BBAE MyAdvisor Q1 2024 Report Card: Smart Beta Portfolios Outperform Benchmarks

As we close out the first quarter of 2024, BBAE’s MyAdvisor is proud to present our Q1 report card, highlighting the performance of our MarketGrader smart beta portfolios. Our cutting-edge digital wealth management platform has continued to deliver strong returns for our investors, outpacing traditional market benchmarks.

What is BBAE MyAdvisor?

BBAE’s MyAdvisor is our cutting-edge digital wealth management platform, conveniently accessible through the BBAE mobile app, that puts the power of smart beta investing at your fingertips. Our technology-driven portfolios track MarketGrader smart beta indexes with a history of outperforming the market. By blending the advantages of passive and active investing, smart beta strives to deliver excess returns over time by systematically capitalizing on market inefficiencies.

Effortless Investing with BBAE MyAdvisor

Investing with BBAE’s MyAdvisor is incredibly simple. Our platform enables you to invest in portfolios containing up to 300 individual stocks with a single click. When you choose a portfolio, our technology automatically distributes your funds across all the stocks in the portfolio, utilizing fractional shares to achieve optimal diversification. This means you can own a piece of every stock in the portfolio, even if you start with as little as $2,000. Your stocks are transparently held in your account, providing you with complete control and visibility over your investments. With BBAE’s MyAdvisor, smart beta investing is accessible to a broad spectrum of investors, making it effortless to construct a diversified, high-performing portfolio tailored to your unique investment goals and risk tolerance.

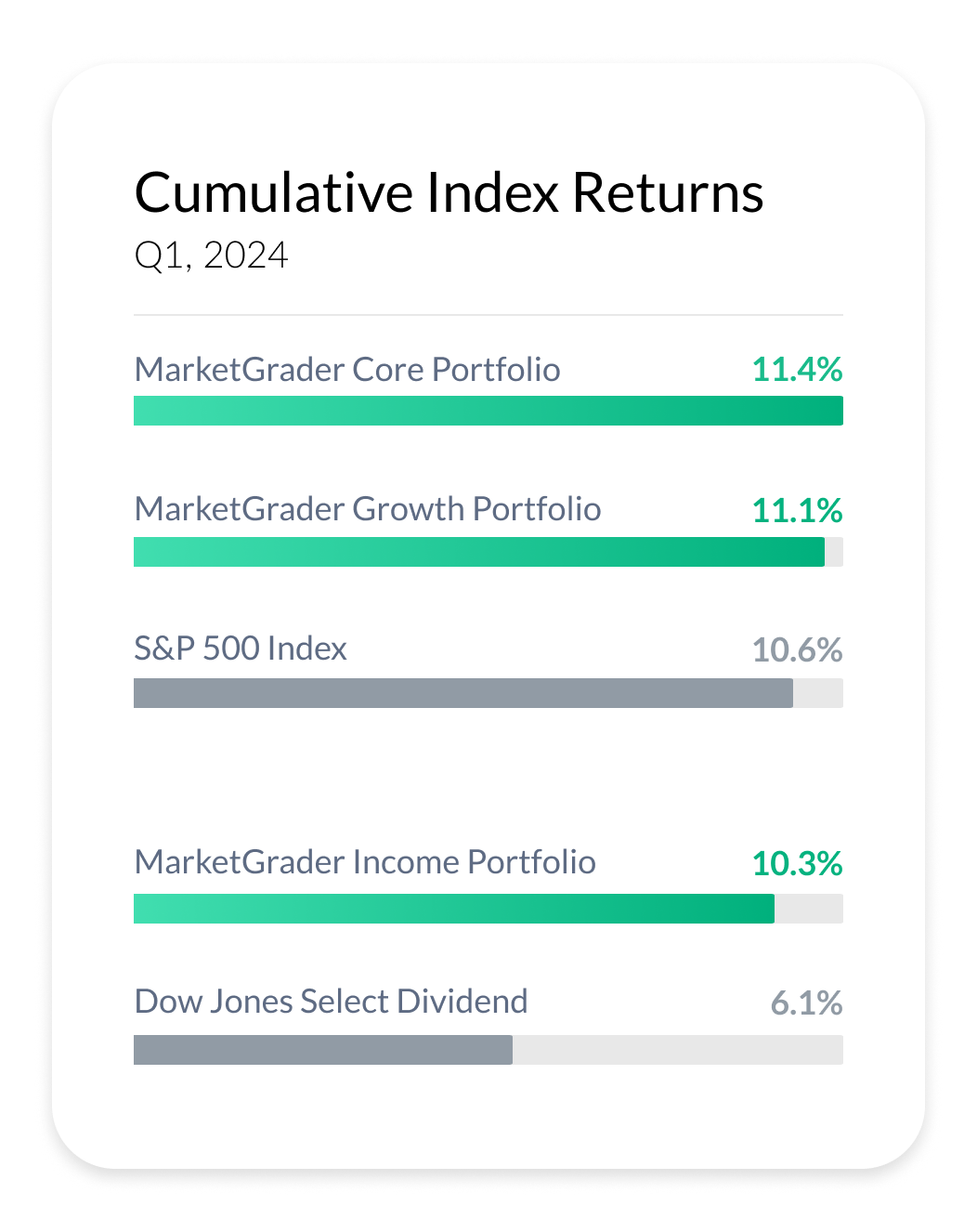

Q1 2024 Portfolio Performance: Impressive Results Across the Board

All figures are based on total returns through March 29, 2024, unless marked otherwise. All returns are calculated in USD, unless otherwise indicated on the table. Sources: FactSet & MarketGrader.

BBAE’s MyAdvisor offers three distinct smart beta portfolios, each carefully crafted to meet the diverse needs and risk profiles of our investors:

1. MarketGrader Core Portfolio: Balancing Growth and Value

The BBAE MarketGrader Core Portfolio aims to provide investment results that closely mirror, before fees and expenses, the performance of the MarketGrader US Core Portfolio Index. This index offers exposure to a rules-based selection of U.S. companies that rank highly in MarketGrader’s GARP (growth-at-a-reasonable-price) + Quality analysis. By offering diversified exposure to U.S. equities across large, mid, and small caps, the index serves as a core holding within an investor’s portfolio. The MarketGrader US Core Portfolio Index is constructed from a combination of four MarketGrader Indexes: the MarketGrader US Select Large Cap Index, the MarketGrader US Large Cap 100 Index, the MarketGrader US Mid Cap 100 Index, and the MarketGrader US Small Cap 100 Index.

In Q1 2024, the MarketGrader Core Portfolio achieved an impressive return of 11.4%, surpassing the S&P 500 benchmark, which delivered a 10.6% return over the same period.

2. MarketGrader Growth Portfolio: Capitalizing on High-Growth Opportunities

The BBAE MarketGrader Growth Compounding Portfolio seeks to deliver investment results that generally correspond, before fees and expenses, to the performance of the MarketGrader US Growth Compounding Portfolio Index. This index provides exposure to a rules-based selection of high-performing U.S. companies across large, mid, and small caps, serving as a growth-oriented holding within an investor’s portfolio. The MarketGrader US Growth Compounding Portfolio Index is built from a combination of four MarketGrader Indexes: the MarketGrader US Select Large Cap Index, the MarketGrader US Large Cap 100 Index, the MarketGrader US Mid Cap 100 Index, and the MarketGrader US Small Cap 100 Index.

In Q1 2024, the MarketGrader Growth Portfolio generated an impressive return of 11.1%, surpassing the S&P 500 benchmark, which delivered a 10.6% return over the same period.

3. MarketGrader Income Portfolio: Generating Steady Income Streams

The BBAE MarketGrader Growth and Income Portfolio strives to achieve investment results that, before fees and expenses, generally correspond to the performance of the MarketGrader US Income 100 Index. This index offers investors a strategic approach to gaining exposure to U.S. companies known not only for substantial dividend yields but also for scoring favorably in MarketGrader’s proprietary GARP (growth-at-a-reasonable-price) + Quality analysis. The MarketGrader US Income 100 Index emphasizes identifying companies that offer the potential for both income generation through dividends and capital appreciation, making it particularly appealing to income-focused investors seeking a balanced approach to growth and income.

In Q1 2024, the MarketGrader Income Portfolio delivered a solid return of 10.3%, significantly outpacing its benchmark, the Dow Jones Select Dividend Index, which returned 6.1% over the same period.

Summary

The first quarter of 2024 has been a testament to the strength and resilience of BBAE’s MyAdvisor smart beta portfolios. Our MarketGrader portfolios have not only outperformed their respective benchmarks but have also delivered impressive absolute returns, showcasing the effectiveness of our data-driven investment approach.

At BBAE, we remain committed to democratizing access to sophisticated investment strategies, empowering investors of all levels to harness the potential of smart beta investing. The user-friendly BBAE mobile app, coupled with the ability to invest in diversified portfolios with just one click, has made investing more accessible and convenient than ever before.

We are grateful for the trust and confidence our investors have placed in us, and we remain steadfast in our commitment to helping them achieve their financial goals. Whether you are a seasoned investor or just starting your investment journey, BBAE’s MyAdvisor offers a compelling solution for those seeking to build long-term wealth through smart, diversified investing.

Join us today and experience the power of smart beta investing at your fingertips with BBAE’s MyAdvisor.

Disclaimer: The BBAE MarketGrader Portfolios seek investment results that, before fees and expenses, correspond to the performance of the MarketGrader US Core Portfolio Index. Performance data prior to September 4, 2023, is backtested, does not reflect actual investment performance, and is provided for informational purposes only. Backtested performance is hypothetical, calculated retrospectively, and does not guarantee future results. Actual investment outcomes may vary due to market volatility, strategy, fees, taxes, and other expenses. Investing involves risk, including the potential loss of principal. This information is not intended as investment advice or a recommendation to engage in any investment strategy. Consult a financial advisor to determine the suitability of any investment. BBAE Advisors LLC is an SEC-registered investment advisor. For detailed information about our services, fees, and conflicts of interest, please consult our Form ADV from the SEC’s Investment Adviser Public Disclosure website.