Shut up and wait.

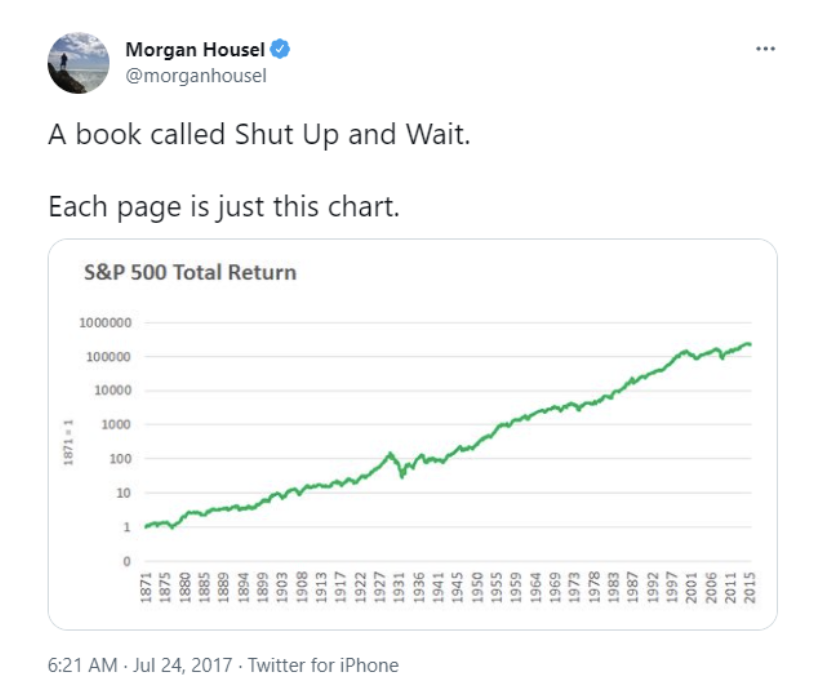

Morgan Housel’s 2017 Twitter post is one of the best investing nuggets.

The premise is simple: The US stock market has, over the long run, always gone up. So no need to make investing complicated: Just buy an S&P 500 index ETF and wait.

Morgan is right. Shutting up and waiting is hard to do, but that’s what makes it so profitable.

But what if you could make it more profitable?

I’m not talking about adding some good returns from crypto, growth stocks, biotechs, or whatever – though you can certainly try that.

I’m talking about enhancing what academics call the beta part of your portfolio – those market-matching ETF or mutual fund building blocks that make up core positions for many, if not most, investors.

What if you could set the set-and-forget part of your portfolio to do just a little better – without taking on more risk than the market?

You’d be talking about smart beta, and BBAE has a new smart beta platform that we believe offers among the best strategies on the market.

Because we’re talking about the baseline/index/building block part of your holdings, we’re not targeting fireworks with returns. Smart beta works in a more subtle way – a better baseline, ideally – often using the same or a similar list of stocks as an index fund, but instead of weighting the stocks by market capitalization (the traditional method), weighting them by other criteria instead, like P/E, sales growth, dividend yield, or dozens of other factors.

The aim is to slightly boost returns while keeping risk in the same neighborhood as the normal index.

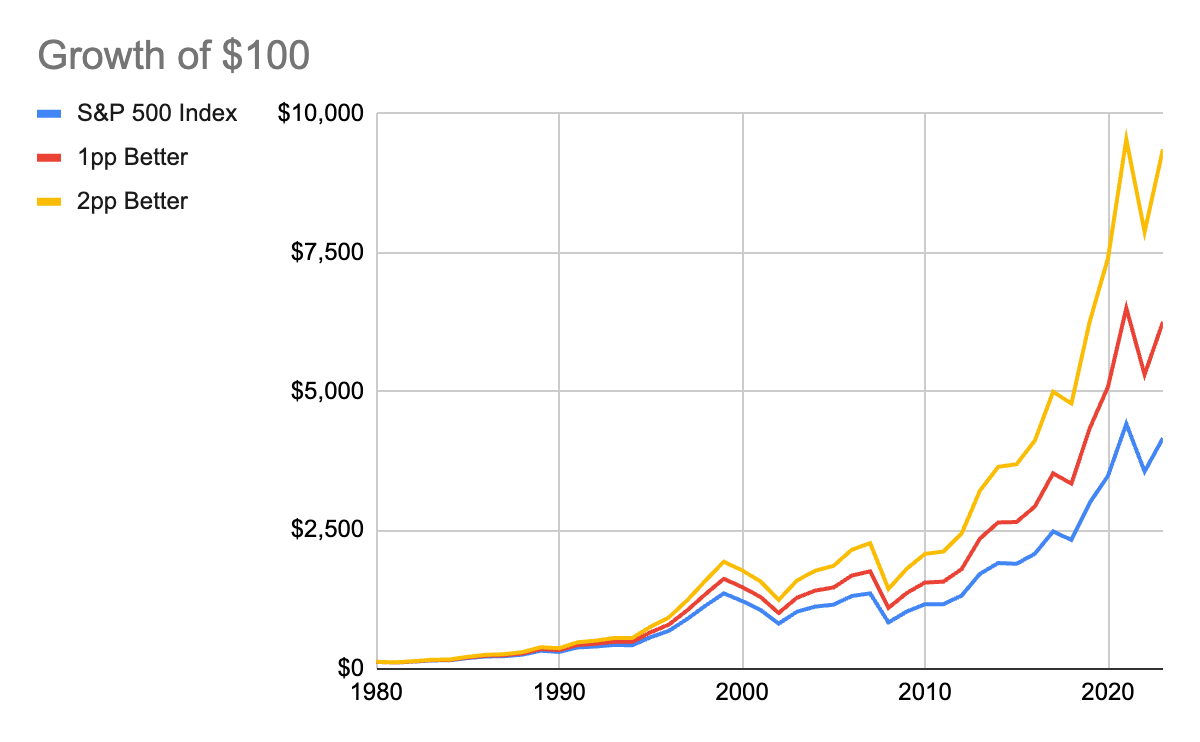

Smart beta might not sound exciting, but over time, its results can be. Imagine if an adjusted index fund had performed just 1 or 2 percentage points better annually than the S&P 500 over 20 or 30 years. Actually, don’t imagine – have a look.

Smart beta: A better baseline

Again, the selling point about smart beta is subtle, and might be missed by novice investors who (incorrectly) believe that every investment means chasing a moonshot stock. But the notion of having a better baseline is attractive enough that smart beta fund inflows have made up roughly half of all passive fund inflows in recent years, according to some analysts.

At BBAE (where I’m Chief Investment Officer), we wanted to bring the benefits of smart beta to our clients as well – with a few ground rules first:

- We wanted a smart beta offering that we expect will perform well. Yes, this is obvious, but more specifically, we wanted to see many years of performance, in an out-of-sample backtest at a minimum. (Out-of-sample means testing a strategy on a time period of data not used to divine the strategy in the first place, which avoids cherry-picking bias.) Every factor may have its day, but we wanted a smart beta strategy that our customers could buy and hold for the long haul.

- We wanted smart beta based on well-proven factors. And ideally, we wanted an array of them, rather than just one or two, for return robustness. Theoretically, any factor aside from market cap – CEO height, company age, number of vowels in a company’s name – can be used to make a smart beta strategy. But we wanted factors that had been proven over time – ideally, both in academia and anecdotally across practicing investors.

- We wanted smart beta that was not available anywhere else. There are plenty of straightforward smart beta ETFs out there that revolve around one or a few factors. There’s nothing wrong with simple ETFs. But for BBAE’s proprietary offering, we wanted something unique, and something we felt would offer better performance across a wider variety of market conditions.

BBAE & MarketGrader: A better smart beta

We found a company called MarketGrader that offered what we were looking for in a smart beta partner, and we’re excited about the new smart beta investment strategies we’re now able to offer.

Here’s why we chose MarketGrader:

- MarketGrader’s indices (it tracks 52 of them in total) have beaten their benchmarks by more than 4 percentage points annually, on average, for more than a decade. These are indices, and not funds, to be clear. But MarketGrader has been around since 1999, and many of its indices have been run in “real time” for years.

- Market Grader’s core methodology is based on 24 individual factors within the collective categories of Growth, Value, Profitability, and Cash Flow. These factors – things like P/E, ROE, and market growth, along with many more – skew toward the well-proven. Academic studies have validated numerous fundamental factors like the ones MarketGrader uses, as have successful fundamental-based investors like Warren Buffett and Peter Lynch.

- MarketGrader has created three strategies exclusive to BBAE. If you read Barron’s, you may have seen that MarketGrader powers the Barron’s 400 ETF. But for BBAE, MarketGrader designed three exclusive products that we’re thrilled to offer our customers.

Does Buffett use MarketGrader? No. But would he recognize and perhaps endorse many of the factors MarketGrader uses? We’re pretty sure he would – in fact, Buffett has often touted ROE as one of his favorite metrics.

Specifically, with MarketGrader, BBAE now offers: (1) a growth strategy that’s slightly tilted toward capital appreciation, (2) a growth/income strategy tilted toward yield, and (3) a “core” strategy that’s a middle ground.

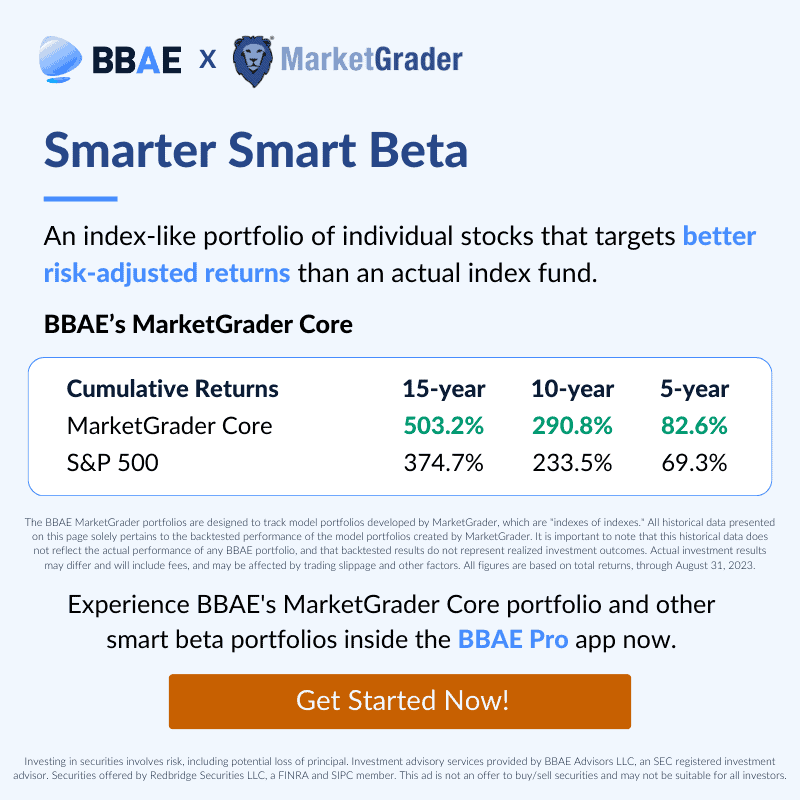

Backtest results (which are not fund or managed account results and don’t reflect fees) over 188 months – roughly 15 ⅔ years – show the following:

| BBAE MarketGrader Smart Beta vs. Benchmarks (15+ year backtest) | |||

| Cumulative Return | Annual Return | Standard Deviation | |

| BBAE MarketGrader Core | 465% | 11.7% | 17.1% |

| BBAE MarketGrader Growth Compounding | 502% | 12.1% | 17.9% |

| BBAE MarketGrader Growth and Income | 461% | 11.6% | 17.2% |

| Benchmarks | |||

| S&P 500 | 321% | 9.6% | 16.2% |

| Dow Jones Select Dividend Index | 234% | 8.0% | 16.4% |

Source: https://staging.bbae.com/portfolios/ The BBAE MarketGrader portfolios are designed to track model portfolios developed by MarketGrader, which are “indexes of indexes.” All historical data presented on this page solely pertains to the backtested performance of the model portfolios created by MarketGrader. It is important to note that this historical data does not reflect the actual performance of any BBAE portfolio, and that backtested results do not represent realized investment outcomes. Actual investment results may differ and will include fees, and may be affected by trading slippage and other factors. All figures are based on total returns, through August 31, 2023.

Although the future is never fully predictable, and real-world strategies involve management fees (though still generally less than active management fees), slippage, and other factors that can cause actual results to come in a bit less shiny, these represent the types of results we’re targeting going forward with BBAE’s new smart beta strategies.

In these test results, you can see that the standard deviation (a rough proxy of risk) was slightly higher for the smart beta strategies. However, the returns were also higher – by enough of a margin that on bang-for-buck basis, the smart beta strategies were a good deal for investors.

Successful smart beta investing begins with framing: Select high-flying individual stocks will always outperform broad-basket indices (the Core and Growth baskets contain more than 300 stocks, and the Income basket 100; within BBAE’s MyAdvisor these can be purchased as a single trade that automatically rebalances for you as MarketGrader updates its indices). But smart beta is not about chasing high returns; it’s about striving for better risk-adjusted returns with the building blocks of your portfolio.

With BBAE’s MarketGrader smart beta strategies, we’ve put effort into bringing our customers an excellent means to pursue that goal. And we hope we’ve succeeded.

We invite you to learn more about smart beta investing through BBAE’s MyAdvisor through the button below.

Happy investing,

James from BBAE

Disclaimer: This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions.