News Roundup: Google Breakup, Good Jobs Report, Defense Stocks on Fire

Google Breakup?

“Breakup” sounds dramatic – and a big company hasn’t been broken up in the US since the AT&T breakup of 1982 – but the real Google story is less dramatic.

As I wrote in August of 2024, DC Circuit judge and “huge” hip-hop fan Amit Mehta declared that Google had monopoly power and had used it inappropriately. (Being a monopoly is not illegal in the US, but using monopoly power in a way that harms consumers or society is.)

Google will appeal that, but Mehta’s first ruling just pertained to the “guilt” part. The next step is the remedy part. Remedy began with the DOJ’s initial suggestions this month (it announced that both “behavioral and structural” changes may be necessary – more on this later). After further discovery, the DOJ will issue a revised proposed remedy in November. And then Google itself will propose its own remedy in December.

Given all the expected back and forth, it could be years before whatever is proposed gets decided, and whatever gets decided is implemented.

The irony, as I mentioned on a business TV program today, is that tech moves so quickly that by the time the resolution happens, AI may have eclipsed the Google search that we know today.

My general view is that the big tech companies have too much power. For instance, as a parent, I’m concerned that they’ve got so much money to pay lobbyists that despite 60+ Congressional hearings, no meaningful online child safety legislation has passed. And as Mehta cited in his ruling, we’ve seen incriminating emails from within Google indicating the company was clearly aware of its power, and was willing to use it in an unsportsmanlike manner. Controlling search, the largest ad exchange, and the largest SSP (like a broker on an ad exchange) very obviously gives Google an unfair advantage.

At the same time, big tech has contributed tremendous value to society – value it likely couldn’t have contributed were it not big tech.

Remedy is not an easy decision. “Behavioral” probably means nixing the $24 billion per year Google pays to Apple, Samsung, and others to get Google search embedded as the default search engine on their devices, and perhaps some data sharing with competitors (not that there are many in search, but there are plenty in the programmatic ad market). Google naturally says that a “structural” remedy – a breakup – would set a horrifying and unfair precedent.

I’m a free-markets guy, but even I tend to think big tech has gotten too powerful – as happened with steamships, oil, steel, railroads, and telephones (and, arguably, operating systems) before. The irony of regulating tech with an “antique” regulatory process designed for a slower-moving non-tech world is that by the time a solution comes, it may not be necessary anymore – much like sending the snow plows out after the snow has melted.

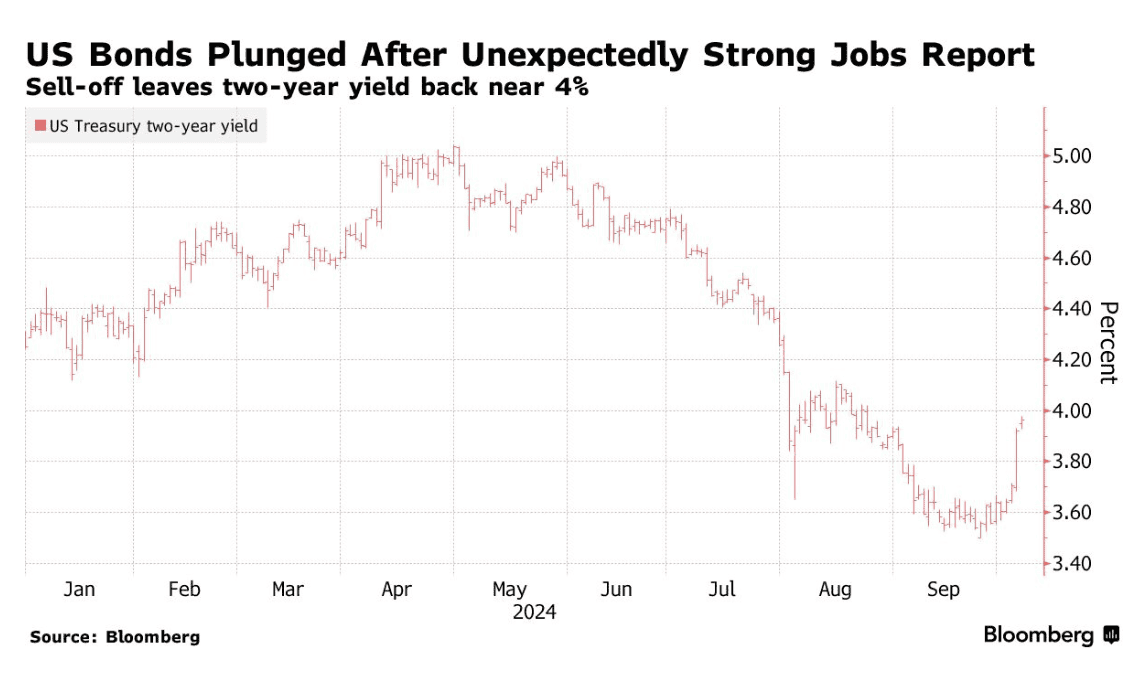

Good jobs report means bonds plunge, which means yields spike

Speaking about the market, an investor I respect once told me:

“It’s really simple: Good news is bad news, and bad news is good news.”

I was early in college and too young to understand all the nuances to this statement, but I grasp it better now.

It points to the reflexive, social science nature of investing, to the fact that it’s the gap between expectations and reality that moves prices, to the fact, that Fed moves sometimes matter more to markets than “real economy moves” (and that sometimes a bad real economy data point can cause a “good” Fed reaction, and vice versa), and to the fact, more simply, that some investments like gold and bonds (and sometimes the US dollar, though I currencies are not quite investments to me) do better on bad news than good.

One example: Last Friday’s US jobs report clocked in better than expected: 254,000 jobs added in September, versus 140,00 expected. Undoubtedly, that’s a positive for the US economy.

But investors had been betting on steep rate cuts, but the hot job report makes them less likely to happen.

A hot US economy (of which a strong job market is a major component) or, more specifically, a hotter than expected US economy means the Fed’s worry needle moves a bit more toward the “possible overheating / worry about inflation / higher interest rates” end of the dial, and a bit away from the “cooling too fast / lower interest rates” end.

More specifically, investors (and the Fed) were expecting the Fed to keep up the big rate cuts. The Fed began last month with a 50 basis point cut. A typical cutting cycle is 250 basis points, but that’s just a guideline.

So with a better-than-expected job market, the Fed is a bit less likely to cut interest rates – and the market has decided that lower interest rates, rather than an actually better US economy, is the better reason for asset prices to move. I’m not saying it’s right. Just saying this is how it is.

Anyway, with a slower, lessened cutting cycle more likely, the US dollar should strengthen (higher than expected rates make a country’s bonds more desirable, which increases the demand for its currency). Investors previously had bid up prices of (existing) bonds, as future lower-yielding bonds would make older, higher-yielding bonds comparatively more valuable.

However this all reversed when the really good jobs report came in.

Sometimes, good news is bad news.

Defense Stocks En Fuego

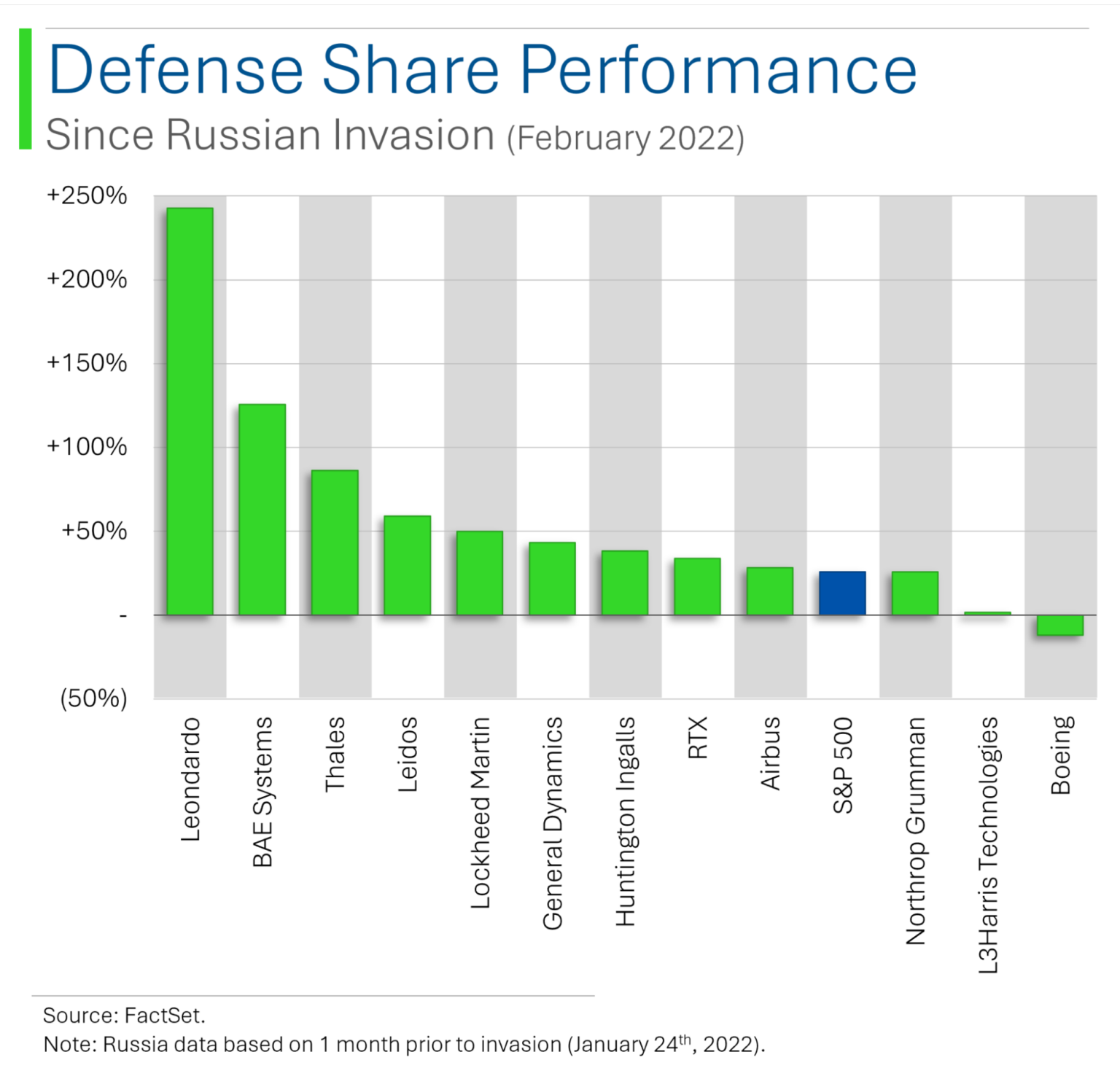

One upside to all these bad headlines: Defense stocks have been on a tear since Russia invaded Ukraine, and with China’s Taiwan threat and the Israel-Hamas-Hezbollah-Iran conflict not looking resolvable any time soon, continue to deliver the goods for investors, as Ryan from MarketLab’s chart shows:

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.