These Stocks Set for Gains if Trump Wins

I have mixed feelings about the plethora of “Stocks to Buy for a Trump Victory” – type articles.

On one hand, they’re reasonable, in the sense of catering to public interest. Biden bombed the debate and though he’s said he’ll stay the course, rumors persist that he’s seriously considering dropping out. This affects (and already affected) markets.

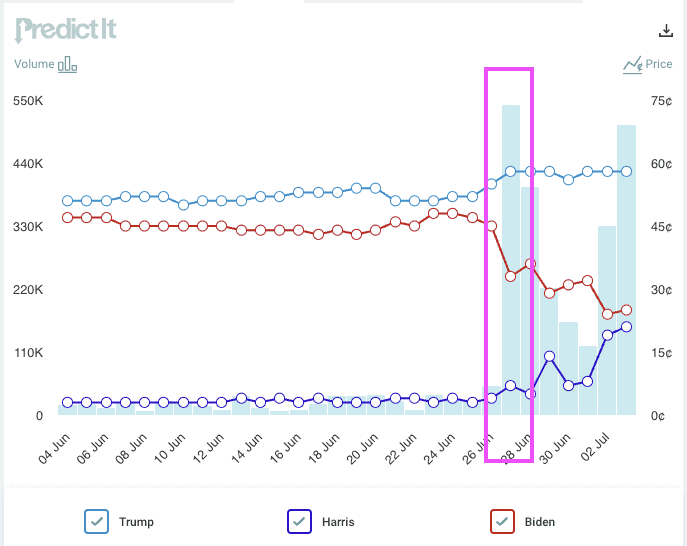

On the other hand, and per the Predictit chart above, Trump has consistently been the frontrunner of late, at least in the eyes of those willing to bet money on the race. Trump was probably going to win before, and he’s probably going to win now.

But I like this story for capturing a nuance many people miss in investing: The notion of relative certainty of an event happening.

Almost never in investing do you have an idea that nobody else has. Almost always, you’re either more certain or more skeptical about expected events happening.

Look closely at the chart above and you’ll see that Trump’s spread over Biden got much larger after the debate. In fact, according to some polls, Kamala Harris now has a better chance of being the next President than Biden.

The S&P 500 rose, too, because US capital markets see Trump as better for them. (That doesn’t mean that the portfolio managers increasing their buying will vote for Trump, or that they even like him, incidentally.)

Investing for a Second Trump Presidency

I’ll give summaries of some of the major “Trump trades” discussed in the investment media. Note that these are simply trading ideas being discussed, and are not presented as recommendations in any way.

At this point, a Trump victory is probably mostly priced in to markets, but not entirely. Remember that in 2016, top pollsters and political statisticians were giving Hilary Clinton a 98% to 99% chance of winning, so upsets can and do happen.

Trump Trade #1: US dollar stronger(?)

This first one is a bit of a trick, because there are views on both sides.

On paper, Trump and team are pursuing a weaker dollar, which is supposed to boost US exports (by making them more affordable to foreign buyers who have to convert their currencies into dollars to buy).

So the take-him–at-his-word crowd might say to short the US dollar, because Trump aims to weaken it.

But this is investing, and there is usually another crowd in investing.

This other crowd notes that Donald Trump was the most protectionist US President in a while, and he’s tossed out the idea of a 10% across-the-board tariff on imports, as well as a 200% tariff on Chinese cars, and a general 60% tariff on Chinese imports, too. Tariffs tend to prompt counter-tariffs. And keeping money in the country can spike inflation.

It is this second crowd – that Trump means a stronger dollar – that is prevailing in the markets:

Trump Trade #1a: US-based steel companies: Trump’s tariffs would likely help American auto makers, and especially steel companies. Cleveland-Cliffs ($CLF) and Nucor ($NUE), both steel companies, rose after the debate.

Trump Trade #2: Small cap stocks

I generally find the “Trump Stocks to Buy” articles that just regurgitate what investments did well under his first term to be intellectually thin, but small caps did well early in Trump’s first term, and may benefit from more domestic spending, as small caps tend to be more domestically focused. That said, they also tend to have a lot more debt (and a lot more variable-rate debt) than larger stocks, and high rates are working against them.

Trump Trade #3: Short bonds, or at least avoid them

Any time you’re betting on politics, you’re betting on decisions made by a few people, and sometimes just one person. (This is one reason I personally don’t invest based on politics, and in fact, prefer stocks that are relatively insensitive to political risk.) Trump is not known for being predictable, but he’s not known for being parsimonious. Sustained spending will likely keep inflation up, and higher inflation will prompt the Federal Reserve to keep interest rates high. So – and again, we’re talking about a chain of probabilities – if you’d bought bonds expecting rates to drop, making your old, high-yielding bonds proportionately more valuable (which happens when newly issued bonds don’t pay as much), you may not get the payday you’re hoping for.

Trump Trade #4: Private prisons

This one is getting a lot of airtime. If Trump indeed starts detaining and deporting more people, some could spend time in prisons run by GEO Group ($GEO) or CoreCivic ($CXW), both of which rose quickly after Biden’s debate performance.

Trump Trade #5: Healthcare stocks

Healthcare is an oft-discussed Trump trade, but I’m less confident on its predictability under Trump than most seem to be. Humana ($HUM) and United HealthGroup ($UHN) and CVS ($CVS) rose after the debate (but have since given up much of their gains); healthcare stocks have traditionally underperformed the general market in election years, presumably because of uncertainty, but this year, they’re basically keeping pace. Trump may generally apply less pressure to reduce drug prices than a Democratic candidate, but the Inflation Reduction Act – which allows for governmental drug price negotiation, starting in 2026 (at least that’s when newly negotiated prices will be passed on to end users) – seems relatively tough to follow with subsequent major new legislation. Biotech has still not recouped its losses, but this is far more an interest rate story than a regulatory one. Bottom line: Other analysts see a Trump win as a win for healthcare stocks; it might be, but I’m less convinced, or at least less convinced it’ll be a major needle mover.

Trump Trade #6: “Dirty” energy up, clean energy down

Clean energy stocks, once speculative darlings of the COVID bubble, have taken a steady march down since 2021:

They don’t need more bad news, but they’ll get it: Whereas Trump’s intentions on health care may be more ambiguous, how he feels about clean energy is clear. (This New York Times piece details more.)

“Clean energy” is almost too broad a word now, but much of the industry still relies on government support of some kind (to be circumspect, the fossil fuel industry, which has made record profits in recent years, also gets a decent bit of government help). Yank the support and these already-depressed stocks may crater.

Meanwhile, as this article in Capital & Main details (my sense is the writer is not jazzed about Trump’s plans, but I’m presenting the article apolitically because it does reasonably cover Trump’s potential energy steps) is expected to open new oil and gas drilling, re-ditch the Paris Accords, slow permitting for green energy projects – which in theory compete with fossil fuel projects in electric generation – as well as shrink the EPA.

Again, Trump’s energy policy intentions seem more clearly telegraphed than his others.

The “safe” money would stay away from clean energy following this logic, but to make an educational point, remember that the stock markets work like horse races: If, for whatever reason, Trump gets elected and doesn’t give clean energy quite the beating the market expects, the stocks could actually do very well. That wouldn’t appear to be the likely outcome for now, but that’s why it would pay off handsomely if it happened.

Trump Trade #7: Financial companies

There are a few prongs to this. One is that Trump, being generally pro-business, would, if anything, soften regulations on financial firms – which have become highly regulated in recent decades, especially after the Global Financial Crisis of 2008-2009. And a Trump administration is generally softer on M&A of any kind, big banks like JP Morgan ($JPM) and Goldman Sachs ($GS) would benefit, as mergers tend to be lucrative business for them. And it’s possible that the yield curve could eventually normalize (i.e., shorter-term rates lower than long-term rates) if the Fed starts cutting while longer-term bond yields stay high – and they are already rising as investors sell off long-term debt in anticipation of a Trump presidency.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.