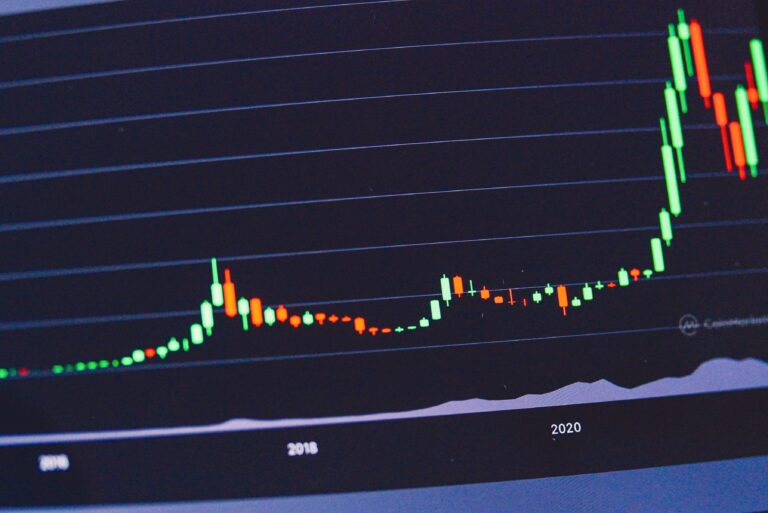

Stock market indices are essential tools for investors looking to gauge the performance of a specific market or market segment. To the extent they represent the market, they can show trends and serve as a benchmark for evaluating investment performance. Let’s look at stock market indices: what they are, their significance, and how investors can use them to enhance their strategies.

What are Stock Market Indices?

A stock market index is a collection of stocks designed to represent a specific market or segment. These indices are often created and maintained by financial institutions or independent organizations. The value of an index is derived from the combined value of its constituent stocks, typically weighted by market capitalization, price, or other factors.

Some of the most widely recognized stock market indices include:

1. S&P 500: This index comprises 500 of the largest publicly traded companies in the United States, representing a broad cross-section of industries. The S&P 500 is considered a key benchmark for the overall U.S. stock market. Fun fact: Most S&P 500 stocks are actually small caps.

2. Dow Jones Industrial Average (DJIA): The DJIA is a stock price-weighted index consisting of 30 large, established U.S. companies from various sectors. It is one of the oldest and most widely followed stock market indices globally, but weighting by stock price is considered weird these days – the DJIA persists, though, because it’s been around forever.

3. NASDAQ Composite: The NASDAQ Composite is a market capitalization-weighted index that includes more than 3,000 companies listed on the NASDAQ stock exchange. It is heavily weighted toward technology and innovative growth companies.

4. FTSE 100: The Financial Times Stock Exchange 100 Index, or FTSE 100, is a market capitalization-weighted index comprising the 100 largest companies listed on the London Stock Exchange. The FTSE 100 is considered a benchmark for the overall UK stock market.

| Advanced Point: The earliest indices (do you prefer “indices” or “indexes?” Let us know!) tended to be assemblages of the biggest stocks on a given exchange. These days, with the proliferation of exchange-traded funds (ETFs) looking for an index (see below), we’ve got indices for almost anything that can be indexed: Billionaire trading, middle-class women’s purchasing preferences, insider sentiment, Master Limited Partnerships, and a lot more. Generally, the weirder the index, the less likely it’s used for anything except being an “official” index for an ETF to follow. |

Significance of Stock Market Indices

Stock market indices play several critical roles:

1. Market Benchmark: Investors often compare their portfolio performance against indices. Because index performance can generally be easily achieved via an ETF (an ETF strategy may underperform the underlying index due to various costs and slippage, but the underperformance tends to be slight for the large ETFs), an index is commonly seen as a hurdle for an actively managed portfolio to clear.

2. Economic Indicator: Indices can serve as barometers for the overall health of an economy or market segment. For example, a consistently rising index may signal a healthy, growing economy, while a falling index may indicate economic stagnation or decline.

3. Passive Investing: Many passive investment products, such as index funds and the aforementioned ETFs, track the performance of stock market indices. These investment vehicles allow investors to gain exposure to a broad market segment or the entire market by investing in a single product.

How Investors Can Use Stock Market Indices

Investors can utilize stock market indices in various ways to enhance their investment strategies:

1. Portfolio Diversification: Investing in index funds or ETFs can provide broad exposure to a market or market segment, offering valuable diversification benefits. This can help reduce risk in a portfolio by spreading investments across a wide range of companies and sectors, although funds tracking narrower indices would naturally offer less diversification benefit.

2. Factor Exposure: On the other side of the diversification coin is exposure. Frequently, an active investor will want to make a proactive “bet” on a theme, factor, geographic area, etc., doing well (or poorly). Indices and their accompanying funds can make such trades convenient.

3. Performance Tracking: Comparing your portfolio’s performance to an appropriate index can help identify areas for improvement. If your portfolio consistently underperforms the chosen benchmark, it may be time to reassess your investment strategy and make adjustments (such as simply buying a fund that tracks the index).

4. Market Analysis: Analyzing index movements and trends can offer insights into market sentiment, sector performance, and potential investment opportunities. For example, if an investor notices particular industry indices consistently outperforming the broader market, he or she might consider exploring the constituents or embedded factors of that industry further.