I have a secret.

Not that kind of secret.

I used to be a dividend guy. I still am, in fact, but I ran Motley Fool Income Investor, which I believe was the largest dividend newsletter in the world for the 10 years I ran it. In addition to that, and being The Motley Fool’s Director of Research & Analysis, I also helped build their London stock-picking business, and picked dividend stocks in that market for 5 years, too. All in, my products beat the market, which is something I should probably trumpet louder than I do.

Maybe that’s my real secret.

Dividend Stocks: Beaten Down – but a Buy?

Anyway, as I wrote in this Benzinga article, dividend stocks have been horrible so far this year: The S&P 500 is up 9.4% thus far, whereas the iShares Select Dividend ETF (NYSE: DVY) is down 9.4%. (As an aside, the equal-weight S&P is just below flat, meaning it’s been a few big names in the S&P that have really driven the index’s returns – most of the rest of the index has been so-so.)

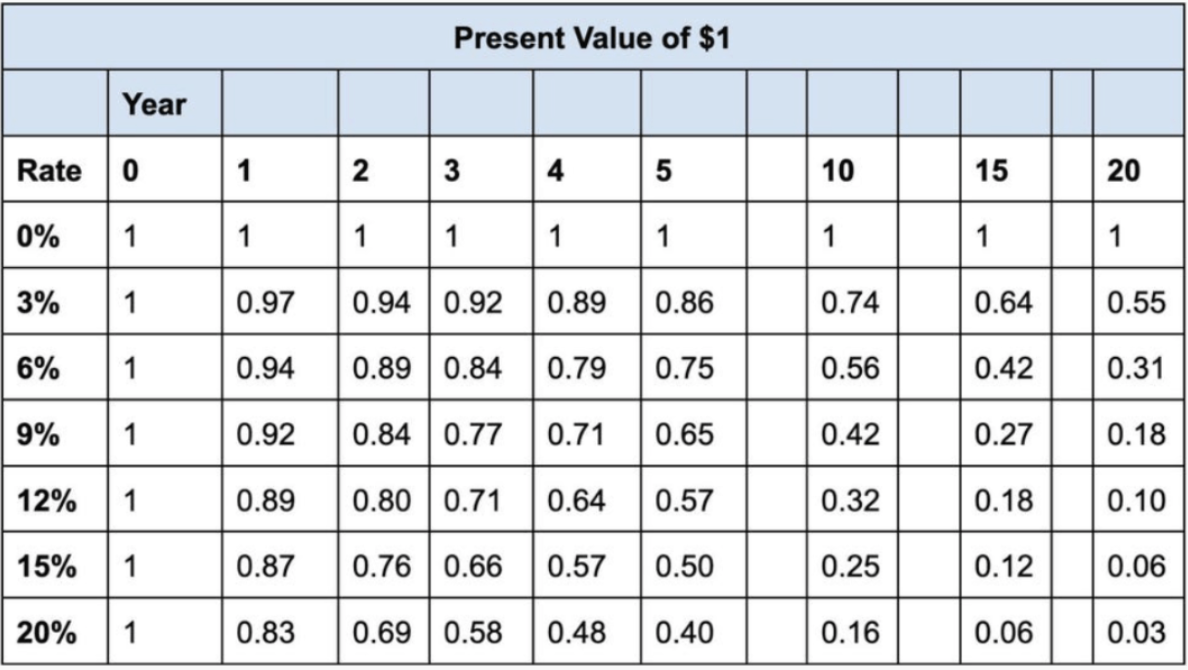

A lot of younger investors who came of investing age during the 13-year bull market we exited last year have not only only known a bull market, but they’ve known a type of bull market whose laws of physics differ from most thanks to ultra-low interest rates that “magically” make cash flows expected far into the future more valuable than they would be with normal interest rates. (If you’re new to investing, this means early stage biotechs and early stage tech companies and any other companies that traditionally lose money for years before turning a profit look disproportionately good on a valuation model.)

Here’s a table I showed in an earlier Forbes article, show how much less (or more) $1 is worth years into the future, depending on the interest rate:

Anyway, it’s been a bad year for dividend stocks; we’ve seen a snap-back rally in many of the sexy industries that got hammered in 2022. And AI is siphoning much of the market’s speculative oxygen.

Cash Flow and Profit-Based Investing: Sexy Again

My message to young investors who believe the secret to wealth is pouncing on the next hot trend: It won’t last.

Sure it worked for the past dozen years, which probably felt like an eternity. But it’s not how the market has traditionally worked, and the number of cases where “this time is different” lasted in perpetuity in the market round to zero.

At some point, we’ll be back to basics (cash flows, actual profit). At some point interest rates will start to fall (again, if you’re a newbie, welcome – and know that rising rates tend to crimp stock prices, at least eventually, and falling rates tend to do the opposite). And with bonds and money market funds paying less, financially secure dividend stocks will likely have their day in the sun.

As I mentioned in the Benzinga piece, the Financial Times shared data showing that $100 invested in 1971 grew to $4,744 in an equal-weight S&P 500 index through 2/2021 (Data from Ned Davis Research and Hartford Funds). In dividend stocks writ large, it grew to $8,942. And in dividend raisers or initiators, it grew to $14,405.

These are pretty good long-term statistics that you may want on your side.

I mention a few stocks in the Benzinga piece, but I’d also like to open the mic to my beloved BBAE audience here: If you have questions about dividend stocks, bring ‘em on. I’m happy to discuss.

Happy investing,

James

p.s. If you’re looking for the very coolest broker to buy your dividend stocks – or any other stocks, but for the moment let’s fixate on dividends – make that broker BBAE. Click here to explore opening an account, which is super easy.

Neither James nor BBAE has an investment position in any securities mentioned in this article.