1988.

George H. W. Bush defeated Michael Dukakis to become the next U.S. President. Pan Am Flight 103 was bombed over Lockerbie, Scotland. And an investor named Warren Buffett started buying Coca-Cola stock in his Berkshire Hathaway holding company.

The man now regarded as the world’s greatest investor didn’t buy it all at once, but the $1.3 billion he invested in Coke has grown to nearly $25 billion.

Wouldn’t it have been great to have been watching over Buffett’s shoulder – and following along – as he made this trade?

Or as he bought into American Express – another $1.3 billion investment that’s grown to $25 billion? Or into Apple or Moody’s or any of his other phenomenal wins?

Look, you and I both know that even Buffett doesn’t nail it every time. But considering that Berkshire Hathaway is up nearly 3,800,000% since its 1965 inception, Buffett nails it often enough to be worth watching. In fact, many famous investors are.

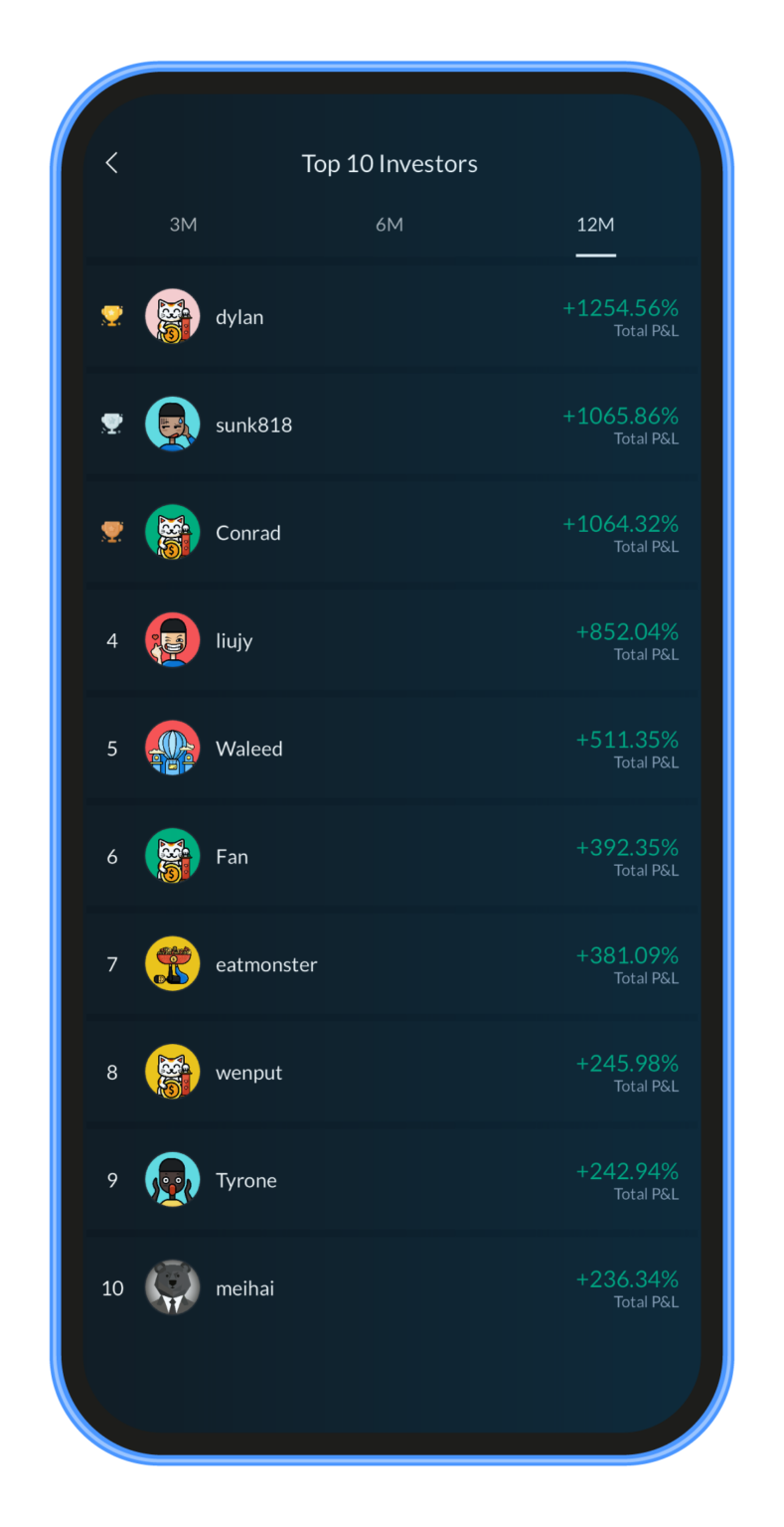

Is the next Warren Buffett in BBAE’s Town Square?

If you’re familiar with SEC filings, you know that you can see what many big investors are doing – with limitations – via SEC Form 13 filings.

- SEC Form 13F, a product of the Securities Exchange Act of 1975, requires institutional money managers with $100,000,000 or more in assets under management to disclose their holdings 45 days after each quarter.

- Schedule 13D, hailing from the 1968 Williams Act, requires firms acquiring 5% or more of a voting class of a company’s shares to disclose their acquisition within 10 days of crossing that threshold. Whereas the purpose of the Form 13F is to let the nation broadly keep an eye on big, systemically significant investors, Schedule 13D’s intention is to warn investors about corporate raiders or hostile “sharks” building a position.

- Schedule 13G is like 13D’s little brother – a shorter, simpler form for 5% owners who don’t fit the shark or raider profile: generally, passive investors who are not seeking voting control. Section 13Gs must be filed within five days of the transaction.

The most watched is the 13F. Managers aren’t required to disclose holdings traded on non-US exchanges (so you won’t see Berkshire Hathaway’s BYD holdings on a 13F, because it bought BYD’s Hong Kong-traded shares). Exemptions are occasionally granted, too: Berkshire Hathaway, in fact, recently filed for an exemption from disclosing one US-traded company.

But the biggest rub is the 45-day delay, which means that the “news” inside a 13F is at the very least a month and a half old (for trades made at the end of the quarter) and potentially almost four and a half months old (for trades made at the start of the quarter).

In theory – and certainly often in practice, too – a manager could be long gone from a position by the time it’s disclosed in a 13F. In an extreme case, a manager might have soured enough to have not only sold but even shorted the stock (shorts, incidentally, are not reported on 13Fs, but are on Form SHO, which is a monthly form required for short positions larger than $10 million or 2.5% of the outstanding shares).

BBAE saw a problem – and a solution.

BBAE set out to build a system where our top investors’ trades could be shared – and copied – practically in real time. Our Town Square Copy Trade feature lets you see and copy trades from any investor who’s opted in to Town Square.

Copying trades is as simple as pressing a button. Literally.

You can see the recent performance of the top investors on the app, and (obviously) can track the performance of your own copied trades.

You can even get notifications when new trades are made.

We look at Town Square as more than a feature – at BBAE, we’re building a community of like-minded investors committed to learning from each other.

BBAE’s Town Square (Copy Trade) is a fast way to add stocks to your portfolio, or just to bubble up ideas to research. Trades are verified, and the whole concept is transparent by design.

If you’d like to check out BBAE’s Town Square, and see what the BBAE community can do for you, we’re happy to extend this invitation: click here to claim it.

BBAE Has Benefits Outside of Copy Trade, too

And keep in mind: these are in addition to all the benefits you get with a BBAE account in the first place. Those benefits include:

- Free equity trades

- Curated stock ideas and themes in BBAE’s Discover section – some follow top investors, whereas others follow themes like EVs, semiconductors, SaaS, and more

- Top-notch options functionality with BBAE’s options pricing tool

- Real-time market data, financials, and charting

- Industry-leading content and education

- Three exclusive smart beta portfolios from industry leader MarketGrader (in BBAE’s MyAdvisor)

- A bonus of up to $400 in BBAE Dollars for opening and funding your account

BBAE is on a mission to give its investors the best investing outcomes – and the best investing tools – possible. Join BBAE and become a part of this mission today.

Disclaimer: This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.