Investors, we have a discrepancy.

In one corner is the Fed, which expects to cut its Fed Funds rate three times in 2024 (cuts tend to happen in quarter-point increments). This would total a 0.75 percentage point reduction to the target Fed Funds rate range, which is currently 5.25% to 5.50%*.

Those three 25-basis point cuts would have the US ending 2024 with Fed Fund rates between 4.5% and 4.75%.

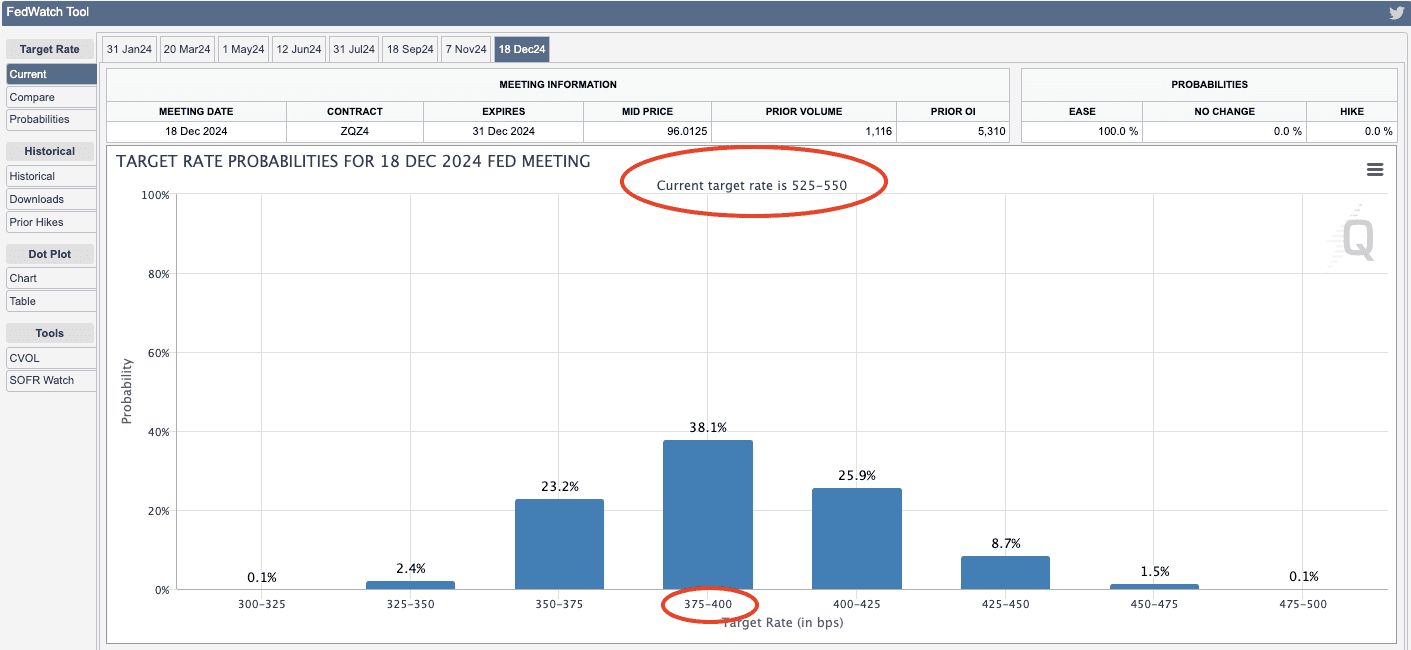

In the other corner is the market, which doesn’t believe the Fed (ironically, about the Fed’s own behavior). CME’s FedWatch tool imputes rate expectations from the Fed Fund futures market, and the largest histogram bar expects Fed Fund rates of 3.75% to 4% as of the Fed’s 12/18/2024 meeting.

The market is expecting roughly double the cutting the Fed expects. And Wall Street banks have their own expectations, with UBS currently the most dovish with 275 basis points of expected cuts.

Interest Rate Questions:

- Who is right?

- How do interest rates affect the stock market?

- What, if anything, should you do?

*For those new to Fed mechanics, the Fed Funds rate is the rate that banks that participate in the Federal Reserve system (which includes all nationally chartered banks and some state banks if they meet the requirements and choose to join; roughly ⅓ of US banks are part of the system, although this minority likely controls the lion’s share of deposits) charge *each other* on overnight loans to meet minimum reserve requirements. The Fed, unlike many other central banks, technically doesn’t set its baseline rate – it just encourages banks to do so. Since the Fed began paying interest on deposits, this has become easier, because would-be lenders will request at least the Fed’s deposit rate from would-be borrowers.

Interest Rate Answers:

- Economics is a social science, and when you see many smart, well-informed people with widely varying views on a topic, it’s a sign that nobody really knows, at least conclusively.

- Let’s unpack and as we do, (3) may be answered implicitly.

Higher interest rates slow down an economy by raising the cost of borrowing, and lower interest rates accelerate it by making loans more affordable. Central banks largely focus on this.

Mathematically, higher interest rates lower the values of companies by lowering the present value of future profits. In a discounted cash flow model, each expected future profit is divided by the quantity (1 + discount rate)number of years into the future.

| The discount rate is itself an estimate embedding both opportunity cost (i.e., what you could earn in government bonds) and the unique risk of the investment. Interestingly, as John Cochrane of Stanford’s Hoover Institution and the US National Bureau of Economic Research published in 2011, variations in discount rate expectations may be more responsible for stock price differences than variations in future cash flows. In other words, stock prices vary less because one analyst expects Tesla’s revenues to reach $250 billion and another thinks they’ll reach $1 trillion (Tesla’s actual revenues are just shy of $100 billion now). Instead, stock price variation, Cochrane says, stems more from different views about the probability of what’s apparently a market semi-consensus outcome actually occurring. |

If you project a very simple company to earn a single $100 cash flow in 10 years, and assume a 10% discount rate, that company is worth $38.55 now.

If you lower the discount rate to 6%, it’s worth $56.45.

This is “real economy” math.

If the real economy is a hot dog – just the meat part of the hot dog – the stock market would be that plus a “bun” of perception and anticipation.

The meat matters. For instance, central banks cut rates and kept them low following the 2008-2009 Great Financial Crisis, and stock markets (especially America’s) largely performed well during that low-rate period. As expected, biotechs and early-stage growth companies whose main projected cash flows are far into the future (and thus punished the most by high rates) did very well for 13+ years, and got clobbered in 2022 as the Fed raised rates 11 times.

Fed Researcher: 1 bps Treasury rate increase = 3.5 bps stock market drop

And there is research (some thinly cited; this one has just a single citation) to support rising rates being bad for equities: Chris Cotton from the Federal Reserve Bank of Boston found that every 1 basis point increase in the five-year Treasury rate lowers stock prices by about 3.5 basis points.

So if five-year rates rose from, say, 4% to 5%, stock prices would fall by 3.5%.

However, the bun matters, too.

Much of the empirical evidence – albeit more granular in many cases – on stocks and interest rates shows the opposite.

BlackRock: Sorry, but stocks rise after rate hikes

BlackRock found that since 1995, the S&P 500 rose by 3.2% in the three months following 50-basis point rate hikes.

That’s counterintuitive.

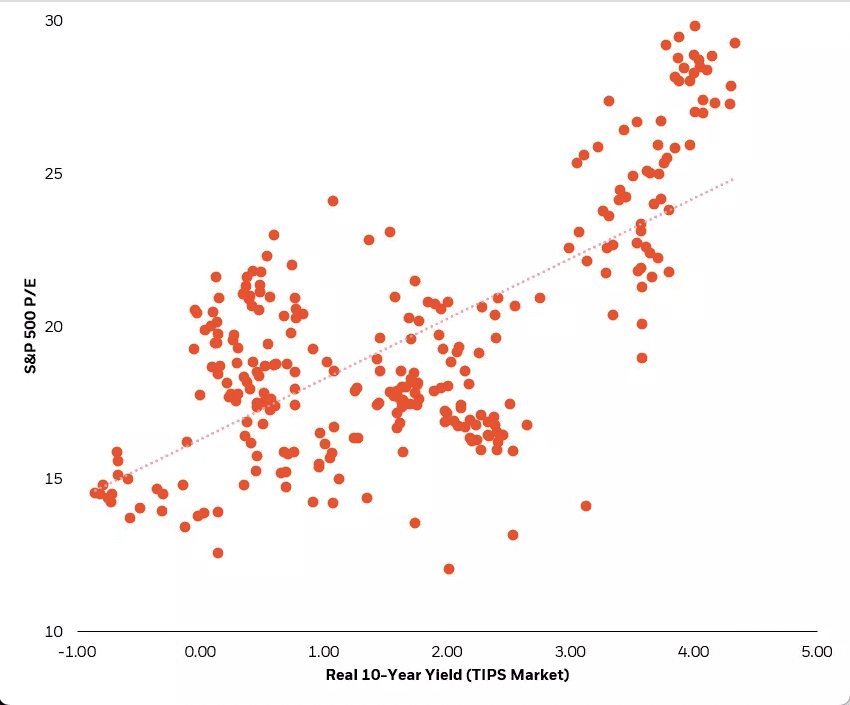

Speaking of counterintuitive and speaking of BlackRock, this article by Russ Koesterich has the following graphic, which shows inflation adjusted 10-year yields versus S&P 500 P/E ratios from 1997 to 2020.

The regression line shows that higher interest rates map to higher P/E ratios. P/E is a fraction, so P/Es can rise because investors are paying more for the same earnings, or they can rise because earnings dropped and patient investors kept the faith by not lowering the stock price.

Some research has shown that the “rising rates hurt stocks” story is a numerator story (i.e., rates affect company financials) as well as a denominator story (i.e., different discount rates), and numerator effects may explain a chunk of this. But, still, it’s unexpected.

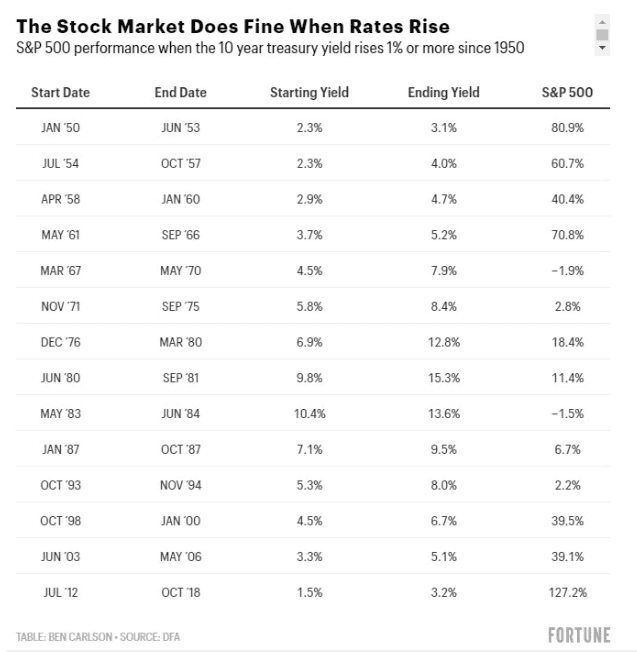

Want more? Here’s a table from Ben Carlson, updating one originally published by Jack Bogle (as found in this Investing.com article by Lance Roberts):

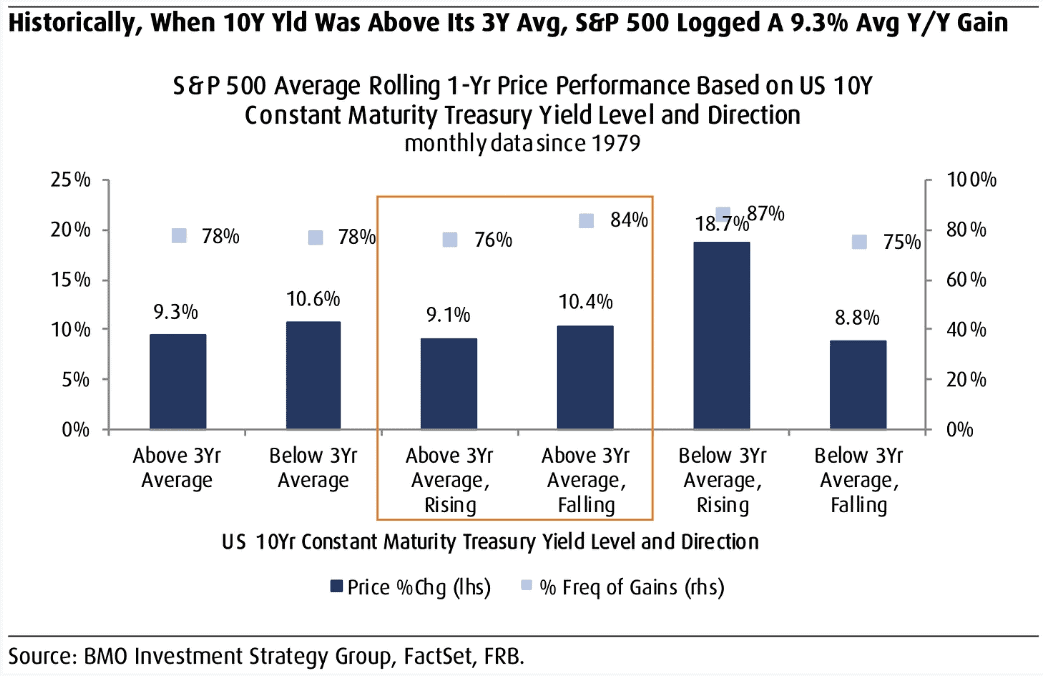

Sam Ro, who publishes Tker.co, recently shared some data from BMO Investment Strategy Group. One point was that from 1979-2022, during rate-hike cycles, the S&P 500 has risen 10.7% annually, on average.

Why can’t anyone provide a definitive answer on stocks and interest rates?

If you came to this article looking for clear, exact, specific guidance on how stocks behave as interest rates move, my apologies. In fact, the whole point is that there is no clear, exact, specific guidance on this topic.

In a data sense, we haven’t had all that many rate hike periods in the modern US economy, first of all, and each one is a little different. And a pet theory I’m nursing is that because the stock market is anticipatory, the “bad news” of rate hikes tends to hit stocks in advance of the actual rate hikes – and during at least the tail end of rate-hike periods, investors are similarly looking ahead to rate-drop periods and pricing those in. Just conjecture – it’s likely that this has been studied somewhere.

Some good news for investors: Per Yahoo! Finance, rate hike peaks in 1995, 2006, and 2018 were each followed by a year of 20%+ gains.

For a muted version of this, let’s re-channel Sam Ro, who himself channeled BMO Investment Strategy’s graphic showing that since 1979, when rates have been above their three-year average and then start falling, the S&P’s average return in the following year is 10.4%.

Either 20% or 10.4% would be a decent return – especially after a year in which the S&P 500 returned 26%.

So what do rising – or falling – interest rates mean for investors?

Given enough data, whatever you want them to.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.