? Consider elevating your investment strategy with the BBAE MarketGrader Core Portfolio. It’s not just about keeping pace with the market—it’s about setting the pace.