Morgan Housel has one of the best money perspectives around. For a young guy – by my standards – he’s phenomenally wise, and in a way that even most wise people aren’t. He deserves all the fame he’s accrued, and more.

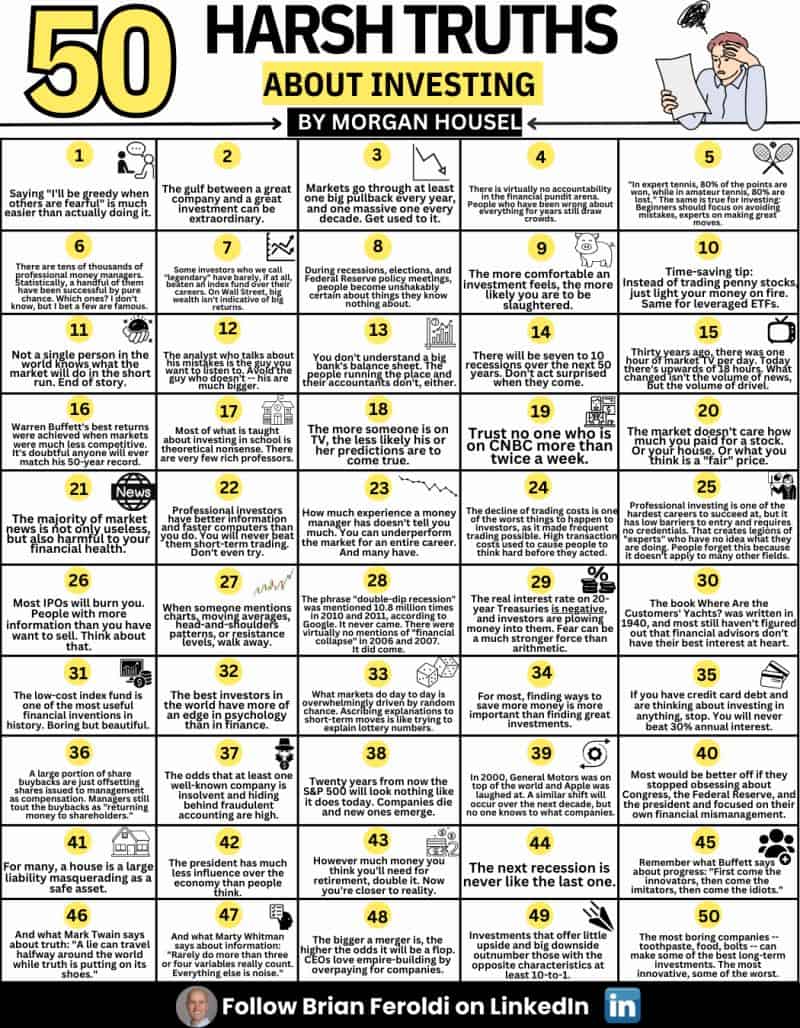

I recently came across a compendium of one-liner-ish quotes from Morgan, assembled into a graphic by Brian Feroldi.

(Which I am about to comment on, marking, in calculus terms, the second derivative of Morgan’s work.)

Anyway, have a look at Brian’s graphic based on Morgan’s quotes first – and then see the James commentary below.

Points that stands out to me, summarized in my own words:

#2: “Good company” isn’t the same as “good investment:” One of the most common rookie mistakes is assuming that a good company equals a good investment. It often does, eventually – Walmart, Nike, Disney, Apple, and many others have, over the long haul, been both good companies and good investments. But the most famous companies smack in the middle of the hottest trends are the most obvious “good” companies to the casual observer – and are often wildly overpriced for that same reason.

#4 & #18 & #19: Investment media and punditry: As someone who’s invited to talk in the media semi-often, but not very often, I’d add that what the media wants is attention. Attention is their business, almost literally. I don’t demonize the media. They’re not out to get you, and nobody in CNBC or Bloomberg wants you to lose money on your investments. They’re usually pretty nice people. But the nature of their work invites the tendency to make much ado about nothing. Seeing smart, experienced people talk on a respected platform at least subconsciously conveys the sense that trade-worthy news is happening all the time – when, in reality, it almost never happens.

#9: Comfortable investments get you slaughtered: Investing is a stochastic social science. Our emotions are wired for physical, non-stochastic things, meaning we can’t trust them in investing. This is why people like Warren Buffett, who excel at restraint, tend to excel at investing.

#36: Share buybacks often just compensate for share issuance for executive compensation: Granular, but true. If a company sells shares for fair value on the open market, that’s not dilutive to value. But giving executives restricted shares or options that let them ultimately buy shares at a strike price much lower than the stock price is (in the case of options, it’s dilutive by the price differential). To mask the increase in share count, companies may repurchase shares. It shouldn’t fool people, but it does.

#40: Worry more about your own finances than the US’ or about Congress, the Fed, etc.: It’s great to be civic-minded and care about the nation. In fact, a big point of democracy is Average Joes and Janes caring about the nation, and voting. But civic care should not come at the expense of your own household’s affairs – if it does, it might be closer to tribalism or entertainment than actual civic-ness. And some investment “gurus” play on your political alignment – birds of a tribe flock together – as a way to sell you advice.

#45: Buffet: Innovators/Imitators/Idiots, in that order: This is obvious when you think about it. Most AI companies will fail. Most car companies failed. Most ecommerce startups failed, and most cryptocurrencies failed. Everyone would agree to this. The rub is self-awareness. Imitators and idiots think they are innovators. This is presumably because, in their minds, they’re doing the same things that the innovators recently did. (Hint: If you’re doing something that someone else did, you’re not an innovator.)

#16: Buffett’s best returns came when the market was less competitive: I put this one after #45 because Buffett has, understandably, inspired legions of imitators. Just as how Buffett has to move on from finding Ben Graham’s net-nets (Ben Graham was Buffett’s mentor) as they disappeared in a more competitive and sophisticated market, the Buffetts of the future will need something new to deliver the 3,800,000% returns that Berkshire Hathaway has. (That said, even imitating Buffett today would, in my view, still give you pretty good returns because his style is based on timeless principles. Just not as good returns as before.)

James

You can learn more about the BBAE philosophy and scope out opening an account right here.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.