Inside Pony AI’s ($PONY) IPO: What Investors Should Know

Pony AI ($PONY), a Chinese autonomous driving technology company, has recently filed for an initial public offering (IPO) in the United States. This follows WeRide, another self-driving taxi startup, which filed for a U.S. IPO in August but later postponed its plans, citing the need for more time to finalize the necessary documentation. Pony AI intends to list on Nasdaq under the ticker symbol ‘PONY.’ In this article, I will provide a comprehensive analysis of Pony AI’s IPO, covering its business model, product offerings, financial performance, and competitive landscape.

What is Pony AI

Founded in 2016, Pony AI specializes in developing autonomous driving technologies across Levels 2 to 4 automation. Below is an overview of Pony AI’s main products and their current operational status:

Main Products and Services:

- Robotaxi (PonyPilot): The company operates a fleet of over 250 robotaxis, which have collectively driven more than 33.5 million kilometers autonomously, including over 3.9 million kilometers without a safety driver. The company claims that the PonyPilot mobile app has over 220,000 registered users. Pony AI is also one of the first companies in China to get approval to operate fully driverless taxis in all four Tier-1 cities: Beijing, Shanghai, Guangzhou, and Shenzhen.

- Robotruck (PonyTron): Pony AI has over 190 self-driving trucks, working both on their own and in partnership with Sinotrans, China’s largest freight logistics company. These trucks have driven around 5 million kilometers. The fleet supports long-distance freight transport in China, carrying over 767 million ton-kilometers of goods. Pony AI is also working with SANY, China’s top truck maker, to develop fully automated (Level 4) robotrucks.

- Licensing and applications: Pony AI offers intelligent driving solutions for privately-owned vehicles (POV), which include software licensing, hardware, and data analytics tools, to OEMs and other industry participants.

Valuation and Fundraising Target

Pony AI reached a valuation of $8.5 billion after its Series D funding round in 2022, according to the company’s press release. This represents more than a 65% increase in valuation from the previous round in 2020, which valued the company at $5.3 billion.

The current valuation target is not stated in the IPO filing, but the company has recently revised its minimum IPO valuation from $8.5 billion to $4.0 billion, and the minimum gross proceeds from $425 million to $200 million.

In comparison, in 2022, WeRide was valued at $4 billion after its Series D private funding round.

Financial Data

Revenue Growth

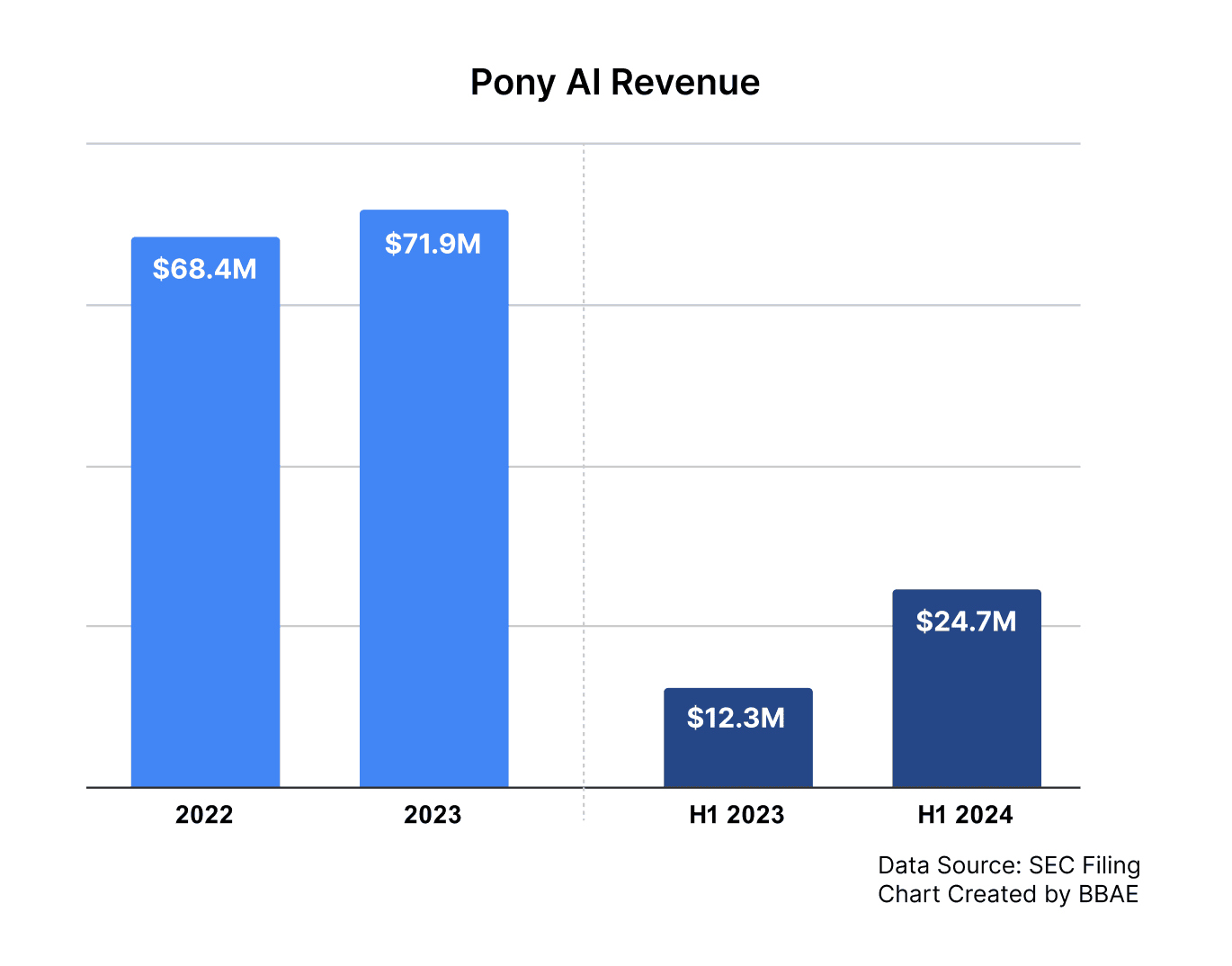

Source: SEC Filing

In 2023, the company’s total revenues grew by 5.1%, reaching $71.9 million, with licensing and applications serving as the largest contributor. Revenues from this segment increased by 5.8%, rising to $39.2 million, driven by the expansion of the company’s vehicle-to-everything (V2X) technology. The robotruck services also experienced robust growth, with an 11.9% increase to $25.0 million, supported by higher transportation fees and expanded mileage through a joint venture with Sinotrans.

However, revenues from robotaxi services declined by 14.4%, falling from $9.0 million in 2022 to $7.7 million in 2023. This decline was mainly due to lower payments for technical work related to an autonomous vehicle project, though this was partly offset by the introduction of fare-paying robotaxi operations in key Chinese cities.

In the first half of 2024, total revenues surged by 101.2%, jumping from $12.3 million in the first half of 2023 to $24.7 million. This significant growth was primarily driven by the continued expansion of robotruck services and increased revenues from licensing and applications.

Liquidity

As of December 31, 2023, the company’s cash reserves stood at approximately $589.8 million. By mid-2024, cash reserves had dropped to $473.3 million, primarily due to $91.2 million spent on business operations and a $25.3 million shift in investments as the company opted for longer-term bank deposits to improve capital management.

Partnerships and Investors

Pony AI has formed a joint venture with Toyota and GTMC to advance the mass production and large-scale deployment of fully driverless robotaxis in China. Additionally, the company has partnered with other leading OEMs, such as SAIC, GAC, and FAW, to co-develop and mass produce robotaxi vehicles.

Competitor Landscape

Pony AI competes with both major tech giants and niche autonomous driving startups, each offering distinct advantages. Keep in mind, this is not a comprehensive list of competitors:

WeRide

- Competing segment: Robotaxi services and autonomous trucking

- Backed by: Nissan and Alibaba

- Valuation: $4 billion (as of 2022)

- Main market: United States

WeRide, a key competitor to Pony AI, operates in both China and the US, specializing in robotaxi services while also expanding into autonomous trucking.You can read my review of WeRide’s IPO filing here.

Waymo

- Competing segment: Robotaxi services and autonomous trucking

- Backed by: Alphabet (parent company)

- Valuation: Estimated $30 billion (as of 2021)

- Main market: United States

Waymo, formerly the Google self-driving car project, is a leader in autonomous driving technology and robotaxi services, presenting significant competition to Pony AI.

Cruise

- Competing segment: Robotaxi services and autonomous delivery

- Backed by: General Motors, Honda

- Valuation: $30 billion (as of 2021), Reuters reported that the valuation was slashed by more than half in 2024.

- Main market: United States

Cruise is developing both robotaxi services and autonomous delivery vehicles, directly competing with Pony AI’s robotaxi offerings.

AutoX

- Competing segment: Robotaxi services

- Backed by: Alibaba, Dongfeng Motor, and SAIC Motor

- Valuation: Not publicly disclosed

- Main market: China

AutoX is primarily focused on robotaxi services in China, directly competing with Pony AI in its home market.

Baidu Apollo

- Competing segment: Robotaxi services and autonomous driving technology

- Backed by: Baidu (parent company)

- Valuation: Not separately disclosed (part of Baidu)

- Main market: China

Baidu’s Apollo project competes with Pony AI in robotaxi services and in providing autonomous driving technology to other automakers.

Momenta

- Competing segment: Autonomous driving software

- Backed by: SAIC Motor, Toyota, Bosch, Daimler, Nio Capital

- Valuation: Over $1 billion (as of 2021)

- Main market: China

Momenta focuses on developing autonomous driving software, competing with Pony AI in providing technology to automakers.

DeepRoute.ai

- Competing segment: Robotaxi services and autonomous driving solutions

- Backed by: Alibaba

- Valuation: Estimated at $1.2 billion when it raised $350 million in private funding in 2021.

- Main markets: China and United States

DeepRoute.ai is developing both robotaxi services and autonomous driving solutions for automakers, putting it in direct competition with Pony AI across multiple segments.

Aurora Innovation (NYSE: AUR)

- Competing segment: Autonomous trucking and robotaxi services

- Backed by: Uber, Toyota

- Valuation: $10.7 billion (Publicly Traded)

- Main market: United States

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. BBAE has no position in any investment mentioned.