Being bearish usually sounds smarter than being bullish.

But is being bullish more likely to be right?

Yes and no.

No if we’re talking about a single stock or short time period.

Yes if we’re talking about a market-sized group of stocks over the long run.

Casting a wide net

The more I read, the more I learn that stock returns are more concentrated than I expected.

I recently shared data about how the market’s gains – and losses – are incredibly concentrated, time-wise, a bit like how scoring plays are a tiny fraction of game time in soccer.

Specifically, if you missed the best 10 trading days of the past 20 years – a nearly negligible 0.19% of trading days – your returns would be 55% lower than those of a fully invested investor. If you’d missed the best 60 – roughly 1.9% of trading days – your returns would be 93% lower.

Big down days were similarly concentrated.

You don’t have ESP, and neither do I, so cherry-picking the good days while avoiding the bad isn’t demonstrably possible in the long term.

It’s hard to be a stockpicker (because of concentrated returns)

If we give up on cherry-picking time periods, what about cherry-picking stocks?

There are plenty of examples of successful investors who’ve done this, but probably many more failures.

Hank Bessembinder, a finance professor at Arizona State University, scored a sleeper hit in 2018 with his paper Do Stocks Outperform Treasury Bills?

Well, do they?

In aggregate, yes. But Hank found that – almost embarrassingly – just 4% of US stocks do all the lifting. The bottom 96% of stocks just matched Treasuries.

Don’t look for the needle in the haystack. Just buy the haystack.

John Bogle

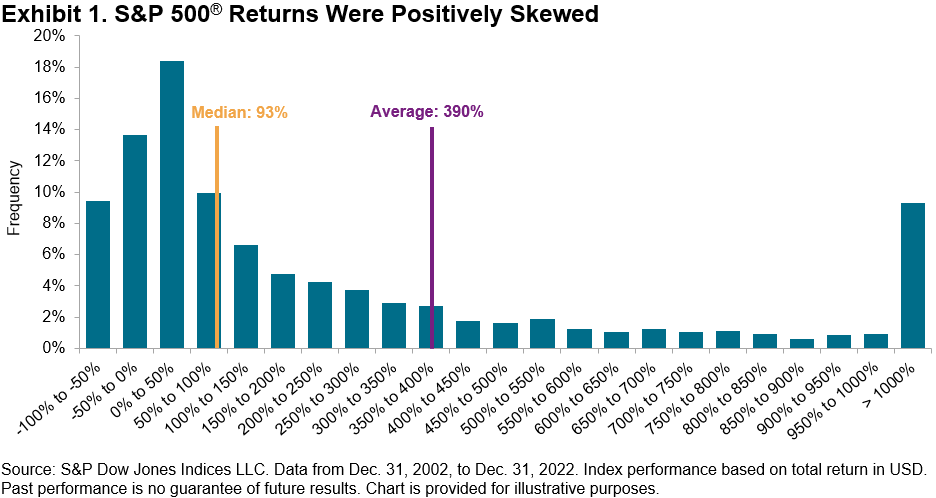

Hank studied all stocks, including the dinky ones. This phenomenon was better when looking at just the S&P 500, but still clearly present: S&P’s Indexology blog found that over a 20-year period, only 24% of stocks in the S&P beat the average.

What about global stocks?

Let’s return to Hank.

A year later, he double-dipped on this topic from a global angle, finding that just 1.3% of global stocks created all the added market value from 1990 to 2018.

Combined, Hank’s studies mean that statistically speaking, over your investing lifetime, a handful of stocks – and a few dozen trading days – will drive the entirety of your investing returns.

Let’s be realistic.

What are your odds of selectively being in the market for best 1.9% – or, harder, the best 0.19% – of trading days? What are your odds of buying just the best 1.3% of global stocks (or subset thereof)?

We both know.

Your odds of buying some of the 4% of overall stocks that drive the market’s returns are better, and likely better still if you confine your choices to S&P 500 companies (just remember that the Indexology’s “24%” stat references beating the S&P average, which is a bit different from what Hans studied).

I’m not against trying to buy the winning 4% or whatever of stocks with an appropriately sized portion of your portfolio. But it’s very hard to pick just the best stocks, and even harder to be in the market for just the best time periods. People have lost a lot of money trying.

This is why wide nets make sense – as cornerstone or anchor investments for nearly everyone, and potentially as an entire equity strategy for a more risk-averse investor, or for someone who’s just not into investing (but understands that he or she should invest).

You cast a wide net time-wise by “mindlessly” holding for a long time.

You cast a wide net stock-wise by “mindlessly” buying a broad basket of stocks.

We’ve made that easy to do at BBAE, with both our interactive Discover tool that makes it easy to find stocks that work for you. On top of that, BBAE recently joined forces with smart beta pioneer MarketGrader to create three ready-to-go smart beta portfolios that implement exactly the principles espoused in this article: hundreds of stocks (using fractional shares) join your portfolio with the click of a button. Click here to learn more.

Disclaimer: This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.