Market corrections and bear markets are painful. And scary. But guess what? There’s no avoiding them. And counterintuitive as it sounds, they often bring investors a “gift” of well-priced entry opportunities.

Let’s explore the difference between a correction and a bear market, look at the causes of market drops, and conclude with strategies for managing your portfolio during soft markets.

What’s the Difference Between a Correction and a Bear Market?

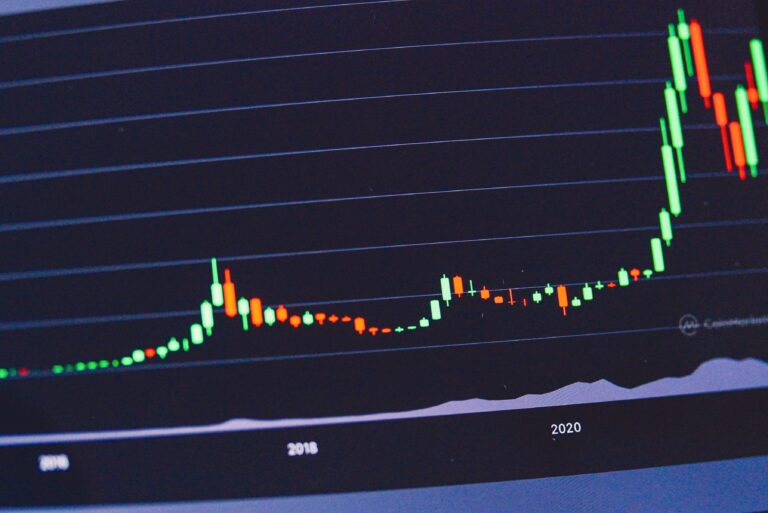

In one sense, these numerical thresholds are arbitrary. But because you’ll hear people use these terms, know that a market correction is a decline of at least 10% from the recent peak in the stock market.

A bear market, meanwhile, is typically defined as a drop of 20% or more from the recent peak.

While market declines may stem from slowdowns in economic activity, or anticipated slowdowns, as the market is forward-looking, the declines themselves also form an important data point that can further feed both market economics and market price movement. A plunging stock market, for instance, may cause consumers to reduce spending (the “wealth effect”) or businesses to reduce hiring.

Causes of Market Corrections and Bear Markets

Several factors can contribute to market corrections and bear markets, including:

1. Economic Factors: Changes in economic conditions, such as a slowdown in GDP growth, rising unemployment, or high inflation, can impact corporate earnings and investor sentiment, leading to declines in stock prices.

2. Geopolitical Events: Geopolitical tensions or uncertainties, such as trade disputes, wars, or political instability, can cause market volatility – because this affects earnings eventually – and lead to declines in stock prices.

3. Market Sentiment: Shifts in investor sentiment, driven by factors such as changes in monetary policy, market valuations, or the perception of market risk, can trigger market corrections or bear markets.

| Advanced Point: Expanding on that last point, multiple expansion is when a company’s earnings remain the same, yet investors suddenly decide to pay more for that company – picture a company that earns $10 per share per year seeing its stock price rise from $100 (a P/E of 10) to $200 (a P/E of 20. Multiple contraction is the same thing in reverse. |

Strategies for Navigating Market Corrections and Bear Markets

1. Maintain a Long-term Perspective: Whether it was 9/11, World War II, the Great Financial Crisis of 2008, COVID, or something else, the US stock market has always recovered. While that’s not an outright guarantee that every decline will be reversed on an individual stock/sector/industry level, on a market level, as long as the US economy expands in the long run, so, too, should the stock market. While there’s no guarantee about how long or short any bear market will be, they tend to be shorter than 18 months. And many advisors recommend only putting money into stocks that you don’t anticipate needing within the next 5 or so years, so if you combine those points, you get a reason for most investors to just stay the course.

2. Don’t be afraid to buy: It’s hard to buy when the news is bad, right? Well, that means it’s hard for everyone else, too – and investing, you get the biggest rewards for going against the crowd (and later being right). Many of the biggest fortunes were made by investors with the nerves to buy during market panics.

3. Diversification: A well-diversified portfolio can help protect your investments during market downturns. By spreading your investments across different asset classes, sectors, and geographical regions, you can reduce the impact of declines in any single area on your overall portfolio.

4. Rebalance Your Portfolio: Market declines can cause your portfolio’s allocation to drift from your target levels. Regularly rebalancing your portfolio (“regularly” is often yearly for many people, though guidance varies) can help you maintain your desired risk profile and take advantage of opportunities to buy undervalued assets.

5. Dollar-Cost Average: Continue making regular contributions to your investment accounts during market downturns. By investing a fixed amount at regular intervals, you can take advantage of lower asset prices and reduce the impact of market volatility on your portfolio.

6. Seek High-Quality Investments: During market corrections and bear markets, focus on high-quality investments with strong fundamentals, such as companies with low debt levels, strong cash flows, and a history of dividend payments. These investments tend to be more resilient during market downturns and can provide stability for your portfolio.7. Consider Defensive Assets: Incorporating defensive assets, such as bonds, cash, or dividend-paying stocks, can help cushion your portfolio during market declines. These assets tend to be less correlated with the broader stock market and may hold up better during downturns.