Weekly Roundup: Google Suit Pros and Cons, Small Banks Coming Back?

Market Lesson: Bad is Sometimes Good

Here’s a great market lesson – particularly about how the market is “reflexive” (a George Soros-ism), and a product of social science rather than a “hard” physical science where certain rules always apply.

I talked recently about the implosion of property values – especially in commercial real estate (CRE), where some recent sales have been for prices literally more than 90% lower than past prices (often set nearly 20 years ago).

In fact, I wrote last week about a Manhattan building that sold for a 97.5% discount from its 2006 price. That’s the equivalent of buying a house for $1,000,000 and selling it for $25,000. Ouch.

The most obvious loser in the “bad CRE” scenario is whoever owns the buildings. The second most obvious loser is the banks who’ve made CRE loans, as not only are any fire-sale sellers with outstanding loans likely to be less able to repay them (because they’re selling for peanuts) but even CRE borrowers not planning to sell now must revalue their properties as the “comps” come in: Even if you never plan to sell your million-dollar house, if multiple houses on your erstwhile million-dollar block start selling for $25,000, at some point you’ll have to face the music that your house, too, is probably worth something like that on the open market.

Greatly reduced values mean their loan collateral (i.e., the building value) goes way down.

Banks are used to the illiquidity of CRE and will presumably be flexible with the borrowers about (not) ponying up more collateral – as that could prompt death spiral selling, hard though it is to imagine prices going even lower – but at a minimum, the bank may need to mark down the loan value.

This is bad for regional bank stocks, all else equal.

But as I wrote recently, the counterargument to this from a market perspective is that the market knows all of this. The bad news is already baked into prices. That means that smaller bank stocks may be “coiled” to bounce up on unexpectedly good news.

It was already happening, in fact.

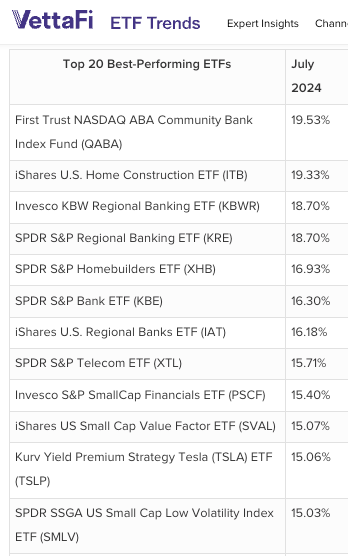

See my partial screenshot of VettaFi’s list of top-performing ETFs last month below. Five of the top 10 are bank ETFs, and another is a small-cap financial ETF, which I’m guessing is heavily small bank-weighted.

Homebuilders have see-sawed this past year as investors juggle the opposing forces of high interest rates (bad) and limited supply (good), and the two homebuilder ETFs may have risen in anticipation of lower rates.

Presumably, the smaller banks are up on that catalyst, too, as it may help real estate and help the front end of the yield curve.

(If you’re new to banks, know that they have a semi-complex relationship with interest rates. It’s often said that high rates are good for banks because banks can charge borrowers more, and that’s true, but a steep yield curve – where short-term rates are low and long-term rates are high – is more precisely what’s good for banks (which pay out short-term rates and take in long-term rates). The yield curve had been inverted for quite some time, until very recently.)

The broader lesson is – and this is something I’ve said before and will say essentially forever because it’s one of the most important (and non-obvious) things about investing – that you’re never investing based on absolute reality, and you’re always investing based on your views relative to the market’s.

That said, one month does not a long-term thesis make, and it’s possible that this is just a giddy bump, and that the bank bears will be proven right in the end. I don’t know, and neither does anyone else.

But this does illustrate the power of value investing. Surprises are what unlock market value (because everything else is priced in), and stocks that are unloved by the market tend to have a lot of potential to surprise it if things go better than planned.

Google Declared a Monopolist

As you probably heard, a case brought by the Department of Justice (and attorney generals from 38 states; the suits were eventually consolidated) against Google for illegal monopoly practices in 2020 was finally resolved – sort of – when US district judge for Washington DC Amit Metha ruled against Google.

“Google is a monopolist and it has acted as one to maintain its monopoly.”

-Judge Amit Mehta

Let’s back up.

Ever endured horrible customer service, waited in long lines, or paid highway-robbery prices because one company had too much market control?

Ironically, it’s what companies want. Well, no. They don’t want you to suffer (and, these days, leave a nasty Google or Yelp review). But a primary goal of a company is to develop enough pricing power that it can charge more than it “should,” so to speak, and the competition can’t do anything.

A brand is the most obvious example of this: The financial aim of the brand is to let a company charge more for the same thing than it otherwise could.

“Overpaying” for brands is highly elective, unforced consumer behavior, and so the government is OK with it. The government does seek to protect consumers overpaying thanks to having their choices limited by big, powerful companies. And whether it’s steamships, railroads, steel, oil, telecom, or tech, new industries give rise to big, powerful companies.

The eternal question: Did these bruisers grow big and powerful because they’re good and offer what consumers want – no shame in that – or because they got big enough to squelch competition, or a little of both?

Google seems solidly in the “little of both” category, at least to me.

Google obviously makes the best browser. It has 89.2% share in general search and 94.9% in mobile; as Bloomberg’s Matt Levine pointed out (registration may or may not be required), Microsoft’s Bing is #2 with 5.5% search share, but “google” is one of the top searches on Bing, meaning a large number of Bing users are, ironically, trying to find their way back to Google.

Google has almost no competition, but simply having a monopoly-level market share is not illegal, much like how being the only restaurant in a small town is not illegal.

It has tons of search and – importantly – tons of data on everyone’s searches. If you’re an advertiser, Google can give you the most benefit, price aside.

Judge Mehta – a huge hip-hop fan, incidentally – decided that Google (technically, Alphabet) did not have a monopoly in general search advertising, but did have one in text search advertising – i.e., it has the potential to overcharge clients.

Mehta also took issue with Google’s huge payments to phone makers to make Google Chrome (and other Google apps) the default on phones, as well as the practice of paying to make “google.com” the default search site on browsers like Firefox and Safari. Mehta pointed out that there have only been two new browser entrants in the past 15 years, and neither amounted to much (DuckDuckGo is eeking out a miniscule existence, and the other failed.)

Google didn’t come across like a “nice guy” company, either.

Years of internal memos showed that Google was well aware that it was cornering the market, Google had an internal policy of having employees cc: an in-house lawyer on anything remotely controversial, with the intent that such communications could be redacted during discovery for attorney-client privilege. Mehta saw through that and scolded Google for abusing this avenue.

And – slightly wonky here – because Google controls both the leading ad exchange and the leading ad sell-side platform (SSP) (SSPs submit ad bids to ad exchanges) – it possesses “inside” bid price information from the whole market that allows it to price its own clients’ bids just slightly above the next-highest bidder, which is unfair to other ad middlemen as well as to publishers.

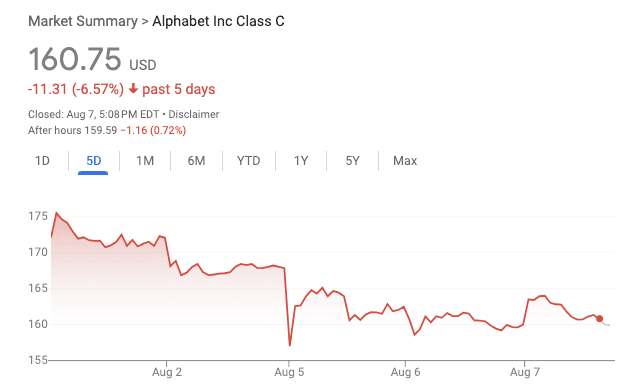

Google’s stock price was barely affected by the August 5th ruling.

What happens to Google/Alphabet next?

This is the key question. Legal scholars have been raving about the job Mehta did – he gave the government’s its first win over Big Tech in 25 years, and in a way that’s well-reasoned, not blindly accepting the DOJ’s argument, and seems likely to hold up on appeal (and Alphabet will try to appeal).

This trial simply decided liability, and not remedy. Remedy must be proposed by the DOJ (but not determined by the DOJ) as a next step, and is the real rub. Some ideas in discussion in the media:

Hard remedy: At the extreme, Google could be broken up, a la AT&T in 1982. Specifically, Google may be forced to sell its Chrome browser or Android operating system.

Soft remedy: On the gentler end, Google may just have to make its pay-for-default-status deals with web browsers and phone manufacturers non-exclusive (email registration may or may not be required).

Middle-ground remedy: Or, Google may have to share data or algorithms with competitors.

The remedy hearing is in September, but considering Google’s appeal, we may not have closure for a few more years – and we may be in a different regulatory environment by then – which is probably why the market is treating this “landmark” ruling as a nothingburger.

A wildcard might be if the DOJ can get an injunction against Google to at least temporarily suspend some of the more egregious monopolistic violations.

My take? If an offering is not the best, but is being forced on users for monopolistic reasons (anyone remember Internet Explorer?), it’s easy to hate the monopolist. If an offering is the best and is also being foisted on people, it’s more complicated – like a “dream guy” in a romance novel who’s also a bit too aggressive. For the ad market, has Google done more harm than good? I don’t know. But it did enough harm to trigger this, and I tend to think Big Tech is past due for regulation.

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.