Lithium Investments: Why now?

In the narrative of modern transportation, electric vehicles (EVs) have emerged as the embodiment of innovation, sustainability, and a shift away from fossil fuel dependency. However, behind the sleek designs and silent engines of these vehicles is an often-overlooked hero: lithium. This silvery-white metal, which might be overshadowed by the more glamorous facets of the EV movement, is the essential element anchoring this narrative.

A Magnet for Investors

Lithium’s growing significance hasn’t escaped the investment community’s attention. With the expansion of the EV market and the continued reliance on lithium-ion batteries across various industries, the demand for this metal is projected to skyrocket. This burgeoning demand offers investors a unique opportunity to delve into a market that seamlessly blends technology with sustainability.

The Lithium Demand Surge: A Deep Dive into the Future

The worldwide pivot to electric vehicles has heralded a new era of resource demand, with lithium emerging as the most coveted. As the cornerstone of rechargeable batteries powering these vehicles, lithium’s demand is on an unprecedented ascent. To grasp this trend’s magnitude, Tesla serves as an illustrative case study, shedding light on the broader implications for the lithium market.

Tesla’s Lithium Appetite

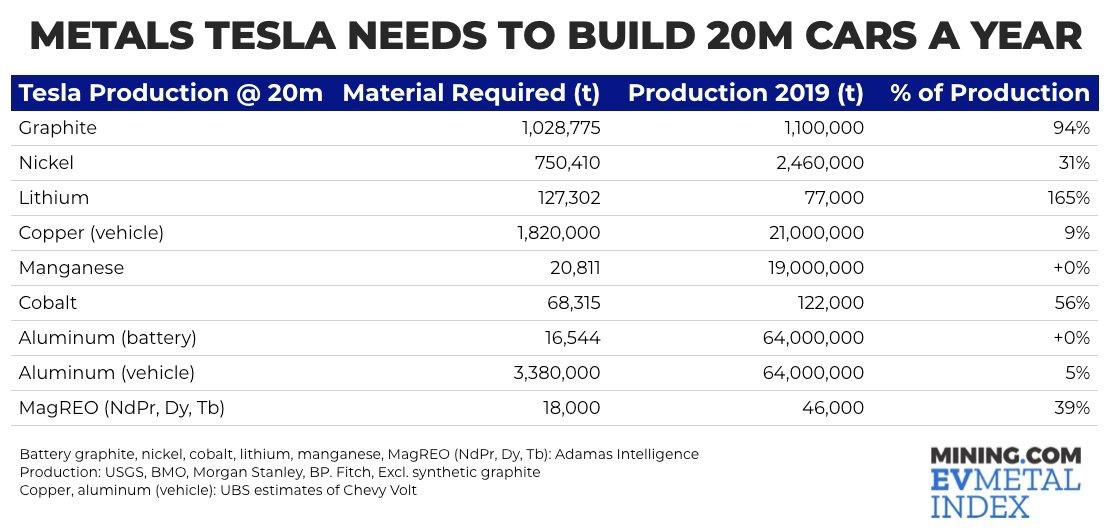

Tesla, undeniably a trailblazer in the EV industry, harbors lofty aspirations. Their objective to roll out 20 million vehicles equates to a phenomenal lithium demand:

- As per a piece from mining.com (a bit outdated but the context persists), to produce 20 million vehicles, Tesla would necessitate 127,302 tons of lithium. To contextualize this figure, it eclipses the total global production of 77,000 tons in 2019 by a whopping 165%.

Source: mining.com

This staggering requirement from a single company underscores the magnitude of the lithium demand surge. However, Tesla isn’t an isolated case.

The Broader EV Landscape

While Tesla is undeniably a pivotal player, the entire automotive sector is transitioning towards electrification:

- Renowned manufacturers such as Volkswagen, General Motors, and Nissan have unveiled plans to bolster their EV production, with some even contemplating the complete phasing out of combustion engines in the upcoming decades.

- As an increasing number of companies embrace the EV trend, the collective lithium demand is set to surge, potentially stretching the existing supply chains to their limits.

Implications for the Lithium Market

In light of this soaring demand:

- Price Dynamics: The lithium price trajectory is anticipated to trend upwards, reflecting potential supply-demand imbalances.

- Mining and Exploration: We can expect heightened investments in lithium mining and exploration companies. Newly discovered lithium reserves will be invaluable, positioning companies with substantial reserves as potential acquisition targets.

- Innovation in Extraction: The escalating demand will catalyze efforts to devise more efficient and eco-friendly extraction techniques, potentially spurring technological breakthroughs in the mining space.

- Recycling Initiatives: Given lithium reserves’ finite nature, the recycling of used lithium batteries will gain prominence. Companies proficient in recycling and reintegrating lithium into the supply chain will enjoy a competitive advantage.

How Tesla and Other Companies Are Responding

Confronted with the imminent lithium demand surge, companies are adopting proactive strategies:

- Strategic Partnerships: Tesla has already established robust relationships with prominent lithium producers globally, ensuring a consistent supply.

- In-house Initiatives: Beyond mere sourcing, entities like Tesla are pioneering methods to independently extract lithium, exemplified by Tesla’s plans in Nevada.

- Diversification: To mitigate the risks of over-dependence on a single source, companies are diversifying their lithium supply chains, procuring from a variety of producers and spanning different geographies.

Investing in Lithium

- Stock Investments in Lithium Producers:

- Major Producers: Giants like Ganfeng Lithium, Albemarle, and SQM dominate the global lithium production scene. Investing in their stocks offers direct exposure to the lithium market.

- Junior Miners: These smaller mining entities are either in the exploration phase or have just commenced production. While potentially promising higher returns, they are also associated with elevated risks. Notable examples encompass Lithium Americas and Piedmont Lithium.

- Lithium ETFs (Exchange Traded Funds):

- ETFs present a diversified avenue to invest in the lithium sector without the need to select individual stocks. The Global X Lithium & Battery Tech ETF and the Amplify Lithium & Battery Technology ETF are prime examples. These ETFs invest in an array of lithium-centric stocks, offering exposure to the entire value chain, spanning mining to battery manufacturing.

- Invest in Battery Manufacturers and Tech Companies:

- Firms like Panasonic, CATL, and LG Chem are at the forefront of battery manufacturing and inherently require lithium. Investments in these companies indirectly align with the lithium market.

- Lithium Royalty Companies:

- These entities finance mining projects in return for a share of future revenues or production, termed a royalty. Investing in these companies offers a lithium sector exposure devoid of the operational risks intrinsic to mining.

BBAE Discover: Your Investment Compass

Navigating the intricate world of EVs and EV Commodities can be daunting. From comprehending the growth trajectory of EV manufacturers to deciphering innovations in charging technology and delving deep into battery production intricacies and essential commodity inputs, the investment landscape is multifaceted. This is where BBAE Discover steps in, presenting a curated assortment of investment themes, market sectors, and renowned investors’ portfolios, meticulously crafted to steer your self-directed trading decisions.

For a full list of the stocks in the BBAE Discover curated portfolio EV Commodity Input Companies, please click here, or find them inside the BBAE app here.

Here’s a snapshot of how BBAE Discover can illuminate your EV Commodity landscape exploration:

- Curated Investment Themes: BBAE Discover allows you to traverse handpicked stocks and portfolios related to EVs and EV Commodities. Whether your interest lies in industry leaders like Tesla, new companies in charging infrastructure, or the intricate realm of battery production and the EV commodities such as graphite, nickel, lithium, and cobalt, BBAE Discover‘s curated themes pave the way for pinpointing potential investment opportunities.

- In-depth Trends Analysis: The EV sector’s momentum is fueled by technological innovations, regulatory shifts, and evolving consumer preferences. BBAE Discover provides fundamental data, empowering you to make informed, data-centric investment decisions. Stay abreast of the latest trends, opportunities, and challenges in the EV sector.

- Market Sector Exploration: BBAE Discover’s market sector exploration tool is your ally in pinpointing potential opportunities and staying updated on industry-defining trends.

BBAE Discover transcends being a mere tool; it’s your investment compass, guiding you through the intricate terrains of EVs and EV Commodities. By synchronizing your trading decisions with your passions and principles, BBAE Discover equips you to invest with unparalleled clarity and conviction in a sector that’s revolutionizing transportation and sculpting the future.

As we accelerate into a future where sustainability and innovation converge, lithium emerges as the silent catalyst propelling us forward. Beyond its role in batteries and vehicles, it symbolizes our collective commitment to a greener, more efficient world. For every investor, recognizing the pivotal role of lithium is essential.

P.S. If you don’t already have a BBAE account, we are still offering up to a $400 bonus for your first deposit. The bonus is automatic when you open your new account, so get it while it’s still available.

Disclaimer: This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions.