You can fund your BBAE account via Instant Bank Transfer, ACH, Wire transfer, or ACAT transfer. To learn more about each of these options please continue reading below.

Filter FAQ list:

How do I fund my BBAE account?

How do I fund my account via Instant Bank Transfer (RTP)?

Real-Time Payments (RTP), or Instant Bank Transfer as it is called in the BBAE app, are transactions that initiate and settle almost instantaneously. At present, Real-Time Payments are only supported by Bank of America, Citibank, and US Bank. To use this method to fund your account, go to the ‘Account’ section and then to ‘Deposit.’ Choose ‘Instant Bank Transfer’ and proceed as instructed. It’s important to note that you must accept the transfer in your online banking app or via an email from your bank after initiating it. Follow the instructions provided by your bank to do so.

The limits for Instant Bank Transfers are as follows:

- Bank of America:

- $3,500 and 10 transactions every 24 hours

- $10,000 and 30 transactions every 7 days

- $20,000 and 60 transactions every month

- Citibank:

- $10,000 daily

- $15,000 monthly

- US Bank:

- $10,000 per transaction

Deposits made by Real-Time Payments (RTP) are immediately available for investing.

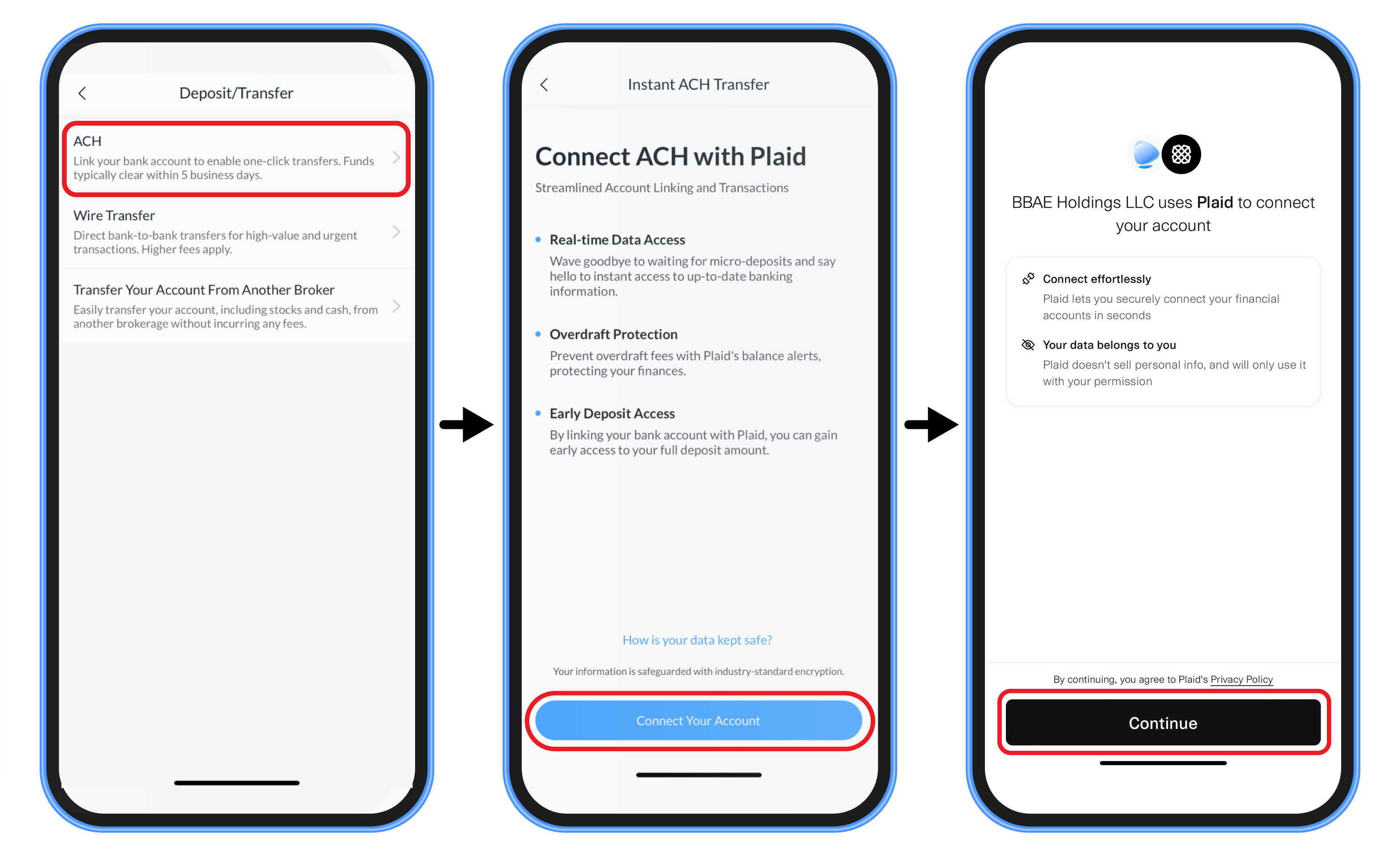

How do I fund my account via ACH?

You can link your bank account through the BBAE app and set up ACH transfers to move funds from your checking or savings account into your BBAE account. Transfers typically take two to three business days to process and five to seven business days to fully settle.

Instant ACH Transfer is a speedy option that lets you connect to your bank account and immediately transfer funds. The process involves logging in with your bank credentials through our trusted partner, Plaid, to confirm ownership, which can be completed within minutes. This method is the quickest way to fund your BBAE account and begin investing. It is important to note that not all banks are eligible for instant verification, necessitating the use of micro-deposit verification (more on that below).

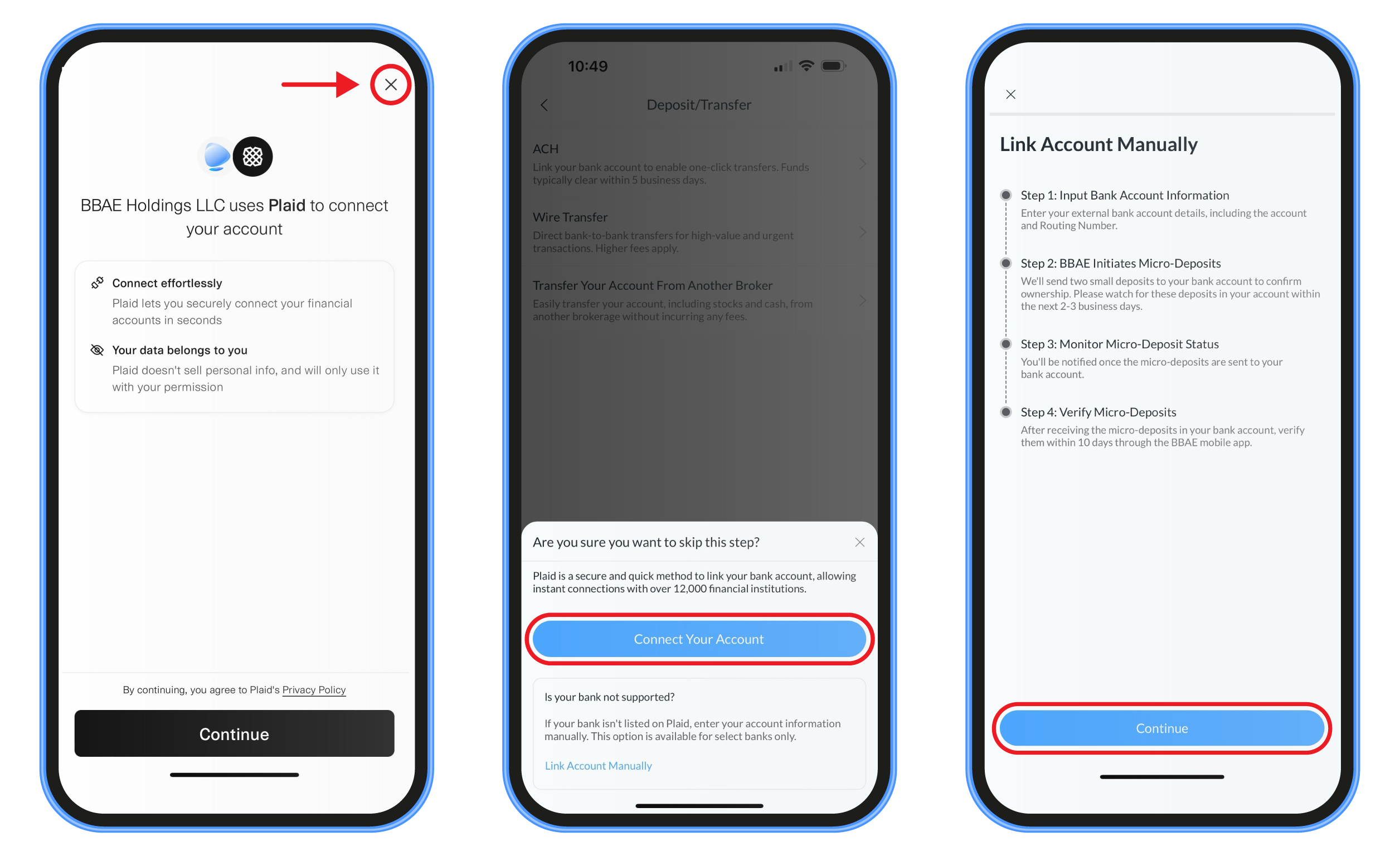

If your bank does not support Instant ACH Transfer, then you can link via Micro-deposit Verification. This is a more traditional approach that involves manually entering your bank account details which includes your routing and account number into the BBAE app. BBAE will initiate a process where small amounts of money, called micro-deposits, are sent to the bank account. Once received, you can verify the deposits to confirm ownership. This method can take up to 2-3 business days to complete. Please note that if verification is not completed within 10 business days, new micro-deposits will need to be sent. To link your bank account via Micro-deposit Verification, please follow the steps outlined below.

- In the BBAE app, navigate to Account – Deposit and then Select ACH

- Click the “Connect Your Account Button”

- Here, you will be prompted to connect via Plaid. Please select the “x” in the upper right-hand corner of the screen to decline.

- On the next screen, select “Link Account Manually” and follow the prompts to link your account via Micro-deposit Verification.

How soon can I start investing after making an ACH deposit?

When you make an ACH deposit, the funds are released to your buying power in three steps:

- Instant Buying Power: All or a portion of your deposit is available for investing immediately as Instant Buying Power, or on the next trading day, depending on when you make the deposit and how you linked your account.

- Deposit Timing:

- Deposits made between 7:30 AM ET and 3:30 PM ET on a trading day are available immediately as Instant Buying Power.

- Deposits made before 7:30 AM ET are available as Instant Buying Power after 7:30 AM ET on the same trading day.

- Deposits made after 3:30 PM ET or on a non-trading day are available as Instant Buying Power after 7:30 AM ET on the next trading day.

- Bank Account Linking Method:

- Plaid: If you linked your bank account via Plaid, the entire deposit amount is available immediately as Instant Buying Power.

- For example, if you used Plaid bank account verification and made a $5,000 deposit, the entire $5,000 amount would be available immediately as Instant Buying Power.

- Micro-deposits: If you used micro-deposits for bank account verification, a portion (at least $1,000 but not more than the deposited amount or your account balance at the time of the deposit) is available immediately for investing as Instant Buying Power.

- For example, if you used micro-deposits bank account verification, you have $2,000 in your account and deposit $5,000:

- Instant Buying Power: You’ll have $2,000 to invest immediately and for the first four trading days.

- Increased Buying Power: From the 5th to the 6th business day, the full $5,000 will be available for investing, but with some limitations.

- Full Access: On the 7th business day, you can use the entire $5,000 for trading without any limitations.

- For example, if you used micro-deposits bank account verification, you have $2,000 in your account and deposit $5,000:

- Plaid: If you linked your bank account via Plaid, the entire deposit amount is available immediately as Instant Buying Power.

- Deposit Timing:

- Increased Buying Power: From the 5th business day to the 6th business day, the amount available for investing will increase to the full deposit amount, but with some limitations.

- Full Access: On the 7th business day, the funds will be fully settled, and you will have complete freedom to use them for trading and withdrawals without any limitations.

It’s important to note that the Instant Buying Power comes with certain limitations:

- Instant Buying Power cannot be used for options trading.

- Instant Buying Power cannot be used to purchase MyAdvisor portfolios.

- Instant Buying Power will not be factored into the calculation of margin leverage.

- Instant Buying Power will not increase the number of day trades allowed.

- Instant Buying Power cannot be withdrawn.

If this is your first deposit or if your account has a zero equity balance, there are additional restrictions:

- Opening positions in stocks with a market capitalization below $500 million is not allowed using Instant Buying Power.

- Funds from the sale of stocks purchased using Instant Buying Power cannot be used to open new positions until the transaction settlement is completed.

All limitations will be lifted on the seventh trading day after the ACH deposit when the funds are fully settled.

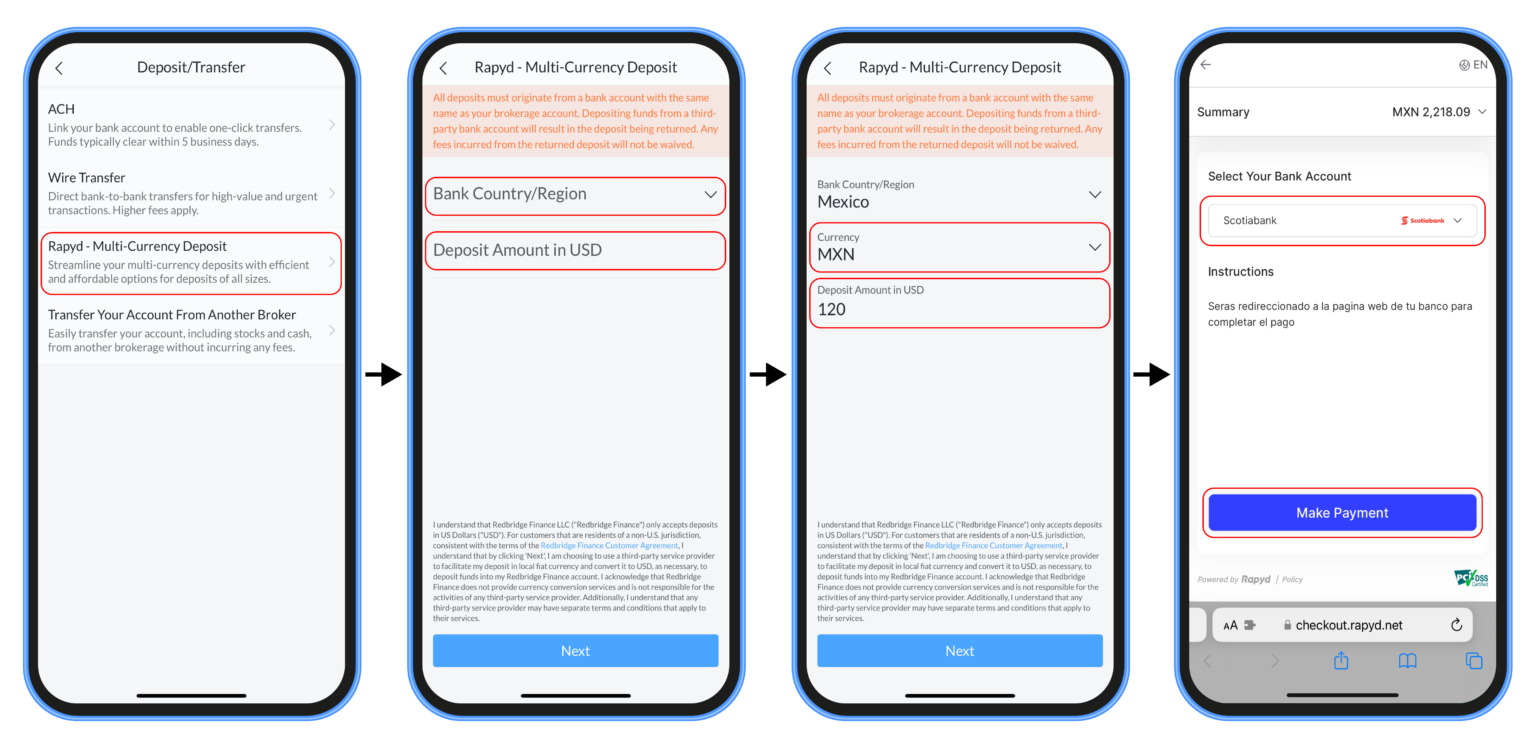

How do I make a Multi-Currency Deposit?

You can make fast and secure multi-currency deposits, offering efficient and affordable options for deposits of all sizes.

To make a deposit, follow these instructions:

- Initiate Deposit:

- Go to the Deposit/Transfer section in your app.

- Select Rapyd – Multi-Currency Deposit.

- Enter Deposit Details:

- Choose your Bank Country/Region.

- Select your Local Currency.

- Enter the Deposit Amount in USD.

- Click Next.

- Confirm and Complete Payment:

- Review the summary of your transaction.

- Select your bank from the list (e.g., Scotiabank).

- Follow the instructions to complete the payment on your bank’s website.

- Receive Confirmation:

- After payment, you will see a Deposit Request In Progress screen.

- Click Got It to finish. You will be notified once the transfer is processed.

Important Notes

- Ensure deposits originate from a bank account with the same name as your brokerage account.

For any issues or questions, please contact our customer support team.

How do I fund my account via Wire Transfer?

Wiring funds allows you to transfer larger amounts of money between your bank and BBAE account in one to two business days. However, there are typically fees charged for wire transfers by the sending bank. If any details are omitted, there may be a delay in processing your wire transfer, or it may be returned. The wire instructions to transfer funds into your BBAE account are as follows:

- Bank name: BMO Harris Bank

- Bank address: 111 West Monroe St., Chicago, IL 60603

- ABA number: 071000288

- Swift code (for International Wires): HATRUS44

- Beneficiary account number: 3713286

- Beneficiary name: Apex Clearing Corporation, Your BBAE Account Number

- Beneficiary address: One Dallas Center, 350 N. St. Paul, Suite 1300, Dallas, TX 75201

- For final credit to: Your name and BBAE account number (Example: John Smith 7XJ05000)

- Remitter’s Name: Your First and Last Name

- Remitter’s Address: Your residential address

Please note that deposits must come from a bank account that matches the name on your BBAE account. Third-party wire transfers will be returned.

How do I fund my account via Automated Customer Account Transfer (ACAT)?

An ACAT allows you to transfer funds or securities from an existing brokerage account to your BBAE account. This enables you to consolidate your investments and have all your assets in one place. You can initiate the transfer through the BBAE App by clicking on Account and then Transfer. From there, you will select your existing broker and fill in your account information. If you do not see your existing broker on the list, please contact our support team at 1-800-950-5266. It is important that you complete the request in its entirety to avoid potential processing delays or a rejection.

For additional information on ACATs, click here.

Are there any other ways to fund my account?

In addition to funding your account via wire transfer, you also have the option to utilize foreign currency transfers. In select countries, you can transfer foreign currency through local bank settlement using the BBAE app. The currency will be converted to USD in your BBAE account. Transfers typically complete within 1 to 2 business days. Transaction and foreign exchange fees apply and are set by the sending bank. Please check the BBAE app under Deposit to see if this service is available in your country.

Why was my ACH returned?

In some cases, ACH deposits into your BBAE account may be returned for various reasons by your bank. Some common reasons for ACH returns include:

- Insufficient funds

- Incorrect bank account information

- Duplicate transactions

- Declined or prohibited transfers

A $30.00 return fee will be applied to your account if an ACH return occurs. Please note that customers are responsible for all charges that result from returned payments and additional trading restrictions may apply.

To avoid ACH returns, we highly recommend the following:

- Ensure you have sufficient funds in your bank account for one to two business days after submitting an ACH transfer request. Note that some banks charge maintenance fees which may impact your daily balance.

- Confirm that your bank account supports standard outgoing ACH transfers and that the account information entered when linking the account is accurate. Be careful when making ACH transfers from a savings account because some savings accounts limit the number of monthly transactions, including the micro-deposits used to confirm the account linkage.

If we receive an ACH return notice from your bank, we will restrict the ACH deposit amount and any reversal fees from your buying power until the funds are transferred back to your bank.

Please take appropriate precautions when setting up and using ACH transfers to fund your BBAE account. Following these best practices will help minimize the possibility of ACH returns and any resulting account restrictions or fees.

What is a routing number?

A routing number, also known as an ABA number or routing transit number, is a unique 9-digit code used to identify your financial institution. It’s assigned to your bank by the American Bankers Association (ABA) to facilitate transactions from your bank account, such as direct deposits, wire transfers, automatic bill payments, and paper checks. Each bank has its own routing number that corresponds to the location where your account was opened.

How do I find my routing number?

The easiest way to find your routing number is to check the bottom left corner of your checks. It’s the first set of numbers and is 9 digits long. If you don’t have a paper check, you can find your routing number by logging into your bank’s website or mobile banking app, under settings for your checking account. You can also call your bank’s customer service line to request your routing number. Some banks list the routing number on monthly paper statements or provide it when you open a new checking account.

It’s important to note that you may have different routing numbers for different transaction types. For example, you’ll use one routing number for wire transfers and direct deposits into your checking account, but a different routing number for ACH payments and transactions from your savings account. Always double check with your bank if you’re not sure which routing number to use for a particular transaction.

Can I fund my BBAE account using a credit card?

No, BBAE does not accept credit card payments for account funding. Please click here to view all the ways you can fund your BBAE account.

What is micro-deposit verification?

Micro-deposit verification is a method BBAE uses to confirm the ownership of an external bank account. This verification is utilized for ACH payments only and is not required for wire transfers. This verification process ensures that the individual attempting to link to the external bank account is indeed the account owner, thereby enhancing security and preventing unauthorized access.

Here’s a step-by-step explanation of the micro-deposit verification process:

- Verification Initiated: To begin the process, you provide your external bank account details, including the account number and routing number, within the BBAE Pro app.

- Micro-Deposits Sent: BBAE initiates a process where small amounts of money, referred to as micro-deposits, are sent to the specified external bank account. Please note that it may take 2-3 business days for the micro-deposits to be credited.

- Deposits Confirmed: Once the micro-deposits are made, you will need to review your external bank account and identify the exact amounts of these deposits. The deposits will be displayed as ‘Redbridge Securities’ on your bank statement.

- Bank Account Confirmed: Please enter the micro-deposit amounts into the BBAE app to confirm ownership of your external bank account within 10 business days.

- Verification Completed: The external bank account is successfully verified if the amounts entered match the actual micro-deposits made. You can then proceed to submit a deposit using the Automated Clearing House (ACH) method.

Please note that if verification is not completed within 10 business days, new micro-deposits will need to be sent.

Is there a minimum deposit required to open a BBAE account?

No, BBAE does not require a minimum deposit to open an account. Whether you have a small amount or a larger sum, you can still open an account and begin investing with BBAE. This flexibility allows you to start investing with the funds that you’re comfortable with, without any mandatory minimum deposit.

Is my personal and financial information secure when funding my BBAE account?

Yes, BBAE prioritizes the security of your personal and financial information. Rigorous measures are in place to protect your data from unauthorized access or disclosure. BBAE implements robust encryption, firewalls, and other advanced security protocols to ensure the confidentiality and integrity of your information during the funding process.

In addition, BBAE’s wholly owned subsidiary, Redbridge Securities LLC, is regulated by the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA). These regulatory bodies enforce stringent standards and requirements for member firms to safeguard customer information. BBAE is fully committed to complying with these regulations and upholding the highest standards of data security to protect your personal and financial details.

You can rest assured that BBAE prioritizes creating a secure environment for its customers, ensuring the confidentiality and privacy of your information throughout the account funding process.