Markel Group: A Baby Berkshire Hathaway

If you’ve seen BBAE’s Berkshire Hathaway (NYSE: $BRK-B) annual meeting coverage, you know that we’re big on bringing you on-the-ground reports when we can. Relatively little of public equity investing life happens in person, so it’s special when 45,000 investors gather in Omaha to hear Warren Buffett talk.

Markel Group (NYSE: $MKL), based in Richmond, Virginia, is often called a “Baby Berkshire,” and though the 3,000-or-so people its annual meeting draws seems piddly compared to Berkshire, it is one of the biggest public company annual shareholders’ meetings in the US, and almost certainly the biggest on an attendee-to-market cap basis.

Is Markel stock a cheaper buy than Berkshire Hathaway?

And for its similarities to Berkshire – it’s an insurance company run by a well-regarded investor who invests in both public and private equities, and a company that treats corporate culture as sacrosanct – and its potential runway (Markel’s market cap is just $21 billion, versus nearly $900 billion for Berkshire), we thought it would be worth both an introduction and a closer look.

As you’ll see below, Markel’s stock is definitely cheaper on a valuation basis, but the question is: What’s the catalyst for that valuation gap to close?

What does Markel do, and why is it notable, despite just being a $21 billion-market cap company?

Second question first: Markel, like Berkshire, has a near cult-like following – and one it actively cultivates. An annual meeting for a regular public company might mean 30 or 50 suits plus a few activists in a room for an hour or so (Amazon is one of the largest companies and its last annual meeting drew 350 people), but Berkshire and Markel deliberately make theirs multi-day affairs, with 5k fun runs, parties, multiple breakout sessions (Markel), company exhibits (Berkshire), and more. Markel is big on feeding its shareholders (and would-be shareholders) at its meeting – and even at the Berkshire meeting, too: It hosts a 2,500-person breakfast in Omaha the day after Buffett speaks.

If you’re thinking that these big meetings must cost a lot of money, time, and mental energy for these companies, you’re right. But they believe it’s an investment that pays off in the form of die-hard, loyal shareholders who see themselves as family (Markel’s meeting is even called the “Markel Reunion”) and basically never sell their shares.

It makes some sense: If you were starting a small business and took capital from some investors, would you prefer investors who watch you nervously, day-to-day, ready to bail at the first sign of trouble, or patient investors who stand by you for the long haul, realizing that both mistakes and market cycles are part of life?

All companies would prefer high-quality investors, but Markel and Berkshire are among the few public companies that make deliberate efforts to cultivate them.

So what does Markel do?

It’s best to think of Markel as an investment conglomerate born of a specialty insurer.

A speaker at last year’s Markel meeting joked: “If you’ve heard of it, we probably don’t insure it.” Markel, founded in 1930 as a bus and trucking insurer, is now a broader property & casualty (P&C) specialty insurer – insuring things that you’ve heard of, but which aren’t mainstream things to insure: ATVs, museums, summer camps, and horses, for example. The competition is lower in these niches and thus the profit margins are higher.

Markel also provides reinsurance (insuring other insurers against really big risks), though these days they’re moving that to a Bermuda subsidiary called Nephila, which effectively takes the big risks off Markel’s balance sheet by operating as an asset manager for investors betting on disasters (typically using something called “insurance linked securities”; in simple terms, outside investors bet on a disaster not happening, and lose their money if one does) as well as a reinsurer.

Markel follows in Buffett’s footsteps in investing its “float” in equities, instead of only in bonds, as most insurers do.

In fact, 14% of Markel’s public equity portfolio is in Berkshire Hathaway. (Berkshire owned Markel for a few years, but sold it in the first quarter of 2024.) Amazon (Nasdaq: $AMZN), Brookfield (NYSE: $BN), Home Depot (NYSE: $HD), and John Deere (NYSE: $DE) are other large holdings, making up roughly 3% of Markel’s portfolio each.

Also like Berkshire, Markel owns or partially owns private companies, too, ranging from Costa Farms, the largest house plant grower in the world, Brahmin luxury handbags, Buckner Heavylift Cranes, Ellicott Dredges, PartnerMD concierge healthcare, RetailData shopping analytics, VSC Fire and Security, and more. If you see no connection among these companies, you’re right – Markel, like Berkshire, focuses more on finding good management teams than specializing in a particular industry..

What happened at Markel’s annual meeting?

Given the heat wave Richmond was experiencing, BBAE analyst Shaoping Huang and I skipped Markel’s optional 5k Fun Run the day before the meeting and showed up bright and early at 8:00 at the beautiful University of Richmond campus the next morning.

Whereas Berkshire Hathaway has one big “arena” meeting, Markel starts with multiple breakout sessions (like Nephila’s below) before moving to the arena for the main event.

Frankly, I felt there were almost too many breakouts. Breakout sessions force painful compromises. We had to choose between learning about reinsurance and taste-testing Nightingale Ice Cream’s ice cream sandwiches (technically, the ice cream eating accompanied an inspirational story of the couple who founded the company). Shaoping, apparently in analyst mode, wanted reinsurance, against my mild protests. Halfway through the reinsurance session, she apparently saw my wisdom, but by the time we made it over to the ice cream, the session was full and the ice cream was gone.

Markel CEO Tom Gayner had a morning session with Tim O’Shaughnessy, CEO of Graham Holdings (a $3 billion investment conglomerate known for formerly owning The Washington Post), who noted: “The worst thing you can have in any business is a mediocre manager, because they poison so many.”

In fact, if you were just beamed into this meeting with no prior knowledge of Markel, the thing that would probably stand out to you was that company specifics and numerical results were discussed a little, whereas things like Markel’s company culture values, good management, hiring smarter-than-you “A” players, and treating employees and shareholders well were discussed a lot.

It is clear that Markel is a “culture first” company – one that believes that if they get the right people and treat them well, success will fall into place.

How has Markel been doing lately?

Overall 2023 operating revenues were up 35.4% for Markel, but 2023 was a rough year for Markel’s insurance division: Insurance revenue rose from $8 billion in 2022 to $8.6 billion in 2023, but a high-catastrophe year and high “social inflation” (higher awards from lawsuits and increased settlements) knocked 2023’s insurance underwriting profits down 79% from 2022 levels. (Relatedly, Buffett has complained about both railroads and utilities being the victims of legal awards so high that they risk scaring companies out of the industry.)

Markel’s public company investing division’s operating income (basically dividends plus unrealized net gains and minus realized losses) rose from a loss of $1.168 billion in 2022 to a gain of $2.241 billion in 2023, and Markel Ventures, which holds Markel’s private company investments, saw operating income grow from $325 million to $438 million. Speaking of Buffett and investment income, he dislikes FASB’s notion that unrealized gains or losses – which, unlike true economic earnings, are valuation-based social science constructs that fluctuate wildly – should rightfully be reported on financial statements as “income” in the first place.

But, basically, aside from high insurance payouts, 2023 was a good year for Markel.

and things may be looking a bit brighter so far in 2024.

For the first quarter of 2024

Luckily, the first quarter of 2024 was better with operating revenue and operating income growth up 23% and 77%, respectively – largely owing to good investment performance in both public and private equity markets and because of higher interest rates.

Markel vs. Berkshire Hathaway

The obvious question for a company called a “Baby Berkshire” is how it compares to the actual Berkshire.

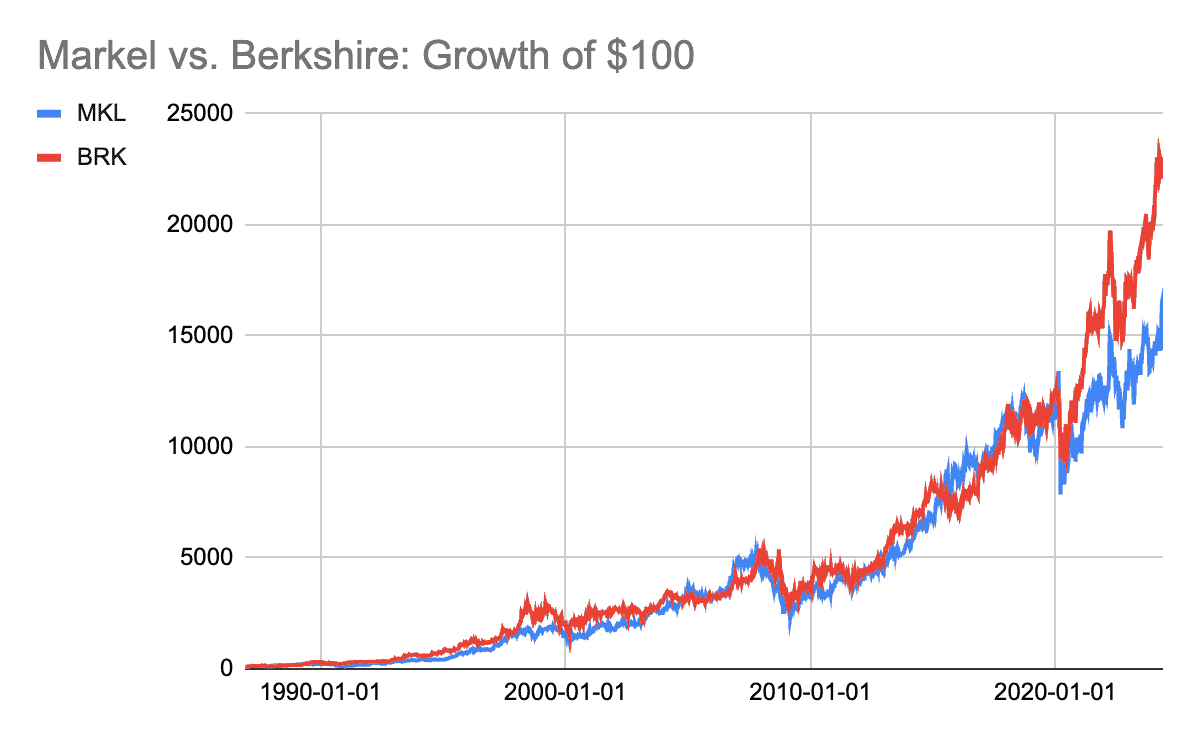

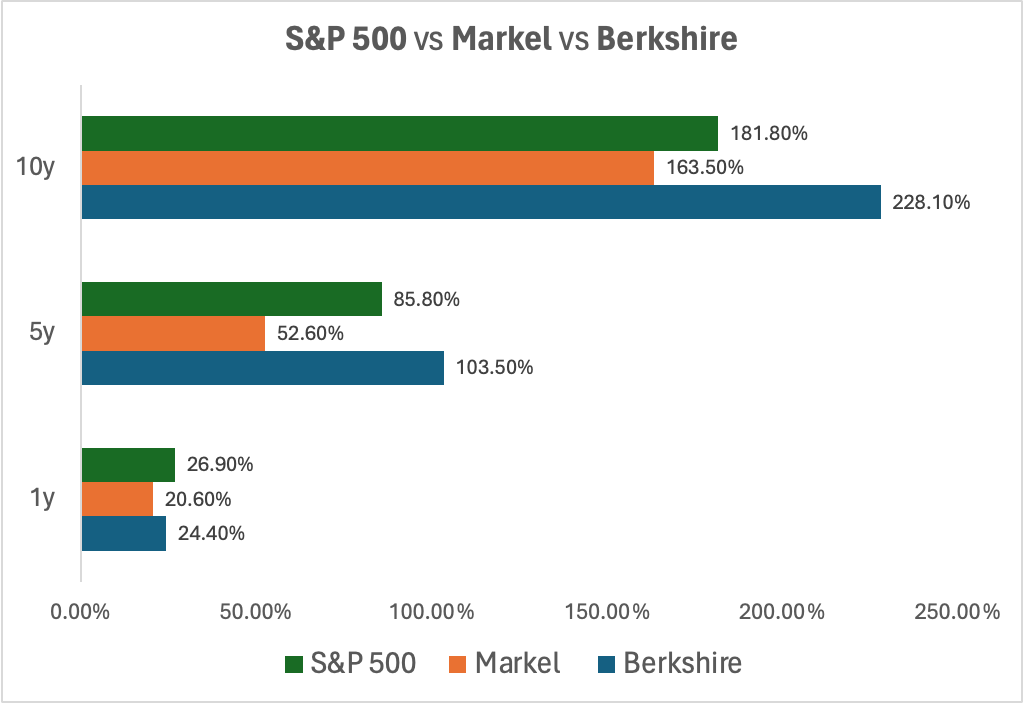

As a practical matter, I believe the vast majority of Markel shareholders are also Berkshire Hathaway shareholders, because they want as much exposure to this sort of vibe as possible, but the two companies have not performed the same. Markel has outperformed the S&P 500 but underperformed Berkshire since its December 1986 IPO.

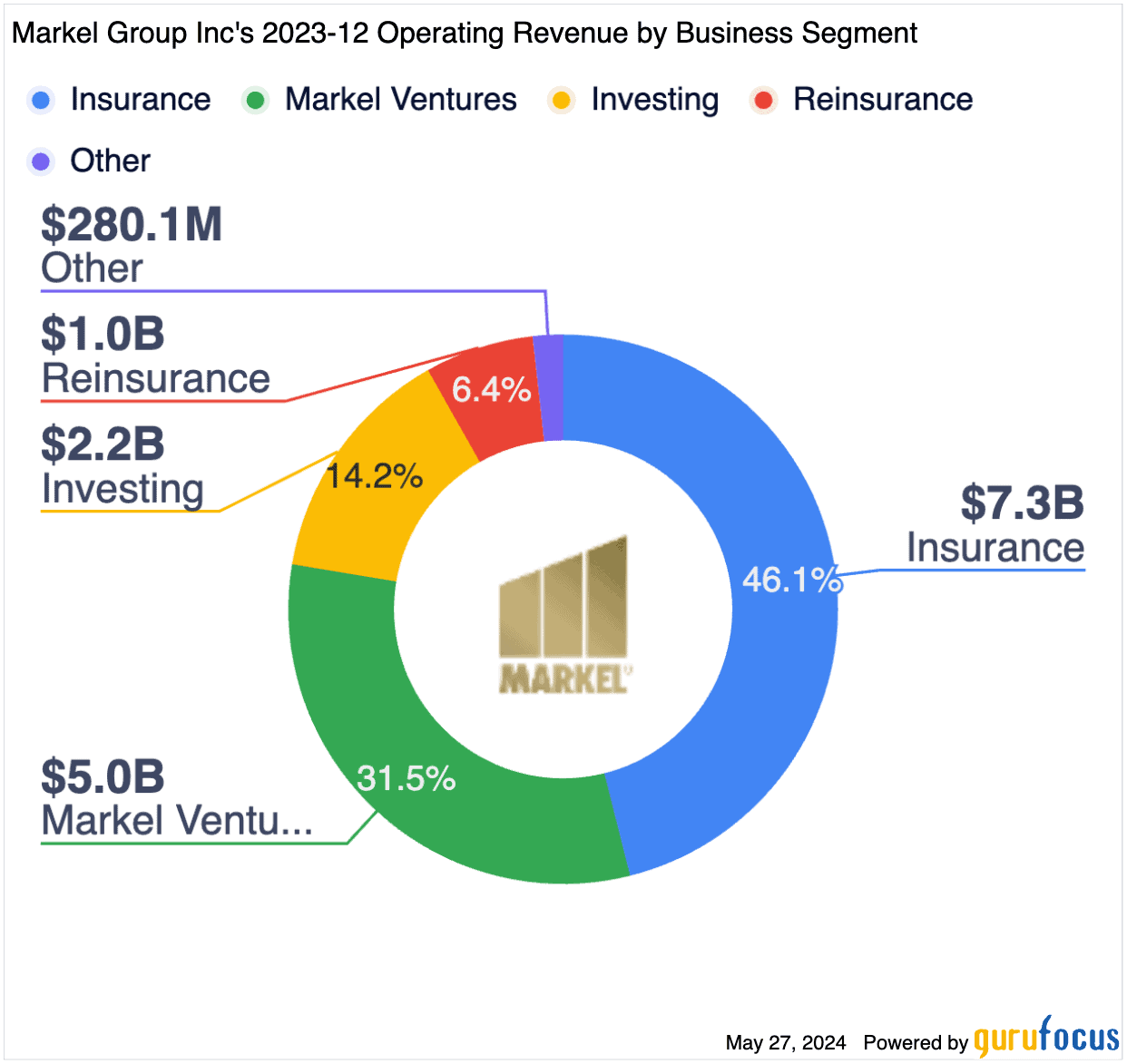

It’s important to note that while Markel and Berkshire are similar, they are not identical. Per this revenue contribution chart from our friends at GuruFocus, you can see that Markel is more of an insurance company than Berkshire is (Berkshire typically gets just over ¼ of revenue from insurance).. So this is not an apples-to-apples comparison.

Source: GuruFocus

On the investing front, Markel CEO Tom Gayner is no slouch.

While I have not compared his investing returns directly to Buffett’s, it’s clear that at least in terms of public equity investing, he deserves the fanfare that he gets:

| Markel Equity Securities Return | |||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Yearly return | 21.6% | -16.1% | 29.4% | 15.1% | 29.8% |

| 5-year annualized return | 14.6% | 9.3% | 18.4% | 15.2% | 11.4% |

| 10-year annualized return | 11.9% | 12.9% | 16.9% | 14.3% | 11.0% |

So why has Berkshire Hathaway outperformed Markel?

The first explanation is the multiple: Markel has recently traded at a P/E of just over 8, whereas Berkshire’s P/E is a bit more than 12. Investors simply pay more – meaningfully more – for every dollar of earnings from Berkshire.

Why? Buffett’s track record is the most obvious reason – investors expect him to grow money faster than Tom Gayner, even though Berkshire is a behemoth compared to Markel. As well, as Shaoping and I discussed in this video, on the private-business side, Berkshire’s cachet gives managers intangible benefits of selling to the world’s greatest investor – social/reputational status, a sense of legacy, or whatever related non-monetary benefits might give them a reason to sell for a below-market valuation. Plus, Berkshire Hathaway is a known, storied company that’s on everyone’s radar, whereas Markel is not yet a household name.

Will Markel become better known with more time – and will that increased awareness drive a higher valuation? WIll Berkshire after Buffett no longer have a competitive advantage in cachet – and thus struggle with getting sweetheart deals? Will Buffett’s lieutenants pick stocks as well as he has?

Nobody knows the answers to these questions. Markel has outperformed the S&P 500 over the long haul, but as Shaoping’s graph below shows, it’s lagged modestly in recent years (to split hairs, Markel beat the market over the past three years, and is beating it year-to-date, too; the exact time period chosen has relevance).

Data from GuruFocus.com

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares of Markel Group and Berkshire Hathaway. BBAE has no position in any investment mentioned.