The Rise and Brutal Fall of EV Stocks: What’s Next?

Since the start of 2024, EV stock prices have sharply declined, led by Rivian, which has seen a drop of over 60% year-to-date, and Tesla, the industry giant, which is down more than 30% this year. In contrast, major market indices such as the S&P 500 and Nasdaq have remained in positive territory for the same period.

The short explanation for the recent decline in EV stocks is a slowdown in the overall electric vehicle market growth and negative market conditions for most companies in this sector. Many of these companies are burning through significant amounts of cash. Additionally, there have been several negative news developments, such as Tesla announcing a 10% workforce reduction after missing delivery expectations for the first quarter of 2024, and Rivian’s second round of layoffs.

To fully understand the reasons behind the electric vehicle stock declines, we need to look back a few years to get the longer-term context.

The Rise of EV Stocks:

I won’t go as far back as 2003 when Tesla was founded and revolutionized the electric vehicle industry over the following decade. Instead, I’ll focus on the period just before the COVID-19 pandemic.

Prior to 2018, there was only one pure-play electric vehicle company publicly traded – Tesla. At that time, there was not much investor confidence or hype around the electric vehicle industry. Even Tesla, now a well-established name, faced significant skepticism, evidenced by the substantial number of investors betting against the company’s stock (Tesla short sellers). The first major EV company to go public after Tesla was the Chinese automaker NIO, which debuted at $10 per share in 2018 but then saw its stock price crash below $2 in the months after its IPO.

The real sentiment shift for electric vehicles happened in 2019. That year marked a significant achievement for Tesla – the company successfully scaled up production of its Model 3 vehicle, which had launched two years earlier, delivering over 300,000 vehicles. Importantly, the overall stock market was also experiencing a strong bullish phase at that time, and Tesla started to be viewed as a high-growth stock with tremendous potential. The optimism around the future of electric vehicles, combined with Tesla’s success, led to speculative demand for EV-related stocks.

The COVID-19 pandemic then accelerated this speculative trading, as an influx of new investors entered the market, further driving up the prices of stocks like Tesla and other companies.

Tesla’s performance made it a poster child for the potential of the EV market. As investors saw Tesla’s valuation skyrocket, they started searching for other opportunities within the same sector, leading to increased interest and investment in a range of electric vehicle startups.

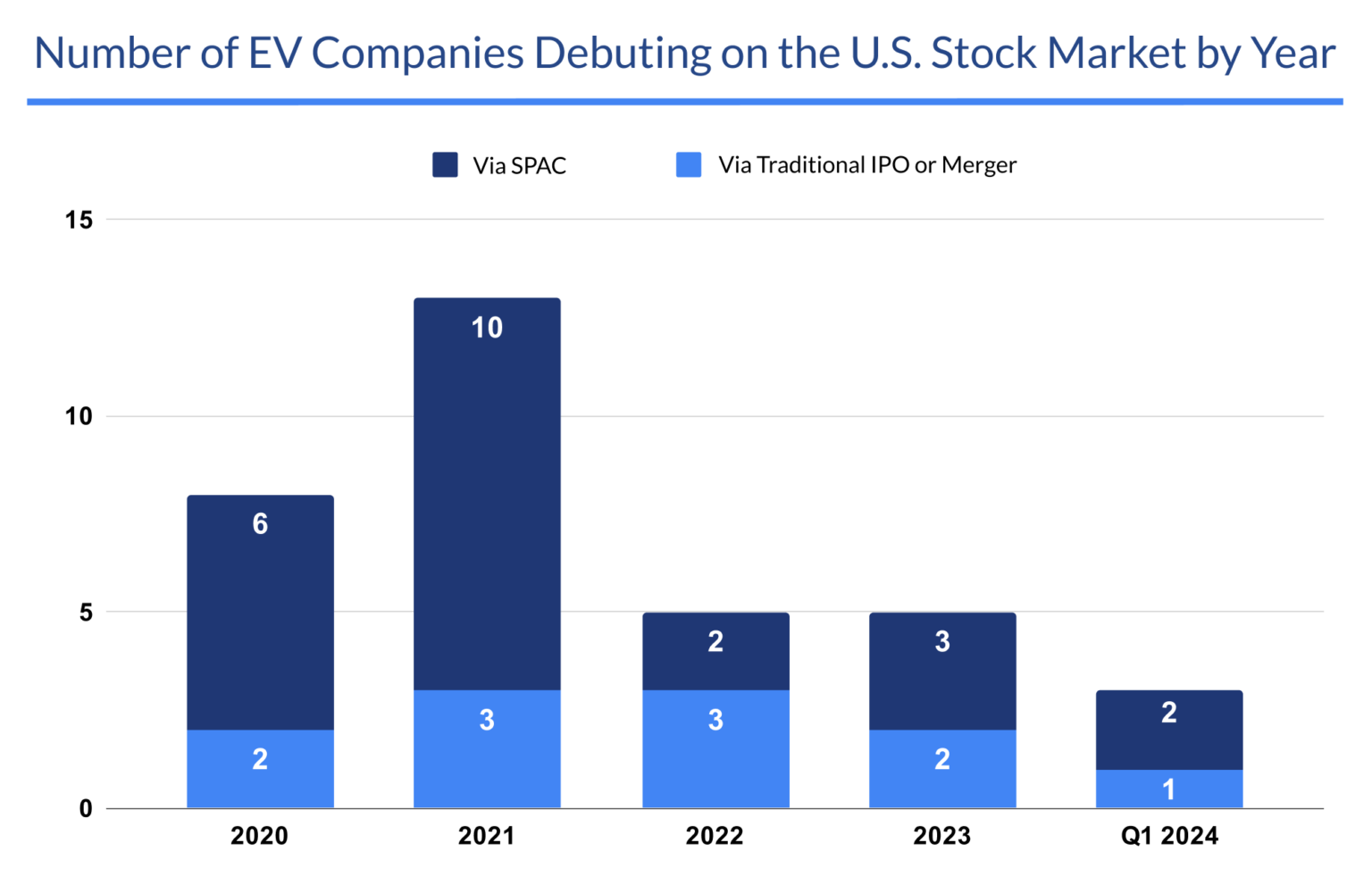

Nikola Motors went public in May 2020 after completing a SPAC (Special Purpose Acquisition Company) transaction. The stock price soared from the $10 SPAC IPO price to over $90 within a few days of the SPAC deal’s completion. Nikola’s IPO was followed by other electric vehicle startup IPOs, many of which were pre-revenue and even pre-product companies. The year 2020 saw a wave of major electric vehicle IPOs, including Fisker, Hyliion, Lordstown Motors, Canoo, and Arrival, all of which went public via SPAC deals. These companies were trading at significant premiums to their SPAC NAV (net asset value) even before the official completion of the SPAC transactions.

The success of Tesla led to speculative investing where the fundamentals of many electric vehicle companies were often overlooked in favor of hype and potential future profits. This speculation fuelled rapid increases in stock prices of these new electric vehicle companies, regardless of their actual profitability or product viability at the time.

The beginning of 2021 was also marked by a high number of EV startups announcing SPAC deals, with Lucid Motors, Faraday Future, and Proterra being some of the most notable ones in the first quarter. Lucid’s IPO was particularly impressive, with the CCIV SPAC (which was rumored to take Lucid public) surging from $10 to $60 based on the rumors alone. The year ended with the largest electric vehicle IPO ever, Rivian, which priced its shares at $78.00, valuing the company at $66.5 billion. The shares began trading at an opening price of $107 and closed the day at $100.73 per share, giving the company a valuation of approximately $86 billion. Rivian’s market cap later crossed $100 billion, surpassing the market caps of Ford and GM at the time, despite the company having only delivered 920 vehicles that year. The willingness of investors to assign such frothy valuations to pre-revenue, pre-production companies laid the groundwork for the painful correction that would come a few years later.

2021 was already marked by a decline in the stock prices of growth stocks, and the Rivian IPO can be considered the last major “positive” development in the EV sector before market sentiment completely changed and became increasingly unfavorable for electric vehicles and other growth companies with negative cash flows.

Decline:

2021 already saw some concerning developments for the newly listed EV companies. Several companies lowered their production and delivery targets just a few months after going public, disappointing investors. The year was also negatively marked by the indictment of Nikola founder and former CEO Trevor Milton by a United States federal grand jury on securities fraud allegations. This case, initiated by the SEC and the Department of Justice a year earlier, involved allegations of securities fraud. Nikola, which had promised to revolutionize the trucking industry with its hydrogen fuel cell and battery electric trucks, became embroiled in controversy in 2020 due to serious allegations of misleading investors and making fraudulent representations about its technology. The Nikola scandal significantly impacted the electric vehicle market, particularly affecting investor sentiment and the perception of new market entrants.

However, the biggest headwinds for the industry came a year later, as the Federal Reserve decided to raise interest rates to combat rising inflation. The increase in interest rates in 2022 had a substantial impact on the stock market, particularly affecting high-growth sectors, where many companies are typically cash-intensive and not yet profitable. For most electric vehicle companies that had already burned through the cash raised from their IPOs and needed to rely on debt to finance their operations, R&D, and scaling of production, the higher interest rates significantly increased their financial burden. Companies burning a lot of cash and still in the capital-intensive phase of ramping up production found it more expensive to service their existing debt and to raise new capital under less favorable terms.

The following year was marked by Tesla starting a price war. Tesla made several price reductions across its entire lineup of vehicles, affecting models such as the Model S, Model 3, Model X, and Model Y. The price cuts occurred in multiple waves throughout the year.

Tesla’s price cuts placed immediate competitive pressure on other automakers, both established players and newer EV companies. Competitors were forced to reconsider their pricing strategies to maintain market share.

These challenging market conditions led to a series of bankruptcies among the more vulnerable EVs. Electric Last Mile Solutions was the first to declare bankruptcy, followed by Lordstown Motors, Proterra, and Arrival, which was once valued at over $10 billion. Most recently, Fisker is also on the brink of bankruptcy; the company has paused all production after failing to make an interest payment.

For the companies that did not go bankrupt, their fate was not much better, as most of the EV stocks that went public after 2020 are significantly down from their IPO prices.

Below is a table illustrating the performance of various electric vehicle stocks compared to their IPO prices, along with a list of those that have declared bankruptcy.

| Symbol | Name | Return from IPO | Year of IPO |

| $NKLA | Nikola Corp | -93.60 % | 2020 |

| $HYLN | Hyliion | -86.40 % | 2020 |

| $FSR | Fisker | -99.40 % | 2020 |

| $RIDE | Lordstown Motors | Bankruptcy | 2020 |

| $GOEV | Canoo Inc | -98.76 % | 2020 |

| $SPRU | Formaly XL FLeet | -95.88 % | 2020 |

| $XPEV | Xpeng Inc | -50.53 % | 2020 |

| $LI | Li Auto Inc | 149.83 % | 2020 |

| $GP | GreenPower Motor | -91.40 % | 2020 |

| $ARVL | Arrival | Bankruptcy | 2021 |

| $LEV | Lion Electric Co | -89.60 % | 2021 |

| $ZEV | Lightning eMotors | Bankruptcy | 2021 |

| $ELMS | Electric Last Mile Solutions | Bankruptcy | 2021 |

| $PTRA | Proterra Inc. | Bankruptcy | 2021 |

| $FFIE | Faraday Future | -99.40 % | 2021 |

| $REE | REE Automotive | -98.64 % | 2021 |

| $HYZN | Hyzon Motors Inc | -93.80 % | 2021 |

| $XOS | Xos Inc | -97.26 % | 2021 |

| $LCID | Lucid Group Inc | -75.80 % | 2021 |

| $RIVN | Rivian Automotive | -88.35 % | 2021 |

| $SEV | Sono Motors | Bankruptcy | 2021 |

| $PSNY | Polestar Automotive | -86.90 % | 2022 |

| $NWTN | NWTN Inc | -31.80 % | 2022 |

| $PEV | Phoenix Motor Inc | -90.67 % | 2022 |

| $EGOX | NexteGO | -99.70 % | 2023 |

| $SVMH | SRIVARU Holding | -97.80 % | 2023 |

| $VFS | VinFast Auto Ltd | -72.80 % | 2023 |

| $FUV | Arcimoto Inc | -86.33 % | 2023 |

| $UCAR | U Power | -99.67 % | 2023 |

| $LOT | Lotus Technology | -37.50 % | 2024 |

| $LOBO | LOBO EV Technologies | -20.00 % | 2024 |

Over the past few years, the performance of EV stocks has been disappointing. Most have declined over 80% from their IPO prices, with the notable exception of Chinese automaker Li Auto. These declines are even more brutal when comparing current valuations to their 2021 highs.

In conclusion, this year-to-date crash in the electric vehicle market is part of a broader trend that began when the IPO frenzy cooled. Many electric vehicle companies went public with inflated valuations that did not reflect their actual financial health or production capabilities. Additionally, this recent quarter was troubled by further negative developments, including overall slowdowns in electric vehicle sector growth. Notably, Tesla missed its delivery targets for the first quarter of 2024 and reported its first quarterly delivery decline in nearly four years. This led to the company announcing a 10% workforce reduction on April 16, 2024. Most investors interpret these layoffs as evidence that the missed delivery targets were due to a lack of demand rather than production issues.

What’s Next?

The surviving electric vehicle companies are in various stages of development and maturity. Some are only experiencing a decline in valuations due to the broader market slowdown, without facing existential threats like Tesla. Others, such as Lucid and Rivian, are still trying to scale up the production in pursuit of profitability. And some are still in the pre-production phase, fighting for survival in the harsh environment amid dwindling cash reserves.

Creating a successful automotive manufacturer has historically been an extremely challenging task, especially in the U.S. market. Prior to Tesla, it had been a long time since any new automaker had succeeded.

The push towards electrification has opened up new opportunities for startups to emerge. However, progressing from the design and prototype phase to full-scale production and achieving profitability remains a formidable challenge. Despite employing diverse strategies – such as building their own production lines, fully outsourcing manufacturing like Fisker, or exploring innovative approaches like Arrival’s micro-factories – there are no guarantees of success.

As the electric vehicle market continues to evolve, several key factors will influence the survivability of current EV players. These include the level of technological innovation, brand reputation and customer loyalty, as well as government support and regulatory compliance. However, in the current economic environment characterized by high interest rates and increased competition, two factors stand out as particularly crucial:

- Strong Financial Position: Companies with robust balance sheets, substantial cash reserves, and minimal debt are better equipped to handle high interest rates. This financial strength enables them to fund research and development, scale up production, and manage operational costs without heavy reliance on debt financing, which becomes pricier in such an environment. Aside from Tesla, Rivian and Lucid Motors have advantages in this area, with Rivian having $9.37B and Lucid having $3.86B in cash or equivalents and short-term investments as of Q4 2023. It’s also worth noting that Lucid has the backing of Saudi Arabia’s sovereign fund and is planning to raise an additional $1B from them in the coming months.

- Strategic Partnerships: Forming strategic alliances with battery suppliers, technology firms, or established automakers can help companies strengthen their supply chains, cut costs, and broaden their market presence. Rivian has secured a significant partnership with Amazon to supply delivery vans, while Polestar benefits from a strong relationship with Volvo, which holds a significant stake in the company.

Given these dynamics, many of the remaining electric vehicle companies may face bankruptcy in the upcoming years. It will be fascinating to watch this market evolve, observing which companies manage to survive and what new advancements they bring to the table.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.