BBAE’s MarketGrader Growth Compounding Portfolio – Q1 2024 Review

Are you an investor who wants to maximize your returns without putting all your eggs in one basket? Do you want an easy way to invest in 300 different stocks with just one click? Look no further than our BBAE MyAdvisor smart beta strategies. This approach combines the benefits of diversification and low costs, just like index investing, but with a special twist designed to help you outperform the market. The BBAE MarketGrader Growth Compounding portfolio is a fantastic example of this strategy in action.

You might be thinking, “Growth Compounding? That sounds like something from a Silicon Valley startup pitch, not a diversified investment strategy. But the BBAE MarketGrader Growth Compounding portfolio, which tracks the MarketGrader US Growth Compounding Portfolio Index, is a carefully crafted mix of the best-performing U.S. growth stocks across different market capitalizations. The best part? You remain balanced to the beta of the overall market, meaning the portfolio’s target volatility is in line with the broader market.

MarketGrader, the brains behind these indexes, is like a talent scout for high-performing companies. They use a rigorous, fundamentals-based selection process to identify businesses with strong growth potential, healthy financial statements, and sustainable competitive advantages. This process involves analyzing each company’s earnings growth, revenue growth, cash flow growth, and other key metrics.

BBAE’s MarketGrader Growth Compounding strategy offers investors a diversified, yet focused exposure to some of the most promising growth stocks in the U.S. market. And with MarketGrader’s proven track record of identifying winners, it’s no surprise that this portfolio has delivered impressive results.

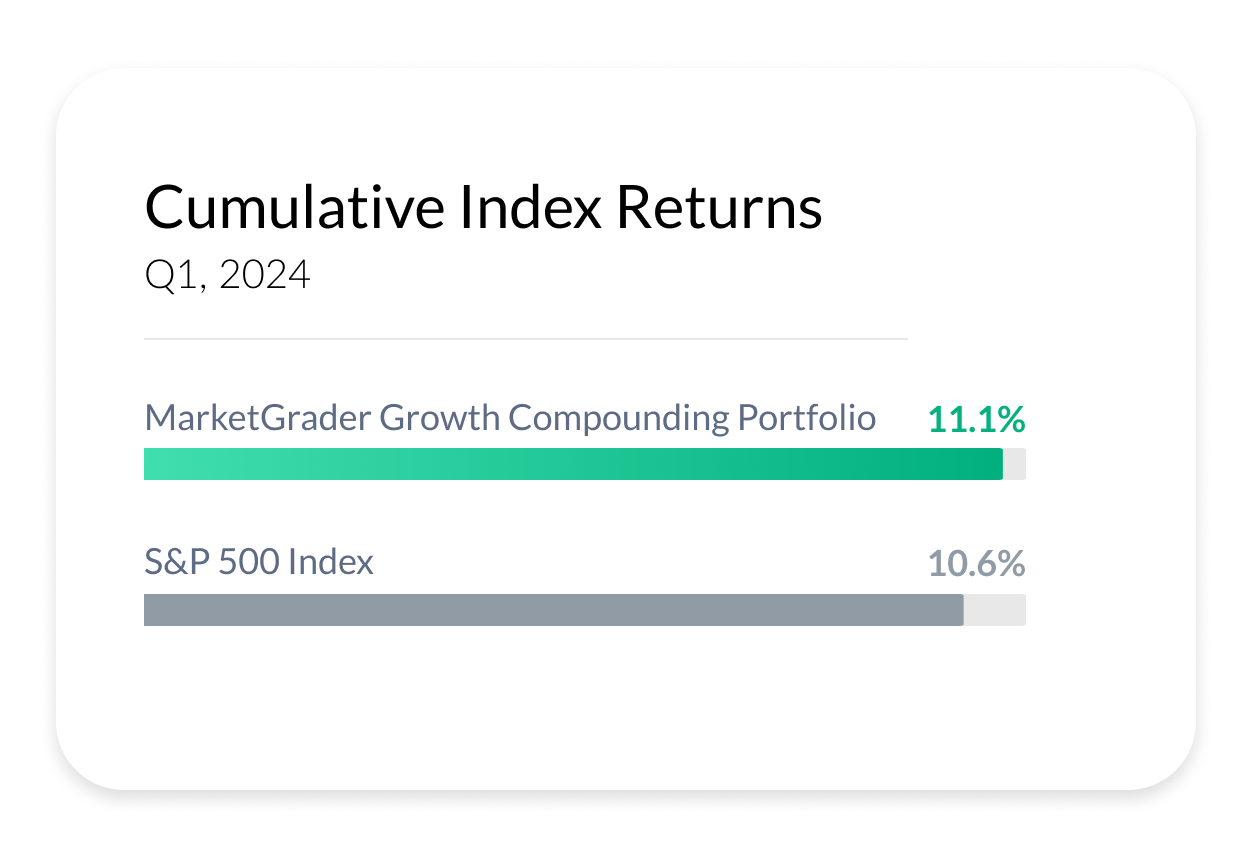

In Q1 2024, the BBAE MarketGrader Growth Compounding portfolio put up some seriously impressive numbers. How does an 11.1% return sound? Pretty good, right? Especially when you compare it to the S&P 500’s 10.6% over the same period.

But here’s the thing: those returns aren’t just a one-hit wonder. The secret sauce behind this portfolio is the rules-based methodology that blends four MarketGrader indexes covering large, mid, and small-cap stocks. And these MarketGrader indexes have been running since 2008.

And the best part? You don’t need to be a customer of a high priced financial advisor or private bank to get in on the action. Through BBAE’s MyAdvisor, you can access this growth-focused smart beta strategy with a minimum investment of just $2,000, using fractional share technology to allocate you perfectly into the 300 stock portfolio.

But the MarketGrader Growth Compounding portfolio isn’t just about accessibility. It’s also has transparency. Unlike your typical mutual fund or ETF, where your money disappears into a black box, this portfolio lets you own each stock individually. You get to see each holding in your account, and it appears on your account statement each month.

Of course, no investment is risk-free, and the BBAE MarketGrader Growth Compounding portfolio is no exception. It’s a growth-oriented strategy, which means it has the potential to be a bit of a roller coaster ride at times. But if you’re the type of investor who can tolerate a few dips in exchange for the potential of outsized returns, this might be the smart beta play for you.

So, if you’re ready to put some growth in your portfolio and remained balanced to the beta of the market, the BBAE MarketGrader Growth Compounding portfolio might just be the ticket for you. With its impressive returns, institutional-quality pedigree, and accessible minimums, it’s a strategy that’s hard to ignore.

Just remember, past performance is no guarantee of future results. But if the BBAE MarketGrader Growth Compounding portfolio can keep putting up numbers like it has been, it might just be the smartest move you make.

Happy Investing,

Barry Freeman

CEO @ BBAE

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.