The future of transportation is electric, and the investment opportunities in the Electric Vehicle (EV) sector are filled with promise and potential. With governments setting ambitious targets to reduce carbon emissions and consumers increasingly embracing sustainable alternatives, the EV market is experiencing unprecedented growth. From innovative vehicle manufacturers to cutting-edge charging infrastructure and the essential commodities powering it all, the landscape is rich with possibilities. But how can investors tap into this burgeoning sector? Enter BBAE Discover, your gateway to the world of EV, Charging, and Batteries. Whether you’re a seasoned investor or just starting your journey, BBAE Discover offers curated insights, comprehensive analysis, and tailored investment themes to guide you through the complex yet exciting world of electric transportation.

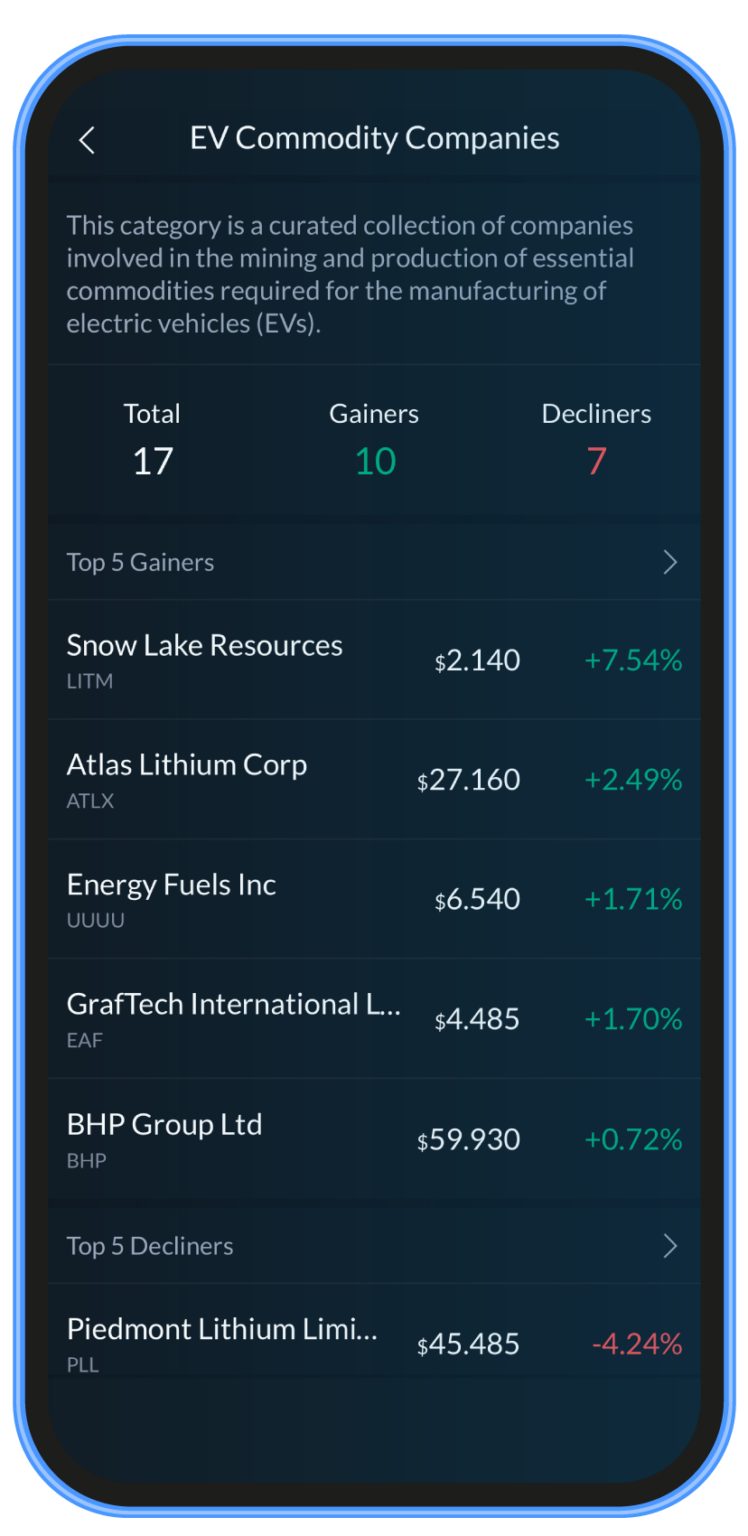

For a full list of the stocks in the BBAE Discover curated portfolio for Electric Vehicles, Charging, and Batteries, please click here, or find them inside the BBAE app here. For a full list of the stocks in the BBAE Discover curated portfolio EV Commodity Input Companies, please click here, or find them inside the BBAE app here.

The EV Revolution: A Curated Investment Theme

Why Invest in EVs?

The transition from fossil fuels to electric power is more than a trend; it’s a revolution. As the world grapples with climate change and seeks sustainable solutions, the shift towards electric vehicles is accelerating. Here’s why investing in this sector is not only timely but also strategic:

- Growth Potential: The EV market is projected to grow exponentially in the coming years. With increasing government support, consumer interest, and technological advancements, the demand for electric vehicles is on the rise. According to some estimates, EV sales could account for over 50% of total automotive sales by 2040. This growth trajectory presents significant investment opportunities for those looking to capitalize on the future of transportation.

- Sustainability: Investing in EVs aligns with global efforts to reduce carbon emissions. As countries set ambitious targets to phase out internal combustion engines, electric vehicles are becoming central to achieving these goals. By investing in EVs, you’re not only positioning your portfolio for financial growth but also contributing to a greener and more sustainable future.

- Innovation: The EV sector is ripe with technological advancements, offering exciting investment opportunities. From cutting-edge battery technology to autonomous driving features, the innovation within the EV space is relentless. Companies are continuously pushing the boundaries of what’s possible, creating new products and services that redefine transportation. This innovation drives market competition and offers diverse investment avenues.

- Government Support and Regulations: Governments worldwide are setting ambitious targets to phase out internal combustion engines, providing subsidies, and implementing regulations that favor electric vehicles. This political backing adds momentum to the EV movement, creating a favorable environment for investment.

- Consumer Adoption: As awareness of environmental issues grows, consumers are increasingly embracing electric vehicles. The expanding range of models, improving charging infrastructure, and decreasing costs are making EVs more accessible to the average consumer. This shift in consumer behavior is likely to sustain the growth of the EV market in the long term.

- Global Market Dynamics: The EV revolution is not confined to a specific region; it’s a global movement. From the U.S. and Europe to China and India, the adoption of electric vehicles is a worldwide phenomenon. This global reach offers diversified investment opportunities and the potential to tap into emerging markets.

Charging Infrastructure: Powering the Future

Charging infrastructure is the backbone of the EV revolution. As electric vehicles become more prevalent, the need for accessible and efficient charging solutions grows in tandem. This essential aspect of the EV ecosystem is not just about plugging in a car; it’s about powering a sustainable future. Here’s why investing in charging infrastructure is a strategic move:

- Increasing Demand: As the number of EVs on the road increases, so does the demand for charging stations. From urban centers to highways, the need for convenient charging locations is expanding. This growing demand translates into investment opportunities in companies that provide charging solutions.

- Technological Advancements: The charging technology itself is evolving, with innovations in fast charging, wireless charging, and smart charging systems. These advancements are enhancing the user experience and efficiency of charging, opening doors for investment in cutting-edge technology providers.

- Government Initiatives: Many governments are actively supporting the development of charging infrastructure through subsidies, grants, and regulations. This governmental backing creates a favorable environment for companies involved in charging infrastructure, enhancing their growth prospects.

- Integration with Renewable Energy: The future of charging infrastructure is closely tied to renewable energy. Solar-powered charging stations and integration with wind energy are examples of how charging infrastructure is aligning with sustainability goals. Investing in companies that pioneer these solutions can be both financially rewarding and environmentally responsible.

Batteries: The Heart of EVs

The battery is the heart of an electric vehicle, powering everything from the motor to the onboard electronics. As the EV market grows, so does the demand for advanced and efficient battery technology. The investment opportunities in this area are vast, and through BBAE Discover, you can explore companies specializing in various aspects of battery technology:

- Lithium-Ion Batteries: The most common type of EV battery, lithium-ion batteries have significant growth potential. As technology improves and costs decrease, these batteries are becoming more accessible and efficient. Companies specializing in lithium-ion technology are at the forefront of the EV battery market, offering promising investment opportunities.

- Solid-State Batteries: A cutting-edge technology that promises higher energy density and safety, solid-state batteries are considered the next big thing in EV battery technology. By replacing liquid electrolytes with solid materials, these batteries offer enhanced performance and reduced risk of overheating. Investing in companies pioneering solid-state technology can provide exposure to this innovative field.

- Battery Recycling and Sustainability: As the number of EVs increases, so does the need for sustainable battery disposal and recycling methods. Companies focusing on environmentally responsible battery lifecycle management present unique investment opportunities aligned with sustainability goals.

- Integration with Renewable Energy: Battery technology is not limited to EVs; it’s also crucial for energy storage in renewable energy systems. Investing in companies that integrate battery technology with solar and wind energy can offer diversified investment avenues.

- Global Supply Chain Dynamics: The production of EV batteries involves a complex supply chain, including raw materials like lithium, cobalt, and nickel. Understanding these dynamics and investing in companies that manage supply chain risks can add depth to your investment strategy.

Commodity Input Issues: Graphite, Nickel, Lithium, and Cobalt

Investing in EVs isn’t just about the end product; it’s also about the raw materials that make it possible. The commodity side of EV investing is fascinating, complex, and filled with opportunities. Here’s how the demand for essential commodities presents unique investment avenues:

- Graphite: Essential for battery anodes, graphite’s demand is expected to soar with the growth of the EV market. Graphite mining and processing companies stand to benefit from this increased demand, offering investment opportunities in a material that’s crucial for battery performance.

- Nickel: A key component in battery cathodes, nickel’s price and availability are crucial for the EV industry. Investing in nickel mining and refining companies can provide exposure to this vital commodity, whose demand is expected to rise in tandem with the expansion of the EV market.

- Lithium: Vital for battery production, lithium’s importance in the EV ecosystem cannot be overstated. From mining to processing, companies involved in the lithium supply chain present unique investment opportunities. The growing need for lithium-ion batteries in both EVs and renewable energy storage is likely to drive continued demand for this essential element.

- Cobalt: Another critical material for battery production, cobalt presents both opportunities and challenges. While it’s essential for battery stability and performance, cobalt mining often raises ethical and environmental concerns. Investing in companies that prioritize responsible cobalt sourcing can align with both financial goals and ethical considerations.

- Supply Chain Dynamics: The global supply chain for these commodities is intricate and influenced by geopolitical factors, regulatory policies, and market dynamics. Understanding these factors and investing in companies that navigate them effectively can add a strategic layer to your investment approach.

BBAE Discover: Your Investment Compass

Navigating the rapidly evolving world of Electric Vehicles (EVs), Charging Infrastructure, and Battery Technology can be complex. From understanding the growth potential of EV manufacturers to exploring the innovations in charging technology and delving into the intricacies of battery production and commodity inputs, the investment landscape is multifaceted. That’s where BBAE Discover comes in, offering a curated collection of investment themes, market sectors, and well-known investors’ portfolios, designed to guide your self-directed trading decisions. Here’s how BBAE Discover can help you explore the EV landscape:

- Curated Investment Themes: With BBAE Discover, you can explore handpicked stocks and portfolios related to EVs, Charging, and Batteries. Whether you’re interested in leading manufacturers like Tesla, emerging players in charging infrastructure, or the complex world of battery production and essential commodities like graphite, nickel, lithium, and cobalt, BBAE Discover’s curated themes provide a streamlined way to identify potential investment opportunities.

- In-depth Trends Analysis: The EV sector is driven by technological innovation, regulatory changes, and consumer preferences. BBAE Discover offers comprehensive fundamental data, allowing you to make confident, data-driven investment choices. Stay informed on the latest trends, opportunities, and challenges within the EV space, from vehicle adoption rates to advancements in solid-state batteries.

- Market Sector Exploration: Dive into the various sectors within the EV ecosystem, from vehicle manufacturing to battery production and charging networks. BBAE Discover’s market sector exploration tool helps you identify potential opportunities and stay informed on the trends shaping the industry, including government initiatives, sustainability efforts, and global market dynamics.

BBAE Discover is more than just a tool; it’s your investment compass, guiding you through the complex landscape of EVs, Charging, and Batteries. By aligning your trading decisions with your interests and values, BBAE Discover empowers you to invest with clarity and confidence in a sector that’s redefining transportation and shaping the future.

P.S. If you don’t already have a BBAE account, we are still offering up to a $400 bonus for your first deposit. Get it while it’s still available.

Disclaimer: This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions.