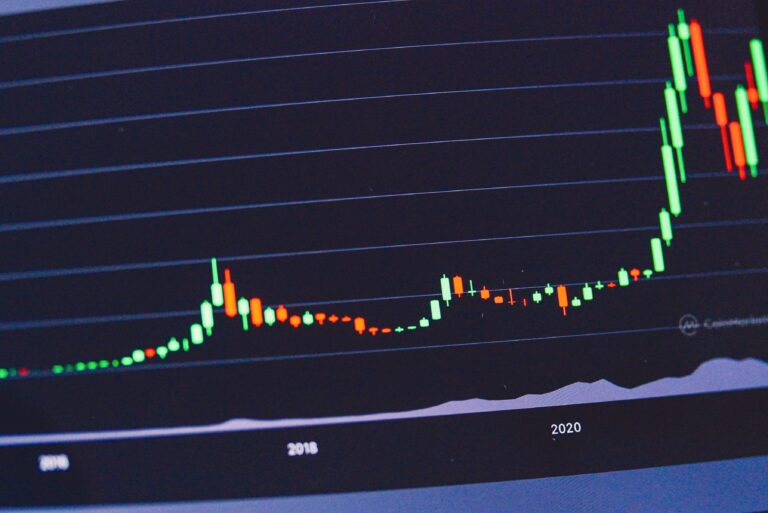

One of the essential concepts in stock market investing is compound interest, which is often referred to as the “eighth wonder of the world” (often erroneously attributed to Albert Einstein, but a great description nevertheless). The power of compound interest lies in its ability to grow your investments exponentially over time, transforming small, consistent investments into substantial wealth. And sometimes, enormous wealth. Let’s look at how compound interest works, its advantages, and how you can harness its power to optimize your returns.

How Compound Interest Works

Compound interest is the interest earned on both the principal amount of an investment and the interest accrued over time. In other words, as your investment earns interest, that interest is added to the principal, and the entire amount earns interest in the subsequent period. This results in a snowball effect, as the interest effectively earns interest on itself, leading to exponential growth.

The formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

A is the final amount

P is the initial principal

r is the annual interest rate (as a decimal)

n is the number of times interest is compounded per year

t is the number of years

Let’s consider the example where the initial investment amount (P) is $1,000, the annual interest rate (r) is 10% (0.10 as a decimal), the investment period (t) is 20 years, and the interest is compounded once a year (n=1). Using the formula for compound interest:

A = P(1 + r/n)^(nt)

We can plug in the values:

A = 1000 * (1 + 0.10/1)^(1*20)

A = 1000 * (1 + 0.10)^20

A = 1000 * (1.10)^20

A ≈ 1000 * 6.7275

A ≈ 6,727.50

After 20 years, the initial $1,000 investment would grow to approximately $6,727.50, thanks to the power of compound interest.

Of course, you as an investor have to find an investment (or a portfolio of investments) that will grow at 10% per year – and hold through whatever ups and downs the investment may encounter, which studies show is quite difficult for people – to get those results. But the results can be great for those who pull it off.

Advantages of Compound Interest

1. Exponential Growth: The biggest advantage of compound interest is its ability to increase the value of an investment exponentially over time. As interest is continually added to the principal, the rate at which your investment grows accelerates.

2. Time Value of Money: The power of compounding becomes more pronounced the longer your investment horizon. The more time your investments have to compound, the more significant the growth. This concept highlights the importance of starting your investment journey as early as possible.

Harnessing the Power of Compound Interest

To fully capitalize on the benefits of compound interest, consider the following strategies:

1. Start Early: The earlier you begin investing, the more time your investments have to compound, and the more significant the growth. Even small, consistent investments made early in life can result in substantial wealth accumulation over time.

2. Consistent Investing: Making regular contributions to your investments, even in small amounts, can accelerate the compounding process. Consider setting up an automatic investment plan that contributes a fixed amount to your investments at regular intervals, such as monthly or quarterly. This approach, known as dollar-cost averaging, can also help smooth out the impact of market fluctuations on your investments.

3. Reinvest Dividends: If you invest in dividend-paying stocks, reinvesting those dividends can help maximize the benefits of compounding. Instead of pocketing the dividend income, use it to purchase additional shares of the stock, thereby increasing the total value of your investments and the amount of interest earned in future periods. (At least if you’ve found a good long-term dividend stock; if you’ve had the misfortune to pick a long-term decliner, reinvesting your dividends will just compound your decline.)

4. Long-term Perspective: Compound interest rewards investors with a long-term perspective. Resist the urge to chase short-term gains, and focus on building a well-diversified, long-term investment portfolio. Avoid frequent trading, especially in taxable accounts.5. Tax-Advantaged Accounts: Utilizing tax-advantaged investment accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s, can further amplify the power of compound interest. These accounts allow your investments to grow tax-deferred or tax-free, ensuring that more of your returns are reinvested, which can lead to faster compounding and greater wealth accumulation.